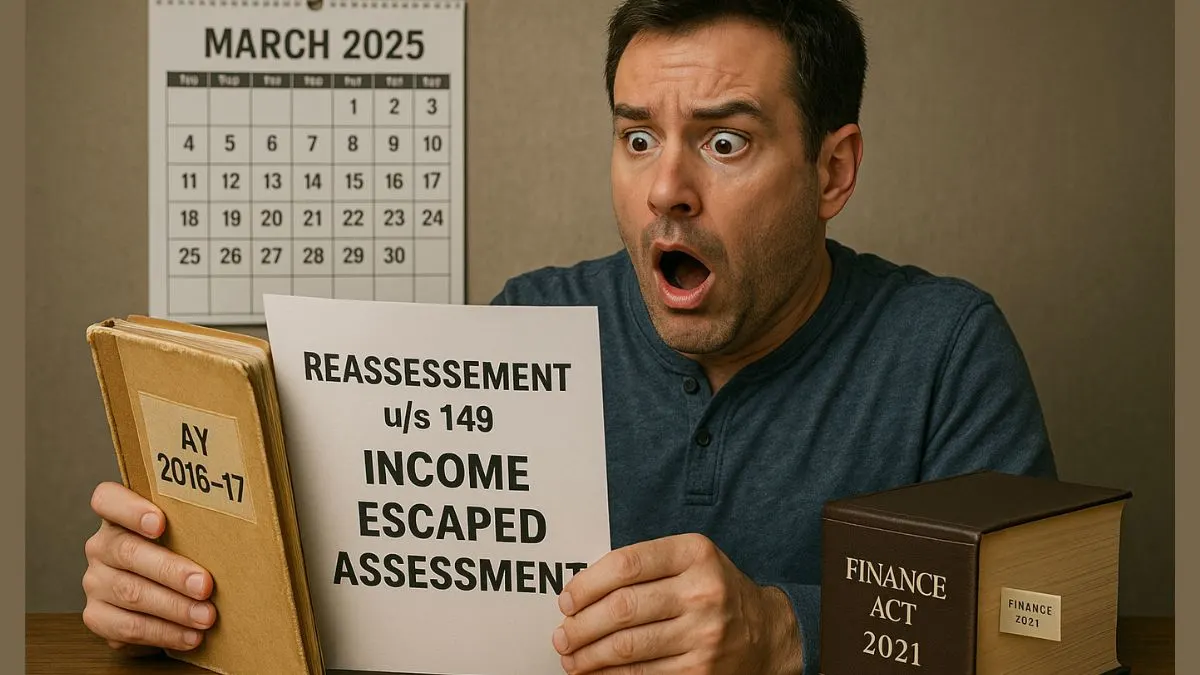

When it comes to tax compliance in India, reassessment is a powerful tool in the hands of tax authorities. However, it must be executed within a legal framework that protects the rights of the taxpayer. That’s where Section 149 of the Income Tax Act comes into play.

This provision defines a limitation period for initiating reassessment proceedings & ensures that income escaping assessment can be brought under scrutiny — but only within clearly defined timelines.

Let’s explore what Section 149 really entails, its importance, key deadlines, & how it impacts both taxpayers & the Income Tax Department.

What is Section 149 of the Income Tax Act?

Section 149 lays down the time limit for issuing a notice to a taxpayer when the Assessing Officer (AO) believes that income has escaped assessment. It’s not an open-ended license to reassess; the AO must act within a prescribed period from the end of the relevant assessment year.

This section is tightly linked with Section 147 (which empowers the AO to reassess income) & Section 148 (which outlines the procedure for issuing notice). Without Section 149, there would be no statutory deadline to guide reassessment actions, leaving room for unfair reopening of old tax cases.

Why Was Section 149 Introduced?

Tax reassessment is a serious matter. It may mean additional tax liability, penalties, or legal complications for the taxpayer. At the same time, the Income Tax Department must ensure that all taxable income is accurately assessed.

Therefore, to strike a balance between the authority of tax officers & the rights of citizens, Section 149 of the Income Tax Act defines a limitation period for initiating reassessment. This ensures that old cases aren’t reopened arbitrarily & only genuine cases of escaped income are revisited.

Section 149: Time Limits Explained

According to Section 149 (as amended by the Finance Act 2021), the time limits for reassessment notices are as follows:

- Up to 3 years from the end of the relevant assessment year if the income escaping assessment is less than ₹50 lakh.

- Up to 10 years from the end of the relevant assessment year if the AO has evidence that income escaping assessment is more than ₹50 lakh & is represented in the form of an asset, expenditure, or entries in books of accounts.

These time frames ensure that taxpayers are not kept in the dark indefinitely & that any action by the department is backed by substantial information.

Example to Understand Better

Suppose a taxpayer filed returns for the Assessment Year 2020–21, & the AO later finds that ₹60 lakh worth of property income was not disclosed.

Since the escaped income is above ₹50 lakh & is related to an asset, the AO can issue a reassessment notice under Section 149 up to March 31, 2031, which is 10 years from the end of the assessment year.

However, if the escaped income had been only ₹30 lakh, then the reassessment window would close by March 31, 2024 (i.e., within 3 years).

Exceptions and Caveats

- If a notice under Section 148 is to be issued after 3 years, it must receive prior approval from higher authorities.

- Notices cannot be issued if the AO has no evidence or reason to believe that income has escaped assessment.

- Section 149 ensures that reassessment notices are not used as a tool for harassment or baseless scrutiny.

Section 149 vs. Section 147

While Section 147 gives power to reassess, Section 149 restricts that power within reasonable time limits. They go hand in hand to regulate the reassessment ecosystem.

Without Section 149, there would be no outer limit to the reopening of completed assessments, & taxpayers would face prolonged uncertainty.

Recent Updates & Amendments

The Finance Act 2021 significantly revamped the reassessment regime, including amendments to Section 149. One of the critical changes was the reduction of reassessment time limits to protect taxpayers & increase administrative efficiency.

Also, in 2022 & 2023, further clarifications were issued to make the process more transparent, especially for high-value assessments.

Final Thoughts

Section 149 of the Income Tax Act may seem technical, but its importance cannot be overstated. It lays down the time limit for issuing a notice to a taxpayer & defines a limitation period for initiating reassessment—providing legal certainty & preventing misuse of reassessment powers.

For taxpayers, understanding this section helps them stay aware of their rights & responsibilities in the face of reassessment. For tax professionals, it’s a crucial tool for advising clients on exposure, risk, & the validity of reassessment notices.

So, whether you’re an individual taxpayer, a CA, or a business owner, knowing the time limits under Section 149 ensures you’re not caught off-guard when reassessment knocks on your door.

Need help responding to an income tax notice or want to safeguard your tax records proactively?

👉 Connect with expert tax consultants now at Callmyca.com & stay audit-ready!