Most provisions of the Income Tax Act apply to individuals, firms, & companies operating within India. But what happens when a foreign shipping company earns income from Indian sources but does not have any presence or PAN in India? That’s where Section 172 of the Income Tax Act comes into the picture.

This special provision is often overlooked, yet it plays a vital role in international maritime taxation. If you're a freight forwarder, shipping agent, NVOCC operator, or an Indian party making payments to foreign vessels, you must understand Section 172 in detail.

Let’s decode this section in simple terms.

What is Section 172 of the Income Tax Act?

Section 172 of the Income Tax Act provides a special scheme of taxation for non-resident shipping companies that occasionally operate in Indian waters without having any fixed place of business or representative office in India.

In short:

✅ It is a self-contained code that governs how income earned by foreign ships from Indian sources is taxed."

✅ It overrides other provisions of the Act, including the need for PAN or TDS procedures.

Why Was Section 172 Introduced?

Foreign shipping companies may carry passengers, mail, livestock, or goods to or from India. Since they don’t have a business presence in India, it's not feasible to make them comply with the usual return filing, PAN allotment, or TDS procedures.

Hence, Section 172 ensures:

✔ India can collect tax on income earned from shipping operations connected to its territory.

✔ Tax is collected before the ship leaves the port.

✔ Compliance is minimal & swift.

Scope of Section 172 of the Income Tax Act

The section applies when:

- A ship belongs to or is chartered by a non-resident.

- It carries goods or passengers from an Indian port.

- The non-resident has no regular agent or permanent establishment in India.

Such foreign entities are taxed on a presumptive basis for each voyage."

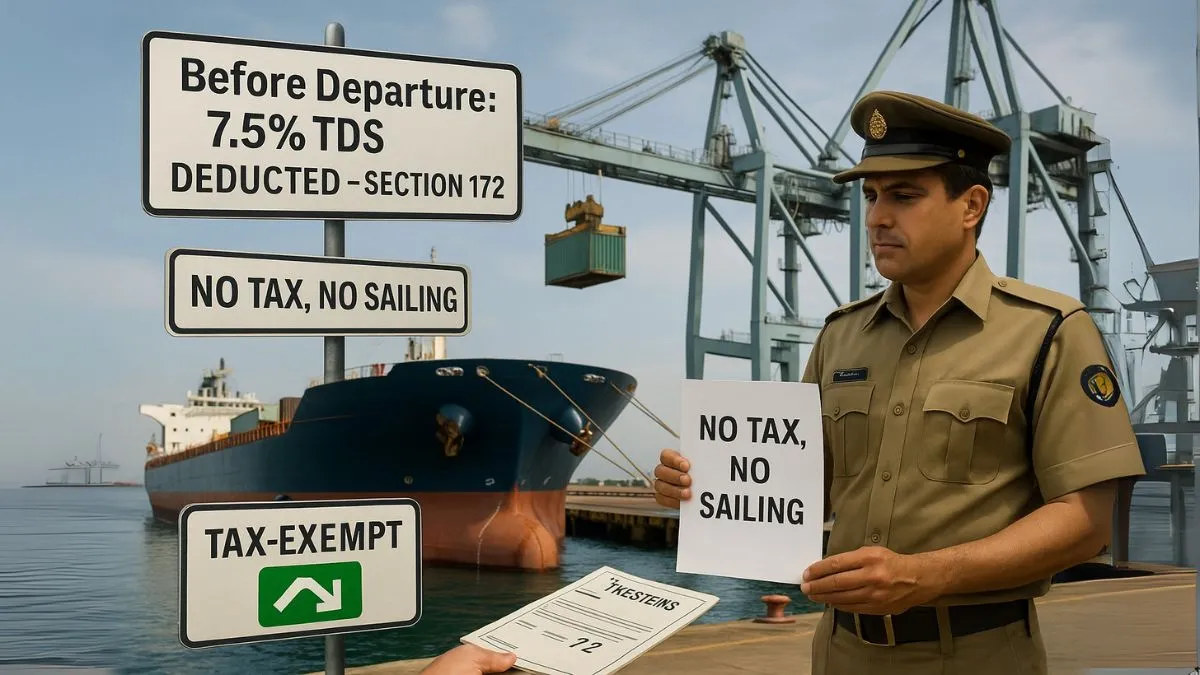

Tax Rate and Calculation Under Section 172

Tax is not based on actual profits. Instead, it is presumed that 7.5% of the freight income is taxable.

- Taxable income = 7.5% of the total freight received or payable in India

- Applicable tax = As per the prevailing rate for foreign companies (generally 40% surcharge cess)

So, if a foreign shipping company earns ₹10,00,000 freight from Indian cargo:

- Taxable income = ₹75,000

- Tax payable ≈ ₹30,000 (after surcharge & cess)

Payment Procedure Under Section 172

1️⃣ Before the ship leaves the Indian port, the ship master or agent must furnish a return of income under Section 172(3).

2️⃣ The Assessing Officer (AO) estimates income & raises a tax demand.

3️⃣ The tax must be paid before departure.

4️⃣ Once tax is paid, the AO grants port clearance.

Can Foreign Shipping Companies File Regular Returns Instead?

Yes, under Section 172(7), the non-resident shipping operator can opt to file a regular income tax return for the entire financial year instead of per voyage.

Benefits of this route:

✅ Tax can be computed on actual income, not presumptive 7.5%.

✅ Deductions & relief under DTAA may apply.

✅ Can help avoid over-taxation in specific situations.

However, once opted, this route must be followed for that entire year."

Real-Life Example

A Singapore-based shipping company carries containers from Mumbai to Dubai. The company has no office or agent in India.

Under Section 172:

- They declare freight receipts before vessel departure.

- 7.5% of the total freight is treated as deemed income.

- Tax is paid at the rate applicable to foreign companies.

- The ship gets port clearance after payment.

Difference Between Section 172 & Section 44B

|

Feature |

Section 172 |

Section 44B |

|

Applicability |

Occasional voyages (non-residents) |

Regular shipping businesses |

|

Nature |

Per voyage basis |

Annual basis |

|

PAN required |

No |

Yes |

|

Return filing |

Simplified or optional |

Mandatory |

FAQs on Section 172

Q1. Who is liable to pay tax under Section 172?

The master of the ship or its agent in India must file the return & pay the tax before the vessel departs.

Q2. Can a foreign shipping company avoid tax by not having a PAN?

No. Section 172 overrides the need for PAN, & tax must be paid per voyage.

Q3. Is there any exemption under DTAA?

If DTAA provisions apply & the operator chooses to file under Section 172(7), relief may be claimed.

Q4. What happens if the tax isn’t paid?

Port clearance will not be issued until the tax is paid.

Q5. Is freight received outside India also taxable?

Yes, if it relates to the carriage of goods from Indian ports, it is taxable under Section 172."

Conclusion

Section 172 of the Income Tax Act acts as a standalone mechanism to ensure taxation of non-resident shipping companies in India. By taxing 7.5% of freight receipts, it simplifies compliance while safeguarding Indian revenue interests.

Whether you’re an agent or a business availing international logistics, understanding Section 172 ensures smooth operations & avoids last-minute port delays.

👉 Handling foreign vessels or freight without knowing Section 172 can cost you time & money. Let the experts at Callmyca.com handle your international tax compliance—so your ships sail smoothly & your taxes stay on course. Book your free call today