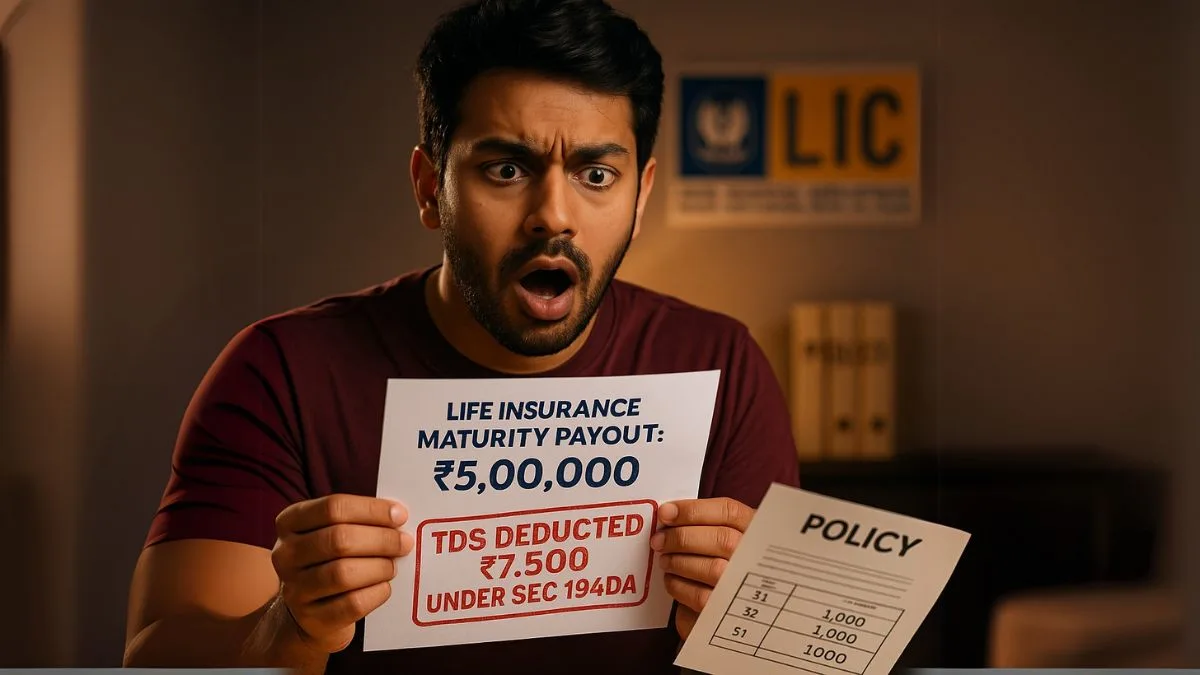

When you receive a payout from your life insurance policy, you may think it’s completely tax-free. But wait—Section 194DA of the Income Tax Act steps in to ensure that certain payouts don’t escape tax liability unnoticed. This provision covers tax deduction at source (TDS) on insurance commissions and life insurance payments, and is essential for insurers, agents, and policyholders to understand.

What is Section 194DA?

Section 194DA of the Income Tax Act deals specifically with tax deduction at source (TDS) on life insurance policy payouts when the amount is not exempt under Section 10(10D). This section was introduced to prevent misuse of insurance maturity amounts for tax evasion & to bring in greater transparency.

So, if you’ve received a life insurance payment, & it does not qualify for exemption under Section 10(10D), then TDS may be deducted before you receive your payout. “

Applicability of Section 194DA of the Income Tax Act

Let’s break it down:

- Applicable to: Any person (insurer) making a payment to a resident under a life insurance policy (including bonus).

- Not applicable if: The payout is exempt under Section 10(10D).

- Applicable from: Assessment years starting from 2015–16 & onwards.

- Exemption ends when the sum assured is not at least 10 times the premium paid in any year during the policy term.

TDS Rate and Threshold

Here's what you need to know:

- TDS is applicable at 5% on the income component (i.e., the maturity amount minus the total premiums paid).

- If PAN is not provided, a higher rate may apply as per Section 206AA.

- TDS is deducted only if the total payment exceeds ₹1,00,000 in a financial year.

For example, if the maturity value is ₹1,50,000 & the premiums paid were ₹1,00,000, TDS would apply to the ₹50,000 income component. “

TDS Deduction Timeline & Compliance

Once the insurer deducts the tax:

- The TDS must be deposited with the government within 30 days from the end of the month in which the deduction was made.

- The insurer is also required to issue a TDS certificate (Form 16A) to the policyholder.

Failing to comply with these steps can invite penalties under the Income Tax Act.

Why was Section 194DA Introduced?

This section mandates tax deduction at source (TDS) to plug the tax leakages happening through high-value insurance products. Earlier, many were misusing the life insurance exemption clause to avoid tax on high maturity proceeds, even if they didn’t qualify under Section 10(10D).

Section 194DA ensures that tax is collected upfront on ineligible policies & also brings more life insurance transactions into the reporting ecosystem.

TDS on Life Insurance Policy Payouts – In Summary

|

Criteria |

Applicability |

|

Section |

194DA of the Income Tax Act |

|

TDS Rate |

5% on the income part |

|

Threshold |

₹1,00,000 (total payment) |

|

Exemption |

|

|

Timeline for deposit |

Within 30 days |

|

Form |

16A (TDS Certificate) |

Key Points for Insurance Companies

- Deduct TDS only if the maturity amount exceeds ₹1,00,000 & the payout is not fully exempt.

- File quarterly TDS returns in Form 26Q.

- Must provide Form 16A to policyholders on time.

- Must deposit the TDS deducted from the government within 30 days of the deduction month.

Final Thoughts

Section 194DA of the Income Tax Act is a crucial compliance requirement for both insurers & policyholders. While life insurance is a trusted instrument for long-term savings & financial security, tax benefits are not always guaranteed. If your policy doesn't fulfil the conditions of Section 10(10D), TDS will be deducted on maturity payouts.

Whether you're planning your tax-saving investments or managing payouts, stay informed & avoid surprises. And if you’re an insurer, ensure you’re complying with all the TDS provisions—right from deduction to timely deposit & certificate issuance.

File your TDS return now with our experts on Callmyca.com.