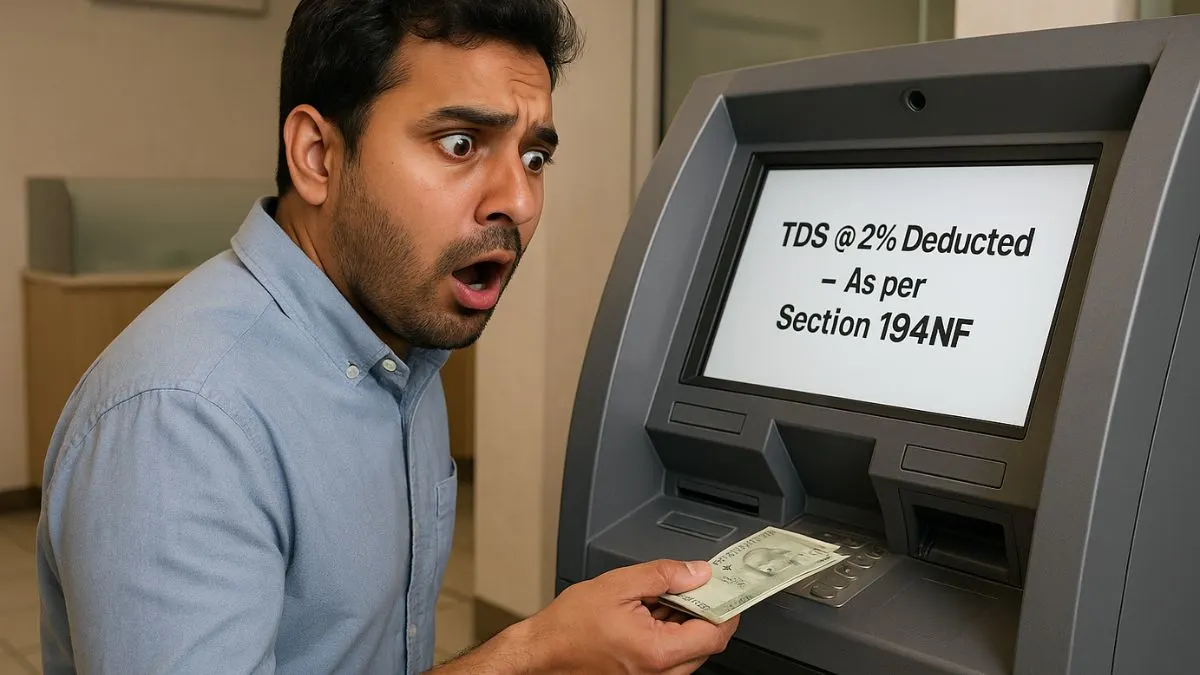

In an attempt to curb the generation & movement of unaccounted money, the Income Tax Department introduced Section 194NF of the Income Tax Act. This provision lays out rules regarding TDS on cash withdrawals exceeding a specified limit. It's primarily aimed at reducing large cash income distributions & promoting digital transactions across the country.

What is Section 194NF?

Section 194NF of the Income Tax Act came into effect with the Finance Act, 2019. It mandates deduction of tax at source (TDS) on cash withdrawals exceeding ₹1 crore from a bank account during a financial year.

Simply put, TDS will be deducted at a rate of 2% on such withdrawals. This provision is a direct move towards increasing transparency & discouraging cash dealings.

Applicability of Section 194NF

Section 194NF applies to:

- Banks (both public & private)

- Co-operative banks

- Post offices

The section is applicable when these institutions make payments to any account holder withdrawing cash that crosses the ₹1 crore threshold in a single financial year.

Additionally, if the person withdrawing cash has not filed income tax returns for the previous three assessment years, the limit drops. In such cases, TDS will be deducted at 2% on cash withdrawals above ₹20 lakhs & at 5% above ₹1 crore.

Key Highlights and Scenarios

Let’s break it down with an example.

Imagine a business owner withdrawing ₹1.2 crore in cash over the financial year. Under Section 194NF, the bank must deduct 2% of ₹20 lakh (i.e., ₹40,000) as TDS. This deduction is to be made at the time of withdrawal.

Now, if the individual hasn't filed income tax returns for the last three years, and their withdrawal is more than ₹20 lakhs, then TDS of 2% kicks in above ₹20 lakhs & 5% beyond ₹1 crore. This means a higher tax liability simply for non-compliance.

Special Provisions for Investment Structures

This section also includes scenarios where 194NF applies to any income distributed by a business trust or investment fund. In such cases, if cash is distributed as income & exceeds the prescribed limits, the payer must subtract 10% tax from the income that is disbursed.

This applies even if the fund or trust is registered. The idea is to monitor & record cash income distributions that otherwise escape taxation."

Who is Exempt?

The following are exempt from the provisions of Section 194NF:

- Government bodies

- Banking companies

- White-label ATM operators

- Any person notified by the government in consultation with the RBI

Penalties for Non-Compliance

Failure to deduct & deposit TDS under Section 194NF can lead to:

- Penalty under Section 271C

- Interest under Section 201

- Disallowance of expenses under Section 40(a)(ia)

Hence, both banks & account holders must stay compliant."

Final Thoughts

In conclusion, Section 194NF of the Income Tax Act is a strategic move by the Indian government to ensure better tax compliance and reduce reliance on cash. Whether you're a business trust, cooperative, or individual dealing in large cash transactions, it's essential to understand this rule and avoid unnecessary tax deductions.

Want to make sure your withdrawals and tax filings stay fully compliant? Let the experts at Callmyca.com help you stay tax-efficient while avoiding hefty deductions—don’t let your cash cost you more than it should!