The Income Tax Act, 1961 is the backbone of India's tax system, laying down the rules & definitions essential for determining how income is taxed. One of the fundamental sections of this Act is Section 2(31), which defines the term “person” for tax purposes. Understanding this section is crucial because tax liability in India is determined based on the category of the person. Whether you're an individual taxpayer, a company, or a trust, the definition under Section 2(31) of Income Tax Act applies to you.

What is Section 2(31) of Income Tax Act?

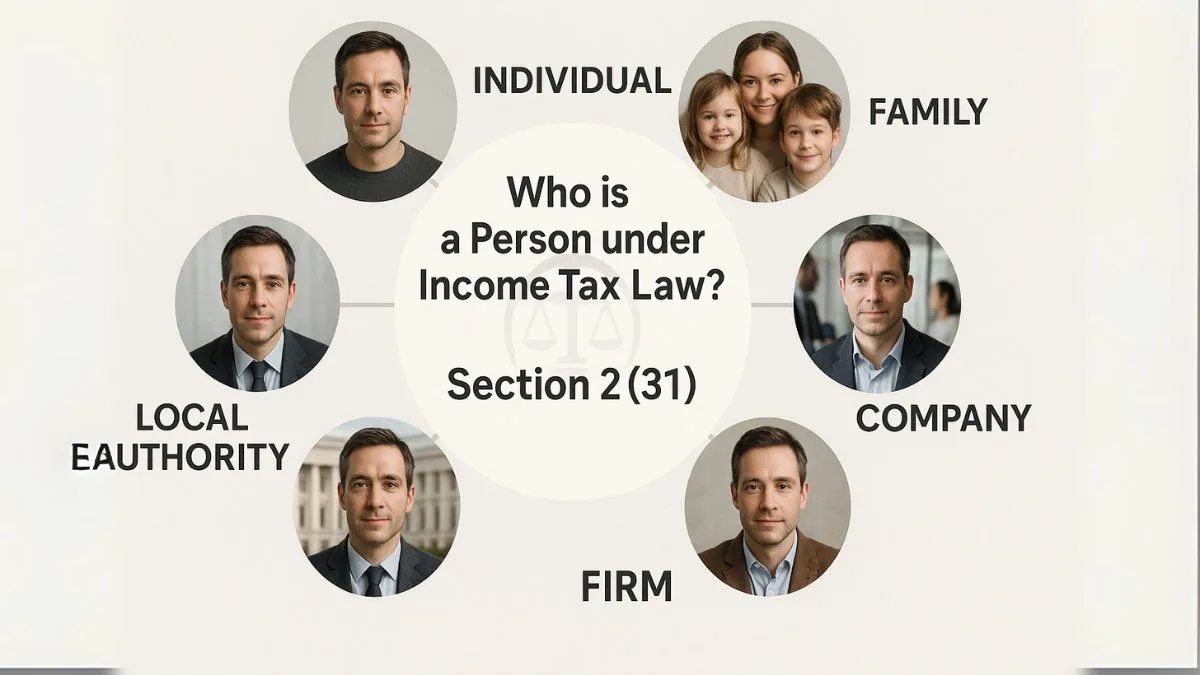

Section 2 subsection 31 of Income Tax Act clearly defines who is considered a “person” under the Act. This definition is not limited to human beings alone; it includes various entities & legal bodies. According to Section 2(31) of the Income Tax Act 1961, the term “person” includes:

- An individual (any natural person)

- A Hindu Undivided Family (HUF)

- A Company

- A Firm

- An Association of Persons (AOP) or Body of Individuals (BOI), whether incorporated or not

- A Local Authority

- Any Artificial Juridical Person not falling in any of the above categories

In simpler words, Section 2(31) of the Income Tax Act provides definitions for various terms used throughout the Act, especially to identify the person under Section 2(31) of the Income Tax Act 1961 for whom tax obligations arise.

Why is Section 2(31) Important?

The importance of Section 2(31) lies in the fact that taxation is person-centric. The income tax liability, filing requirements, exemptions, & benefits vary depending on the classification of the taxpayer. For example:

- An individual enjoys various deductions under sections like 80C, 80D, etc.

- A Company is taxed at corporate tax rates.

- An AOP or BOI may have a different tax rate structure.

Thus, knowing the classification helps taxpayers comply correctly with their tax obligations.

Person Under Section 2(31): Detailed Explanation

Let’s break down the key categories further:

- Individual:

A single human being, whether salaried, self-employed, or earning income through other sources.

- Hindu Undivided Family (HUF):

A HUF is treated as a separate tax entity under the Act. If you're wondering how is Hindu Undivided Family (HUF) treated under Section 2(31) of the Income Tax Act, the answer is—it is considered as a distinct person for taxation.

- Company:

All registered companies, including Indian & foreign entities.

- Firm:

Partnership firms, including Limited Liability Partnerships (LLPs), fall under this definition.

- Association of Persons (AOP) or Body of Individuals (BOI):

When two or more individuals come together for a common purpose without forming a legal entity like a company or firm, they are treated as an AOP or BOI.

- Local Authority:

Municipalities, Panchayats, & other local government bodies.

- Artificial Juridical Person:

This includes entities like Deities, Temples, Trusts, etc.

Special Provisions: Voluntary Contributions & Electoral Trusts

Section 2(31) also plays a crucial role in the taxation of trusts, especially electoral trusts. The special provisions relating to voluntary contributions received by electoral trust ensure transparency in political funding. Such trusts fall under the “person” definition & are accountable under the Income Tax Act.

Section 2(31) and its Practical Implications

- It helps determine tax slab applicability.

- Provides clarity on tax audit requirements.

- Essential for applying correct TDS (Tax Deducted at Source) rates.

- Impacts eligibility for various deductions, exemptions, & benefits.

For example, as per Section 2(31) of the Income Tax Act 1961 a person includes even non-corporate entities like AOPs or BOIs, which may often be overlooked."

Common Queries Related to Section 2(31)

- Does Section 2(31) include foreign companies?

Yes, foreign companies operating in India or earning income from India fall under the “company” category.

- Are trusts taxed as individuals under Section 2(31)?

No, trusts are classified as Artificial Juridical Persons & taxed accordingly.

- Is there a case law on Section 2(31)?

Yes, several case laws interpret this section, particularly when deciding the taxability of unconventional entities."

Conclusion

Understanding Section 2(31) of the Income Tax Act is fundamental for every taxpayer in India. It ensures correct tax filing, avoids legal hassles, & helps in availing the right benefits. Whether you are an individual, company, or trust, this definition impacts how you are taxed under Indian law.

If you still have doubts about your tax status or need help with compliance, our experts at Callmyca.com are just a click away. Get your taxes done right—without stress, without confusion.