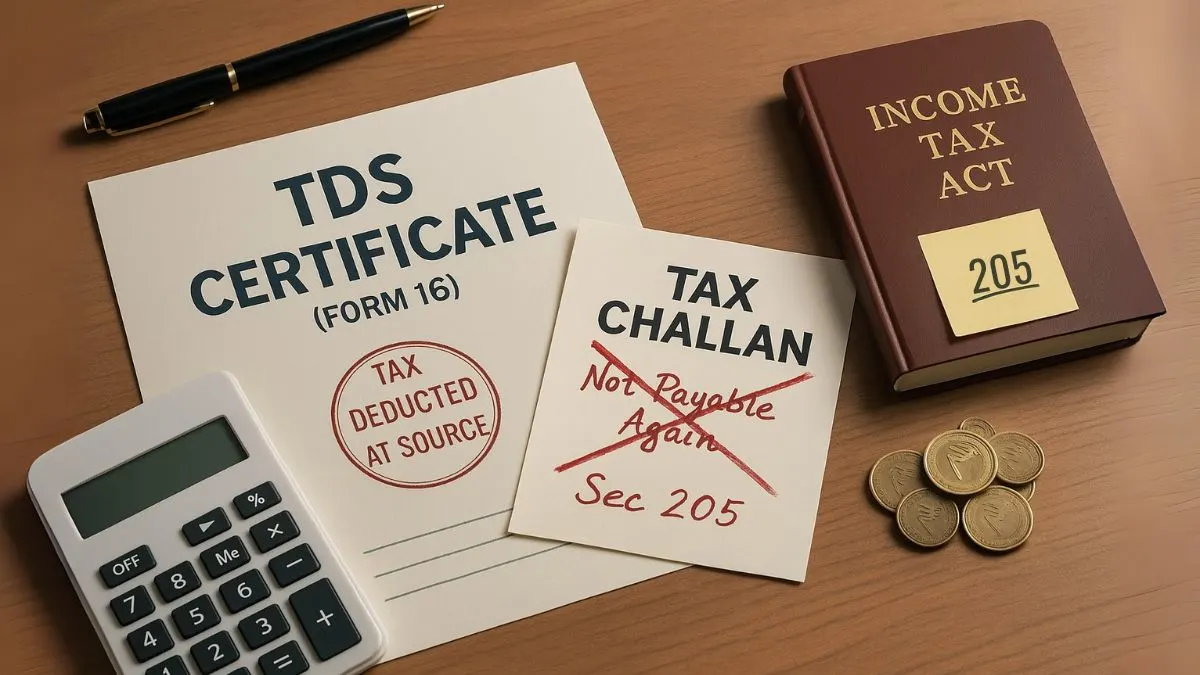

The Indian tax system relies heavily on the mechanism of Tax Deducted at Source (TDS). It ensures that taxes are collected in advance before the income actually reaches the taxpayer. However, in certain cases, taxpayers face unnecessary difficulties when tax has already been deducted at source, but authorities still raise a demand for payment. To address this, Section 205 of Income Tax Act acts as a safeguard.

This provision ensures that where tax is deductible at the source under the foregoing provisions of this Chapter, the assessee cannot be asked to pay it again. Simply put, it prevents double taxation for individuals and entities.

In this detailed guide, we will cover the meaning, scope, judicial interpretations, and importance of Section 205 of Income Tax Act.

What is Section 205 of Income Tax Act?

Section 205 states:

“Where tax is deductible at the source under the foregoing provisions of this Chapter, the assessee shall not be called upon to pay the tax himself to the extent to which tax has been deducted from that income.”

This provision provides relief to taxpayers by making it clear that once the deductor has deducted TDS, the deductee (recipient of income) cannot be held responsible for paying the same tax again.

Key Features of Section 205

- Protection Against Double Taxation

- Once TDS has been deducted, the taxpayer cannot be asked to pay the same amount again.

- Responsibility of Deductor

- The obligation to deposit deducted TDS with the government lies with the deductor (employer, bank, company, etc.).

- Applies to All Types of TDS

- Covers salary, interest, dividend, professional fees, rent, and other payments where TDS provisions apply.

- Concessional Tax Treatment

- Section 205 also provides for the conditions for the concessional rate of taxes wherever applicable.

Also Read: The Rule That Doubles Your TDS if You Don’t File ITR

Why Was Section 205 Introduced?

Prior to this provision, taxpayers faced hardships because:

- Even if TDS was deducted, in case the deductor failed to deposit it with the government, authorities raised demands on the assessee.

- This created double hardship—tax was already deducted, but the taxpayer still had to pay again.

Section 205 of Income Tax Act shifted the responsibility to the deductor, ensuring fairness in the system.

Example to Understand Section 205

Suppose, Mr. Rajesh earns ₹10,00,000 salary annually. His employer deducts TDS of ₹1,00,000 & issues Form 16.

- Later, during assessment, the Income Tax Department notices that the employer did not deposit the deducted TDS to the government treasury.

- Without Section 205, Rajesh would have been forced to pay ₹1,00,000 again.

- With Section 205, Rajesh is protected. The liability rests with the employer (deductor), not the employee (deductee).

Judicial View on Section 205

Indian courts have consistently upheld the principle behind Section 205:

- Kumudini Venugopal v. CIT (Kerala HC) – It was held that once TDS has been deducted, the taxpayer cannot be asked to pay again, even if the deductor fails to deposit it.

- Smt. Anusuya Alva v. Union of India (Karnataka HC) – The court emphasized that Section 205 prevents double taxation & protects the taxpayer.

These rulings confirm that the law stands firmly in favor of the taxpayer.

Practical Importance of Section 205

- Relief for Salaried Employees

- Employees do not suffer due to non-compliance of employers.

- Clarity in Tax Responsibility

- Ensures that only the deductor is liable for depositing TDS.

- Encourages Transparency

- Builds trust between taxpayers & authorities.

- Concessional Tax Rates

- In cases where concessional rates apply (such as DTAA benefits for non-residents), Section 205 strengthens taxpayer protection.

Limitations of Section 205

- While it protects taxpayers, in reality, when TDS is deducted but not deposited, it causes mismatch in Form 26AS/AIS.

- This may lead to notices or delays in refunds.

- The taxpayer must then prove that TDS was indeed deducted by producing salary slips, bank certificates, or Form 16.

Steps Taxpayers Should Take

- Regularly Check AIS/26AS

- Ensure TDS deducted is correctly reflected.

- Collect TDS Certificates (Form 16/16A)

- Keep them safe as proof.

- Raise Grievances Promptly

- If TDS is not deposited, use TRACES portal or approach the deductor.

- Seek Professional Help

- Sometimes legal action may be required against the deductor.

Also Read: Taxation of Capital Gains Explained

Conclusion

Section 205 of Income Tax Act is a taxpayer-friendly provision that ensures fairness in the taxation process. It clearly states that where tax is deductible at the source under the foregoing provisions of this Chapter, the taxpayer cannot be asked to pay again. It also provides for the conditions for the concessional rate of taxes, making it an essential safeguard against double taxation.

For individuals and businesses alike, this section provides much-needed relief & legal protection. However, to truly benefit from it, taxpayers must maintain proper records and stay updated on their TDS status.

💡 Want to ensure your TDS is accurately filed and avoid unnecessary disputes?

👉 Visit Callmyca.com – where our tax experts handle compliance, refunds, and notices, so you never pay more than you should.