Have you ever received a notice from the Income Tax Department stating that your refund is being adjusted against a previous year's dues? That’s not a mistake—it's Section 245 of the Income Tax Act at work. This provision empowers tax authorities to set off refunds against tax remaining payable from any earlier assessment year. But the key here? Intimation must be given in writing.

Let’s break this down in simple terms.

What Is Section 245 of the Income Tax Act?

Section 245 deals with a very specific situation: when you are due for an income tax refund for a particular financial year, but you also have unpaid dues from a previous year. In such cases, before issuing your refund, the department is allowed to adjust it against the earlier year’s pending tax liability.

This is done via a type of notice/intimation issued by the Income Tax Department to inform you of the same. The purpose? To notify you that you have dues pending for a previous year, & the department intends to settle them using your current refund amount. "

What Does the Law Say?

Here’s the essence of the law in plain English:

- The Assessing Officer (AO) may adjust a refund due against any existing tax payable from an earlier year.

- However, the adjustment cannot be done without notifying the taxpayer.

- That’s why an intimation should be given in writing before the adjustment takes place.

This ensures transparency, legal compliance, and gives you an opportunity to raise any dispute or disagreement regarding the pending tax. "

Why Did You Receive an Intimation Under Section 245?

There are a few common reasons why you might receive such an intimation:

- Old tax demand: You may have missed paying tax on certain income in a prior assessment year.

- Interest or penalty: Interest under Section 234A/B/C or a late filing penalty might not have been paid.

- Mismatch in TDS or income reporting: This can lead to automated demands in the tax portal.

- Revision or reassessment: In some cases, earlier returns are reassessed and generate new dues.

Regardless of the reason, Section 245 ensures the department informs you about the action.

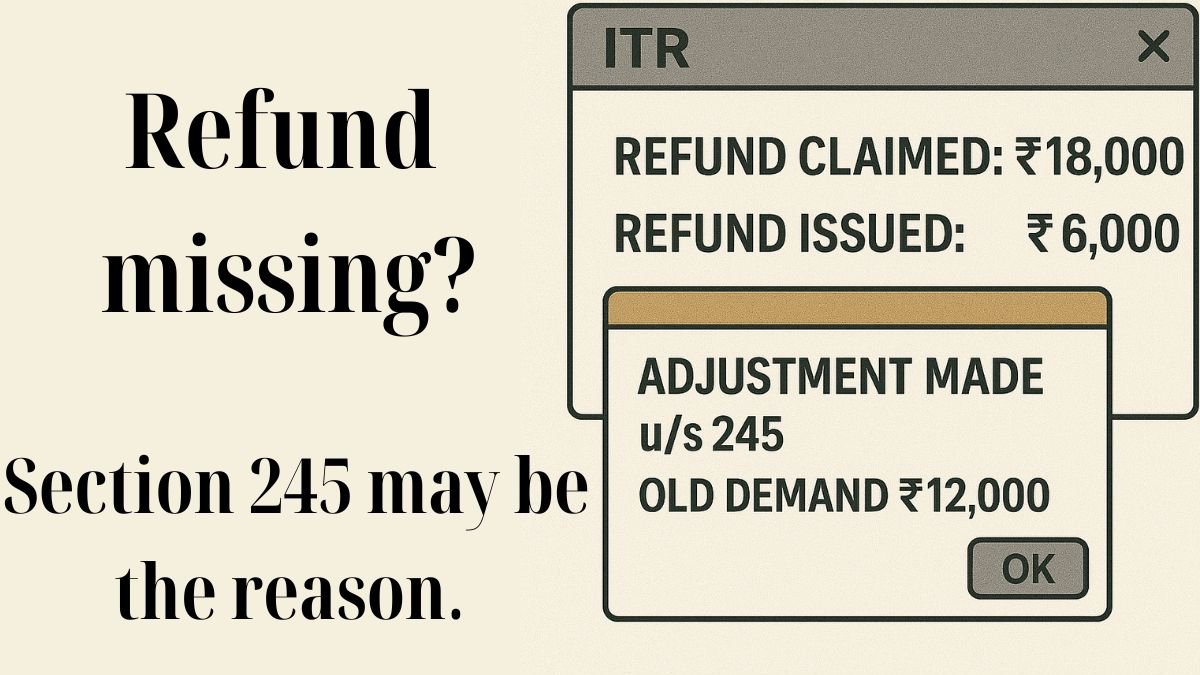

Example Scenario

Imagine you’re due to receive a refund of ₹15,000 for AY 2024–25. But the department notices that you still owe ₹6,000 from AY 2022–23. Before giving you the refund, they’ll send you an intimation notice under Section 245, explaining that the ₹6,000 will be adjusted against your refund, & the remaining ₹9,000 will be issued to you.

Is It a Demand Notice?

No. This is not a tax demand notice. It is just an intimation that your refund is being adjusted against a prior tax due. But you must check the details carefully—sometimes, the old demand may no longer be valid or may have already been paid.

That’s why the Income Tax Department mandates that an intimation must be issued in writing. This ensures you get a fair chance to verify or contest the adjustment.

How to Respond to Intimation Under Section 245

- Log in to your income tax portal: Visit www.incometax.gov.in.

- Go to Pending Actions > Response to Outstanding Tax Demand.

- Accept, disagree, or partially agree:

- If you agree, the refund will be adjusted.

- If you disagree, upload supporting documents like challans or Form 26AS entries.

If you ignore the intimation, the refund will be automatically adjusted after 30 days.

Intimation for Political Parties and Institutions

Interestingly, Section 245 also applies to political parties, charitable trusts, and other exempt institutions. If they’re eligible for a refund but have pending dues under a prior assessment, they too may receive this intimation.

This ensures fairness & compliance across all types of taxpayers, not just individuals.

Best Practices for Taxpayers

- Always verify old demands: Before accepting the adjustment, check your Form 26AS or AIS to ensure accuracy.

- Maintain old tax records: Especially if you have revised returns, updated ITRs, or pending rectification requests.

- Respond within 30 days: Otherwise, the adjustment is made automatically, & you may lose the chance to raise objections.

- Learn about intimation & manage refunds proactively: Staying informed helps you avoid unwanted surprises during refund season.

Final Thoughts

Section 245 of the Income Tax Act is not meant to trouble you—it’s simply a tool to maintain tax accountability. Setting off of refunds against tax remaining payable is done only after the taxpayer is informed and given a chance to respond.

If you’ve received an intimation notifying you about pending dues for a previous year, don’t panic. Just log in, check the details, & respond accordingly. With e-filing & prompt communication, managing your tax refunds & dues has become easier than ever.

If you found this useful, feel free to bookmark, share, or ask your questions in the comments below. Tax rules can seem scary, but when simplified, they become manageable and empowering.