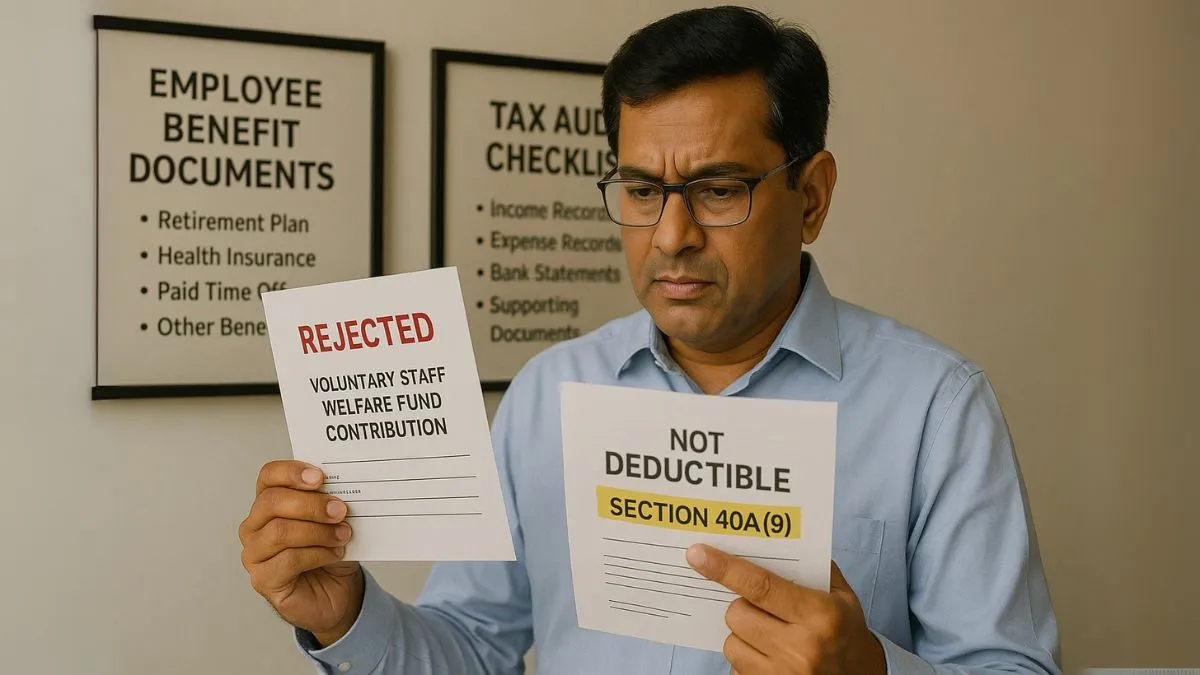

Tax legislation is often laden with nuanced provisions that carry significant implications if overlooked. One such provision is Section 40A(9) of the Income Tax Act, which specifically disallows certain payments made by employers. This clause frequently escapes notice until it surfaces during tax assessments or scrutiny proceedings, by which time, adverse consequences such as disallowances & penalties may already have been triggered.

It is therefore essential for businesses to understand the scope and applicability of Section 40A(9) to ensure that eligible deductions are not inadvertently compromised.

What is Section 40A(9) of the Income Tax Act?

In simple terms, Section 40A(9) disallows the deduction of any sum paid by an assessee as an employer, unless it’s mandated by law. That means if a company makes contributions or payments to a fund, trust, or institution voluntarily — without any statutory obligation — such expenses cannot be claimed as a deduction while computing income under the head “Profits & Gains of Business or Profession.”

In other words, just because you paid it for your employees doesn't automatically make it deductible. This clause ensures only mandatory contributions are allowed & everything else gets disallowed.

Why Did This Section Come Into Existence?

Before Section 40A(9) was introduced, many employers were making discretionary payments in the name of welfare funds, family trusts & internal gratuity schemes to reduce taxable profits.

To curb this trend, the government brought in this section through an amendment in the year 1984 under the Income Tax Act, 1961. It made the rule clear — only those contributions that are statutorily required can be deducted. Everything else? Tax disallowed.

Real-World Examples of Disallowed Deductions

Here are a few real-life examples where businesses faced trouble:

- A company contributed to an employee welfare trust, not mandated by law — deduction disallowed.

- An employer paid a voluntary bonus into a fund outside the regular payroll system — deduction disallowed.

- Payment made to a private fund created by a group of companies — deduction disallowed.

Even with good intentions, if the payment is not supported by a law, the tax department won’t let it slide & the expense becomes a burden instead of a benefit."

So, What Can Be Deducted?

The following contributions are generally allowed as deductions, provided they comply with other sections like 36(1)(iv) or 43B:

- Contributions to Recognised Provident Fund

- Statutory Gratuity Fund contributions

- Payments to Employees' State Insurance (ESI)

- Contributions under the Payment of Bonus Act or similar legislation

If you’re unsure whether a particular expense qualifies, it’s always better to check if there is legal backing for that contribution. If not, Section 40A(9) may just strike it down.

What Should Employers Do to Stay Compliant?

Tax-saving shouldn’t turn into tax trouble. Here’s how employers can stay on the right side of Section 40A(9):

- Maintain proper documentation for statutory contributions

- Avoid routing discretionary employee benefits through trusts or funds not recognised by law

- Consult a tax advisor before creating internal funds or schemes"

- Align all employee-related expenses with existing acts & rules like the EPF Act, Gratuity Act, or ESI Act

These small checks can save you from large disallowances later.

How Does It Impact Tax Liability?

Any payment disallowed under Section 40A(9) gets added back to your taxable income, increasing your final tax liability. That means what you thought was a tax-saving move can lead to higher taxes, interest & even penalties.

Let’s say you contributed ₹10 lakh to an internal employee trust not required by law — that ₹10 lakh won’t reduce your income. Instead, it will be added back, & you’ll pay tax on it as if you never spent it.

Common Misunderstandings Around Section 40A(9)

- “It’s for the benefit of employees, so it should be allowed.”

→ Not unless it’s backed by a statutory requirement. - “We’ve been doing this for years, never had an issue.”

→ That doesn’t mean it’s compliant. You’ve just been lucky. - “We consulted our HR team.”

→ HR focuses on benefits. For tax, consult your CA.

Is There Any Way Around It?

Yes — not by evading, but by planning smartly. Instead of discretionary funds, employers should route all employee welfare payments through government-recognised schemes or directly into payroll with proper tax treatment. This ensures both compliance & employee satisfaction without risking deductions.

Also, always cross-check with your auditor or tax consultant during year-end closing to make sure such expenses are correctly classified & justified.

Confused whether your employee payments are tax-deductible or disallowed? Visit Callmyca.com today & let expert CAs simplify Section 40A(9) compliance for your business!