Section 41 of the Income Tax Act, 1961, plays a significant role in ensuring fairness in taxation, especially in cases where taxpayers have previously claimed a deduction and later recovered the same. This section ensures that income which had once escaped tax due to prior deductions is brought back into the tax net if circumstances change. One of the most important phrases associated with this section is “profits chargeable to tax.”

Let’s decode what this means in a practical and SEO-friendly way.

What Is Section 41 of the Income Tax Act?

Section 41 deals with “profits chargeable to tax” when an assessee recovers any amount that was previously allowed as a deduction or benefit under the Income Tax Act. In simple words, if a business had claimed a deduction for an expense or loss in a previous year, but later recovers that amount (in cash or kind), then that recovered amount becomes taxable in the year of recovery.

This provision is applicable under various heads, such as:

- Remission or cessation of trading liability

- Recovery of bad debts

- Recovery of loss, expenditure, or trading liability

- Balancing the charge on assets in power generation

- Deemed income on withdrawal of subsidy or grant

Each of these scenarios falls under the umbrella of profits chargeable to tax as defined in Section 41. "

Why Was Section 41 Introduced?

To plug tax leakages.

Imagine a scenario where a business claims bad debt of ₹1,00,000 as a deduction in FY 2021–22. This lowers their taxable income. Now, in FY 2023–24, if the debtor repays the ₹1,00,000, it would be unfair if that income escapes tax.

This is where Section 41 comes into action. It ensures that such recovered income, which was previously deducted, is added back to taxable profits. "

Key Situations Covered Under Section 41

- Recovery of Bad Debts [Section 41(4)]

When a taxpayer recovers an amount from bad debts which was earlier written off and allowed as a deduction, such recovery is treated as profits chargeable to tax.

Example:

A business wrote off ₹50,000 as bad debt in 2021. In 2024, they recover ₹30,000. The ₹30,000 will be taxed as business income in 2024.

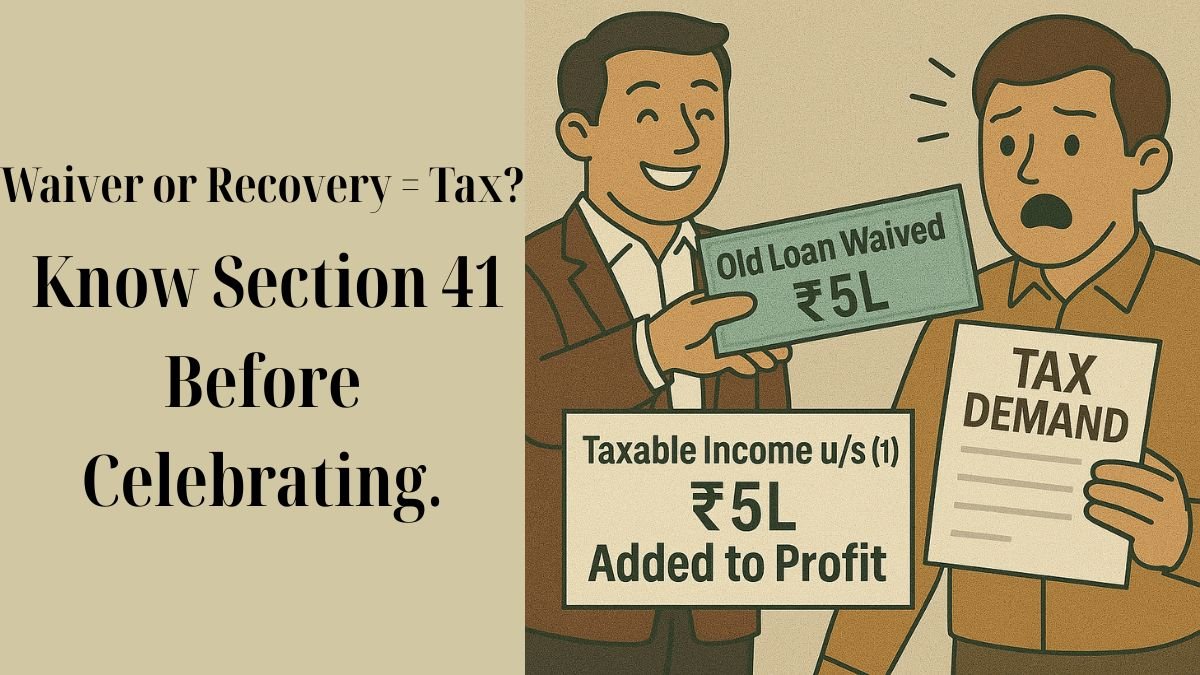

- Remission or Cessation of Trading Liability [Section 41(1)]

If a trading liability is waived off by the creditor, the waived amount becomes taxable.

Example:

You owed a vendor ₹2,00,000, but the vendor agrees to waive it. This ₹2,00,000 is now deemed as your income.

- Balancing Charge on Asset Sale [Section 41(2)]

In case of sale of depreciated assets related to power generation, if the sale proceeds exceed the written down value (WDV), the excess is taxed as profits chargeable to tax, not as capital gains.

- Subsidy, Grant, or Assistance Withdrawn [Section 41(3)]

If a subsidy or grant received for a business purpose is later withdrawn, the previously deducted benefit becomes taxable income under Section 41.

Important Points to Remember

- Income under Section 41 is taxed under the head of Business and Profession, not under capital gains or income from other sources.

- The timing of taxation is the year in which the benefit is received or the liability is waived.

- The section applies to all assesses — individuals, firms, companies, etc.

Example to Understand Practically

Scenario:

Let’s say a firm claimed ₹1,20,000 as bad debts in FY 2022–23. In FY 2024–25, the debtor pays back ₹70,000.

Taxability:

Under Section 41(4), the ₹70,000 is profits chargeable to tax in FY 2024–25 under “Profits and Gains of Business or Profession.”

Commonly Asked Questions

✅ Is Section 41 applicable even if the business is no longer operational?

Yes. Even if the business is discontinued, any recovery related to earlier deductions will be taxed under Section 41.

✅ Is the entire recovery taxable?

Yes. If a deduction was claimed earlier, the entire recovered amount is taxable in the year of recovery, even if partial.

✅ What if I didn’t claim a deduction earlier?

If no deduction was claimed previously, then the recovered amount is not taxable under Section 41.

Conclusion

Section 41 of the Income Tax Act is an essential anti-abuse provision that ensures fairness. If you recover any amount previously claimed as a deduction, that amount becomes profits chargeable to tax. It discourages taxpayers from misusing loss or expense claims and helps the Income Tax Department bring back such recoveries into the tax net.

As a taxpayer, understanding Section 41 can help you comply better, avoid notices, & plan taxes more efficiently. Whether you’re a business owner or a professional, being aware of these deemed profits will save you from future tax surprises.