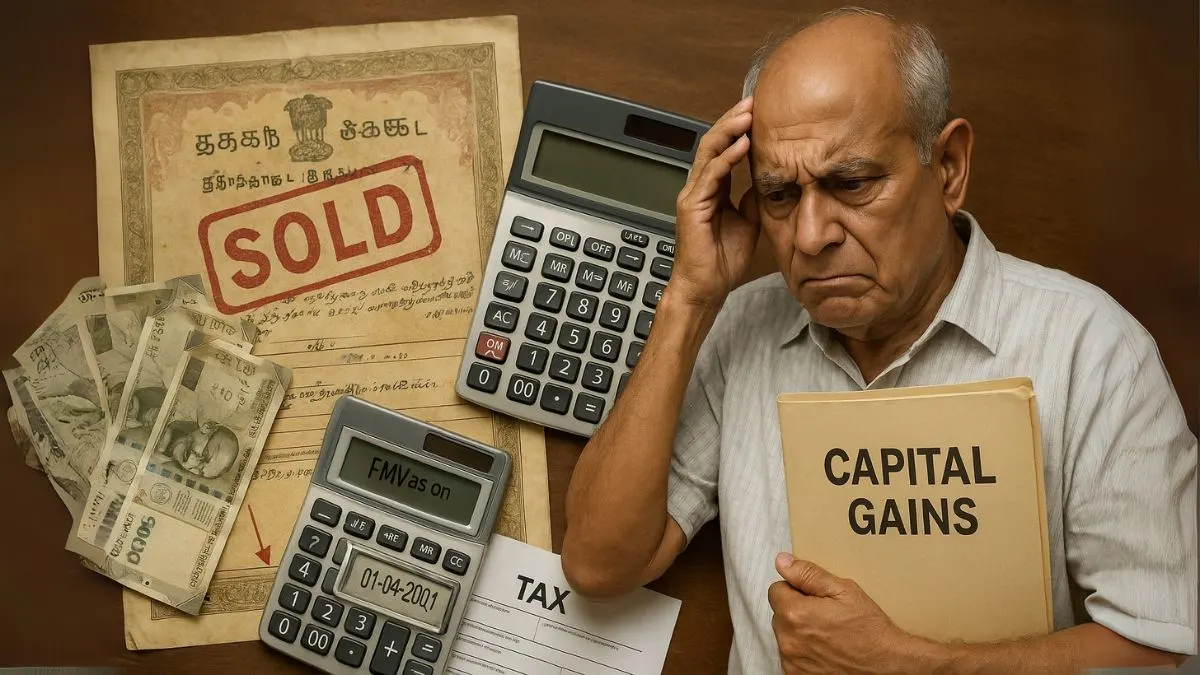

When calculating capital gains, one of the trickiest aspects for taxpayers is determining the cost of acquisition, the cost of improvement, & what exactly qualifies as an “adjusted” cost. That’s where Section 55 of the Income Tax Act comes into play—it lays down the foundation for understanding how capital gains are computed for various types of assets.

If you're dealing with real estate, shares, intangible assets, or even inherited property, this section could significantly impact your tax liabilities.

Let’s understand how.

What is Section 55 of the Income Tax Act?

Section 55 of the Income Tax Act, 1961, defines terms like:

- Cost of acquisition

- Cost of improvement

- Adjusted cost of acquisition

It also outlines how these values are to be calculated in different situations—whether you’re selling a self-acquired asset, an inherited one, or assets that were previously exempt from taxation.

Essentially, Section 55 helps compute the capital gains tax liability more precisely by defining what constitutes the “cost” of an asset.

Why is This Section Important?

Capital gains tax is applicable when you sell an asset for more than its cost. But what if the asset was inherited, gifted, or acquired before a certain date? That’s where the computation gets tricky—& that’s why amendments to Section 55 have been critical over the years.

The section ensures taxpayers are not unfairly taxed on appreciation that occurred decades ago. For instance, with Section 55(2)(b)(i), you can use the Fair Market Value (FMV) as of 1st April 2001 as the cost of acquisition for assets acquired before that date.

What is the Cost of Acquisition under Section 55?

The cost of acquisition refers to the price paid for acquiring a capital asset. In some cases, the Income Tax Act allows you to substitute this with FMV to ensure fairness."

- For shares or mutual funds acquired before 2001, FMV as on 1.4.2001 is permitted.

- For intangible assets or rights without any cost, the cost of acquisition is considered nil.

- In case of assets acquired through gift or inheritance, the cost to the previous owner is taken as the cost of acquisition.

The adjusted cost of acquisition is used when indexation is applied to factor in inflation, especially for long-term capital gains.

Cost of Improvement

Cost of improvement means any capital expenditure incurred in making additions or alterations to the asset. For most assets, only improvements made after 1st April 2001 are considered while calculating long-term capital gains.

This becomes highly relevant for:

- Renovated property

- Improved infrastructure

- Additions to factories or buildings

Again, for intangible assets or goodwill, the cost of improvement is considered nil unless it's backed by verifiable expenditure.

Section 55 Amendments: What Changed?

Recent amendments to Section 55 of the Income Tax Act in 2023 stirred significant discussion. Earlier, certain assets like goodwill, brand value, & trademarks were allowed deductions for the cost of acquisition & improvement. But the Finance Act, 2021 & further clarifications in 2023 brought some reversals:

- Goodwill of a business or profession is no longer eligible for depreciation.

- For capital gains calculation, the cost of acquisition of goodwill is considered nil, unless it was acquired for a price.

These updates make it crucial for business owners, especially in M&A transactions, to revisit how they calculate capital gains."

Example: How Section 55 Works

Let’s say you inherited a property from your grandfather that he acquired in 1995. You sell it in 2024.

Under Section 55(2)(b)(i), you can take the fair market value as on 1st April 2001 as your cost of acquisition. You can also claim indexation benefit on that FMV to compute the adjusted cost of acquisition, which will reduce your taxable capital gains.

This makes Section 55 incredibly taxpayer-friendly, especially for those holding long-term or ancestral assets.

Intangible Assets & Rights under Section 55(2)(a)

This clause specifies that for intangible assets like trademarks, brand names, & tenancy rights, if they are self-generated (not purchased), the cost of acquisition is zero.

If they were acquired, the purchase cost becomes your cost of acquisition. This provision is key for startups, creators, & professionals selling intangible capital assets.

Final Thoughts

Section 55 might seem technical, but understanding it can save you lakhs in unnecessary capital gains tax. Whether you're a real estate investor, business owner, or inheritor of ancestral property, knowing how to compute the cost of acquisition & cost of improvement under this section is essential.

Still confused about how to calculate capital gains or which date to pick for FMV?

👉 Let experts at Callmyca.com help you decode the fine print & make tax-smart decisions—without the headache of endless calculations.