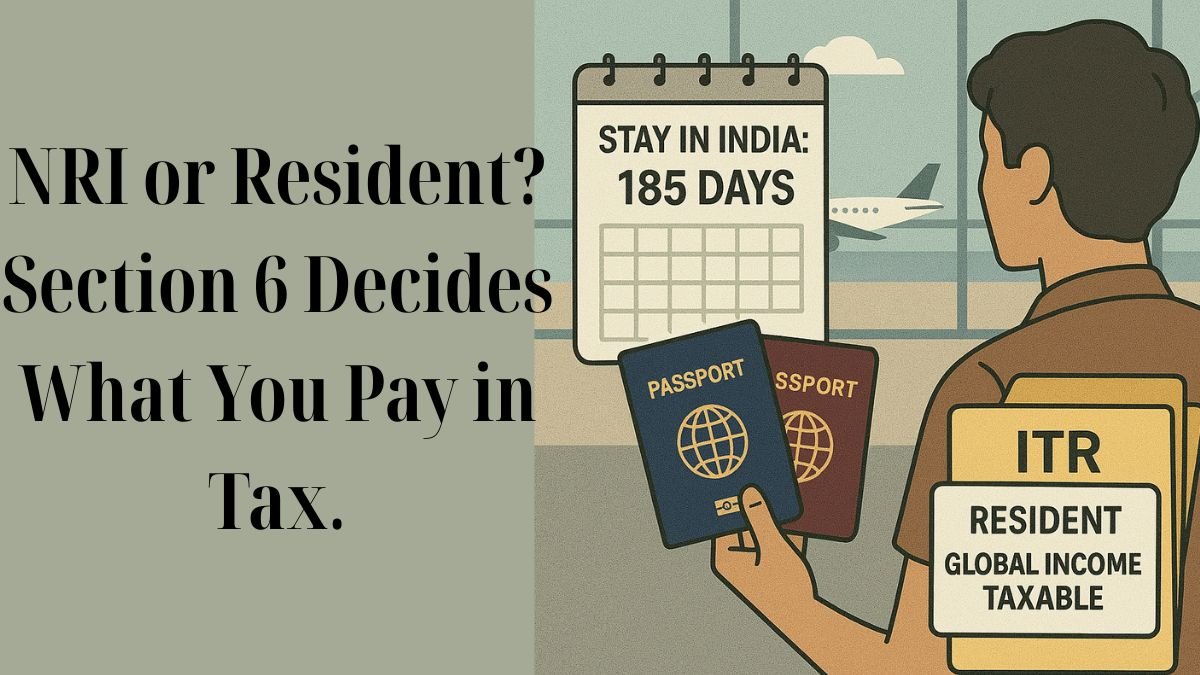

When it comes to income tax in India, one of the most important factors that determines your tax liability is your residential status. This is exactly what Section 6 of the Income Tax Act, 1961 defines. It may sound like a legal technicality, but this section is the foundation for determining how much of your income will be taxed in India, & which income may be exempt.

Let’s break it down in simple terms so it’s easy to understand.

What Is Section 6 of the Income Tax Act?

Section 6 of the Income Tax Act defines who is considered a resident in India for taxation. It lays down specific rules based on the number of days an individual stays in India during a financial year.

This section is crucial because an individual is taxed in India based on whether they are:

- Resident and Ordinarily Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

- Non-Resident (NR)

And guess what? These three statuses are determined solely by Section 6. "

Who Is a Resident?

The law says, an individual is said to be resident in India in any previous year if:

- They stay in India for 182 days or more during that financial year, or

- They stay in India for 60 days or more during that year & have stayed for 365 days or more in the 4 years preceding that year.

But there are some exceptions, especially for Indian citizens or Persons of Indian Origin (PIOs) who come to visit India. For them, the 60-day limit is replaced by 182 days.

This tweak makes sure that people who live abroad but visit India for holidays or family reasons aren’t unnecessarily taxed as residents. "

Resident but Not Ordinarily Resident (RNOR)

Even if someone qualifies as a resident, there’s another test to clear before being tagged as a Resident and Ordinarily Resident (ROR). If the individual:

- Has not been a resident in 9 out of the 10 previous years, or

- Has stayed in India for less than 729 days during the last 7 years,

Then they fall under the RNOR category.

This status is especially beneficial for returning NRIs who haven’t spent enough time in India recently. They are taxed only on their Indian income and not global income, unlike RORs.

Non-Resident (NR)

If you don’t meet either of the two basic conditions, you're treated as a non-resident. This means only the income earned or received in India will be taxed here.

Why Residential Status Matters

Here’s a quick overview of how your residential status impacts taxation:

|

Residential Status |

Tax on Indian Income |

Tax on Global Income |

|

ROR |

Yes |

Yes |

|

RNOR |

Yes |

No (with few exceptions) |

|

NR |

Yes |

No |

So, Section 6 does more than just count your days in India—it defines your tax world!

Common Scenarios

Let’s say you are an NRI working in Dubai who visits India every year for about 70 days. Over the last four years, you’ve stayed more than 400 days in total. That makes you a resident, right? Yes, according to the second condition.

But wait—if your visits were for less than 120 days each year & your total stay is still under 365 days in 4 years, you might still be non-resident. That’s why calculating the exact days becomes so crucial under Section 6.

Key Updates and Amendments

In recent years, Finance Acts have made tweaks to the definition, particularly around Indian citizens earning above ₹15 lakh from Indian sources. In such cases, the threshold of 182 days may be reduced to 120 days for certain individuals. So, it’s always a good idea to check the latest amendments to Section 6 of the Income Tax Act before making any assumptions about your status.

How to Use This Information

- If you're an NRI returning to India, you can plan your investments and earnings accordingly to avoid being taxed globally right away.

- If you’re a frequent flyer, it’s important to track your days in India each year to know how the law sees you.

- If you're a tax consultant or financial advisor, use Section 6 to guide your clients more accurately about how to reduce their tax burden legally.