One of the most critical factors in determining a person’s taxability under Indian tax law is their residential status under Section 6 of the Income Tax Act. Whether you're an individual, an HUF, or a company, your residential status directly affects how your income is taxed, especially during the financial year-end Income Tax return season.

🔍 What is Residential Status and Why Is It Important?

The residential status under Section 6 of Income Tax Act helps identify whether your global income is taxable in India or not. It is not linked to citizenship, which means you could be an Indian citizen but still be a non-resident for tax purposes, or a foreign citizen & yet be treated as a resident.

Different entities like individuals, HUFs, companies, and partnerships have distinct rules to determine their residential status, which then defines their scope of income tax liability in India.

🧾 Key Amendment from FY 2020–21

A significant rule update states: An Indian citizen who is not liable to tax in any other country, and has total income (excluding foreign income) exceeding ₹15 lakh, will be treated as a deemed resident in India for that year.

👤 Residential Status for Individuals: ROR, RNOR, or NR?

There are three classifications:

- Resident and Ordinarily Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

- Non-Resident (NR)

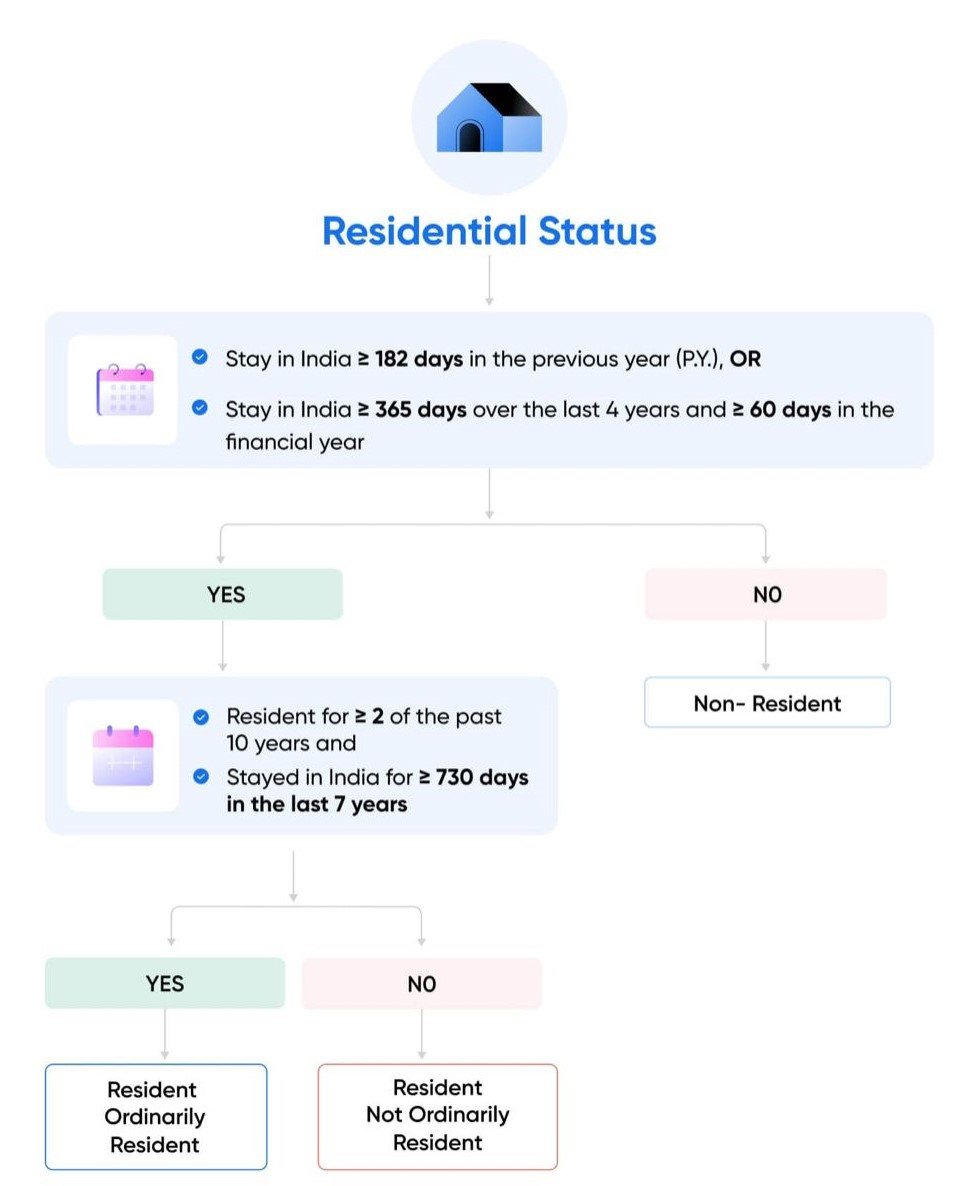

✅ When is an Individual Treated as a Resident?

You’ll be treated as a resident if:

- You’ve stayed in India for 182 days or more during the relevant financial year, or

- You’ve stayed in India for 365 days or more in the previous 4 years & 60 days or more in the current financial year

🚨 Exceptions for Citizens & Persons of Indian Origin

If you're an Indian citizen or Person of Indian Origin (PIO) visiting India:

- You'll be treated as a resident if your income (excluding foreign income) exceeds ₹15 lakh AND

- Your stay is 182 days during the previous year, OR

- You’ve stayed 365 days in the last 4 years & 120 days in the current year

If such an individual is not liable to tax in any other country, he/she will be a “deemed resident in India.”

📍 Resident But Not Ordinarily Resident (RNOR)

An individual becomes RNOR if:

- They’ve been a resident in less than 2 out of 10 previous years, or

- They’ve stayed in India for less than 730 days in the last 7 years

- They qualify as a deemed resident in India under the latest amendment

❌ When Are You a Non-Resident (NR)?

You will be treated as a Non-resident if:

- You were in India less than 182 days during the financial year

- AND did not meet the 365 60 days test in the previous years

Also Read: How Rs 1 Lakh Can Become Rs 1 Crore: The Magic of Compounding if You Start Early

🧠 Key Points to Note:

- Stay in India includes time spent in Indian territorial waters (12 nautical miles)

- Both arrival & departure dates are counted

- Your citizenship has no relevance in defining residential status

- It is possible to be resident in more than one country

🏢 Residential Status of Other Entities

HUFs (Hindu Undivided Family)

- Resident if control and management are in India

- ROR or RNOR depends on the Karta's (manager’s) past residential track record:

- Must be resident for at least 2 out of 10 years, and

- Stayed in India for 730 days or more in last 7 years

📝 Only individuals & HUFs can be classified as Resident but Not Ordinarily Resident (RNOR).

Companies

A company is a resident if:

- It is incorporated in India, or

- Its place of effective management is in India

(Place of effective management = Where commercial decisions are made.)

Firms, LLPs, AOPs, BOIs, Local Authorities

- Resident if the control and management is exercised from India

- Otherwise, treated as Non-resident

🌍 Understanding Key Terms

- Income from foreign sources: Income earned outside India, not arising from a business set up in India

- Non-resident Indian (NRI): Indian citizen or PIO who does not meet resident criteria

- Person of Indian Origin (PIO): An individual with Indian ancestry (parents or grandparents born in undivided India)

💰 Taxability Based on Residential Status

|

Status |

Taxable Income in India |

|

ROR |

Global income (India overseas) |

|

RNOR |

Income earned in India foreign income if derived from Indian business/profession |

|

NR |

Only income received or accrued in India |

🧾 Example:

- Received in India: FD interest from Indian banks

- Received from India: Payment from an Indian company to a foreign account

✅ Conclusion

Understanding residential status under Section 6 of the Income Tax Act is crucial for every taxpayer. It influences whether you’re taxed on global income or just Indian income. The rules may seem technical, but they hold the key to accurate tax planning & compliance—especially if you're an NRI, frequent traveler, or managing income across borders.