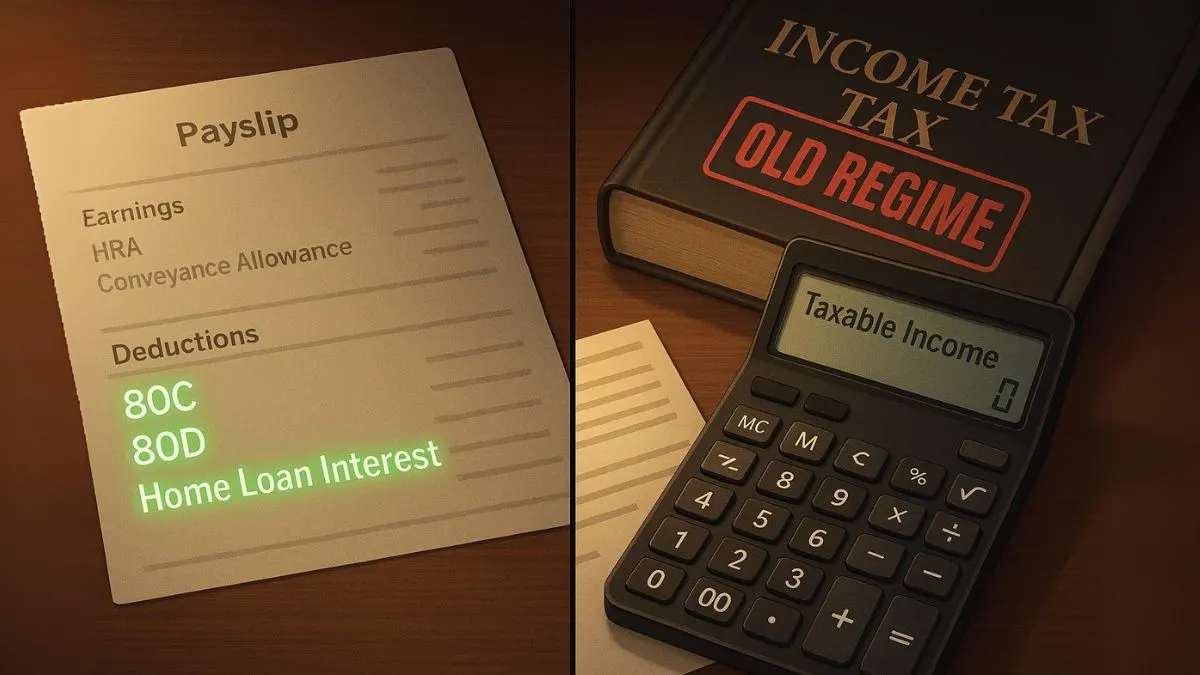

When it comes to saving tax in India, Section 80 of the Income Tax Act is often the first name that comes to mind for both salaried individuals & business owners. This powerful section provides exemptions or deductions on specific expenditures & investments, offering taxpayers an effective way to reduce their taxable income legally while promoting good financial habits.

Under the umbrella of Section 80 of the Income Tax Act of 1961, various subsections allow individuals & companies to claim deductions for different types of payments, contributions, & investments. From donations to pension contributions to insurance premiums, Section 80 truly covers a wide spectrum of tax-saving opportunities.

What is Section 80 of the Income Tax Act?

The Income Tax Act of 1961 includes Section 80 as a dedicated provision to encourage savings, investments, & social contributions by granting tax deductions. By utilising these deductions, taxpayers can significantly reduce their taxable income, ultimately decreasing the amount of tax they owe to the government."

Key Deductions under Section 80

Let’s dive into some popular subsections & benefits available under Section 80 of the Income Tax Act:

- Section 80C

- The most well-known section among taxpayers.

- Provides a deduction of up to Rs. 1.5 lakh for investments in instruments like Life Insurance, PPF, NSC, ELSS, Sukanya Samriddhi, home loan principal repayment, etc.

- This is the go-to option for salaried individuals looking to reduce their taxable income.

- Section 80G

- Encourages philanthropy by offering tax relief on charitable donations.

- Allows taxpayers to claim a tax deduction on donations of either 100% or 50%, depending on the organisation donated to."

- This promotes social responsibility while offering tax savings.

- Section 80CCD(1B)

- Additional deduction up to Rs. 50,000 for contributions to the National Pension Scheme (NPS).

- This allows you to claim a deduction for contributions made to pension plans, helping you build retirement savings while saving taxes today.

- Section 80D

- Deduction for premium paid on health insurance for self, family, & parents.

- Essential for both tax-saving & securing your family’s health.

- Section 80E

- Deduction on interest paid on education loans, ensuring that higher education doesn’t become a financial burden.

- Section 80JJAA

- Offers a tax incentive to companies or LLPs that are eligible start-ups by providing deductions on employment of new workers.

These are just a few examples. The Section 80 series includes other important subsections like 80GG (house rent), 80TTA (savings account interest), & 80U (for disabled individuals) that collectively provide various deductions to taxpayers."

How Section 80 Helps Taxpayers

The primary goal of Section 80 of the Income Tax Act is to ensure that individuals, professionals, & businesses take financial planning seriously. By making use of these deductions, not only do you reduce your taxable income, but you also secure your future through prudent investments.

Let’s not forget that the government uses tax incentives to nudge citizens toward desirable behaviour: saving more, buying health insurance, donating to charitable causes, or investing in retirement.

In addition, many of these deductions align with life goals—be it buying a home, educating your children, or ensuring health security for your family.

How Much Can You Save?

For most individuals, the combined benefits of Section 80C, 80CCD(1B), 80D, & other deductions can result in tax savings of several thousands of rupees annually. A smartly planned financial year, using the right mix of eligible expenses & investments, can help you maximise your deductions under Section 80 of the Income Tax Act.

Important Reminders

- Each section under Section 80 comes with specific rules, limits, & documentation requirements.

- It is crucial to invest or spend before the end of the financial year to claim the benefit.

- Not all deductions are automatic; some require proactive planning & submission of proofs.

If you’re feeling overwhelmed by the various deductions under Section 80 of the Income Tax Act or need help with tax planning & filing, let our experts at Callmyca.com take care of it for you—because saving tax smartly is not just your right, it’s your opportunity!