When it comes to income tax filing in India, taxpayers are given a choice: whether to opt for the old tax regime or the new tax regime. Each system has its own set of rules, benefits, and drawbacks. However, the old tax regime continues to hold its ground for millions of taxpayers because it allows them to maximize savings through deductions and exemptions.

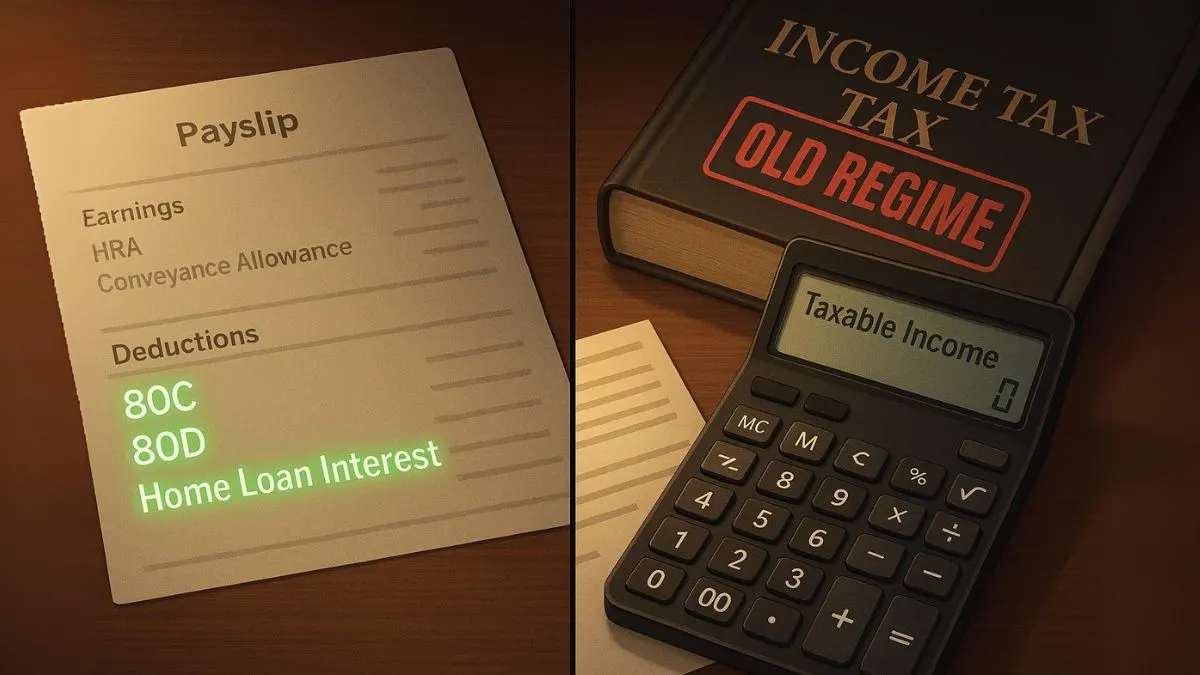

The old tax regime refers to the system of income tax calculation & slabs that has been in existence for decades. It provides flexibility to individuals by enabling them to reduce their taxable income with the help of various deductions under sections like 80C, 80D, and 24(b). While the new regime offers lower tax rates with no deductions, the old system is still preferred by those who make planned investments and want to claim tax benefits.

What is the Old Tax Regime?

In simple terms, the old tax regime refers to the system of income tax calculation & slabs where taxpayers can take advantage of multiple deductions and exemptions.

For example:

- Investments in PPF, ELSS, Life Insurance, and NPS are deductible under Section 80C (up to ₹1.5 lakh).

- Health insurance premiums are deductible under Section 80D.

- Home loan interest can be claimed under Section 24(b).

This regime promotes tax savings through planned investments while encouraging individuals to save for the future.

Old Tax Regime Slabs (AY 2025-26)

One of the unique features of this regime is that the basic exemption limit is determined by age.

- Individuals below 60 years → Basic exemption: ₹2,50,000

- Senior citizens (60–79 years) → Basic exemption: ₹3,00,000

- Super senior citizens (80 years) → Basic exemption: ₹5,00,000

Your income tax slab in the old tax regime will be between ₹5 lakh and ₹10 lakh, with higher incomes taxed at 30%."

|

Income Range (Old Regime) |

Tax Rate |

|

Up to basic exemption (₹2.5–₹5 lakh depending on age) |

Nil |

|

₹2.5 lakh – ₹5 lakh |

5% |

|

₹5 lakh – ₹10 lakh |

20% |

|

Above ₹10 lakh |

30% |

This tiered structure ensures that low-income taxpayers & senior citizens get relief.

Also Read: Save Tax with Health Insurance and Preventive Check-ups

Exemptions and Deductions in the Old Tax Regime

The biggest advantage of this system is that it allows you to claim exemptions & deductions. Here are some major ones:

- Section 80C: Deduction up to ₹1.5 lakh for investments in PPF, ELSS, Life Insurance, NSC, etc.

- Section 80D: Deduction on medical insurance premiums.

- House Rent Allowance (HRA): Exemption if you live in a rented property.

- Leave Travel Allowance (LTA): Exemption for travel expenses incurred within India.

- Home Loan Interest (Section 24(b)): Deduction up to ₹2 lakh on housing loan interest.

- Education Loan (Section 80E): Deduction for interest paid on education loans.

The tax regime provides for several additional tax benefits that can bring down taxable income significantly.

Benefits of the Old Tax Regime

- Encourages Savings: By investing in eligible schemes, you not only reduce tax but also build wealth for the future.

- Flexibility: Different deductions allow you to structure finances as per your goals.

- Age-Based Relief: With a higher basic exemption limit for senior citizens (₹3,00,000) & super senior citizens (₹5,00,000), it ensures fairness."

- Additional Benefits: You can claim deductions on expenses like medical bills, home loans, and even education loans.

- Better for High-Income Taxpayers: Those in higher slabs benefit more by claiming multiple deductions.

Drawbacks of the Old Tax Regime

While the old regime is beneficial, it also comes with limitations:

- Complexity: Filing can become complicated with multiple exemptions.

- Mandatory Investments: To save taxes, you need to lock money in PPF, ELSS, or insurance.

- Not Always Best for Low-Income Earners: For individuals with limited deductions, the new regime may be simpler & cheaper.

Also Read: Maximize Your Home Loan Tax Benefits

Old Tax Regime vs. New Tax Regime

|

Criteria |

Old Tax Regime |

New Tax Regime |

|

Tax Rates |

Higher |

Lower |

|

Deductions |

Allowed (80C, 80D, HRA, etc.) |

Not allowed |

|

Basic Exemption |

Age-based (₹2.5L – ₹5L) |

Uniform ₹3L |

|

Complexity |

High |

Simple |

|

Best For |

Those with planned investments |

Those with fewer deductions |

The decision depends on individual financial situations.

Who Should Choose the Old Tax Regime?

You should stick with the old tax regime if:

- You invest in tax-saving instruments like ELSS, PPF, Insurance, and NPS.

- You pay home loan EMIs & want to claim deductions.

- You receive HRA and LTA benefits.

- You are a senior citizen & benefit from higher exemption limits.

In such cases, the old regime ensures maximum tax savings.

Practical Example

Let’s take an example:

Mr. Rohan earns ₹12 lakh annually. He invests ₹1.5 lakh in PPF, pays ₹25,000 as health insurance premium, and ₹2 lakh as home loan interest."

- Gross income: ₹12,00,000

- Less 80C: ₹1,50,000

- Less 80D: ₹25,000

- Less Home Loan (24b): ₹2,00,000

- Net taxable income: ₹8,25,000

Tax on ₹8.25 lakh = much lower compared to paying without deductions.

This shows how the old regime promotes tax savings through planned investments.

Also Read: How to Reduce Tax in the Old Regime?

Conclusion

The old tax regime refers to the system of income tax calculation & slabs that has shaped the way Indians save and invest. By offering a wide variety of deductions & exemptions, it ensures that taxpayers can reduce their burden legally while building financial security. For those who actively plan their finances, this regime is still the preferred choice over the simplified new tax system.

💡 Want expert help in choosing between the old and new tax regimes for your ITR?

Check out Callmyca.com – where we simplify tax filing and help you save the maximum legally.