When planning your taxes, Section 80CCC of the Income Tax Act can play a pivotal role, especially for individuals considering annuity or pension plans. This provision is a vital part of the tax-saving arsenal, especially if you are focused on long-term financial stability after retirement.

But what exactly does Section 80CCC cover, & how can you benefit from it?

Let’s break it down in simple terms.

What is Section 80CCC of the Income Tax Act?

Section 80CCC is a clause in the Income Tax Act, 1961, which provides deductions for investments made in certain pension schemes. It allows individuals to claim a deduction up to a specific limit for contributions made to approved pension funds.

Whether you're a salaried employee or a self-employed professional, Section 80CCC of the Income Tax Act allows you to plan smartly for retirement while also reducing your taxable income.

Dedication in Respect of Contribution to Certain Pension Funds

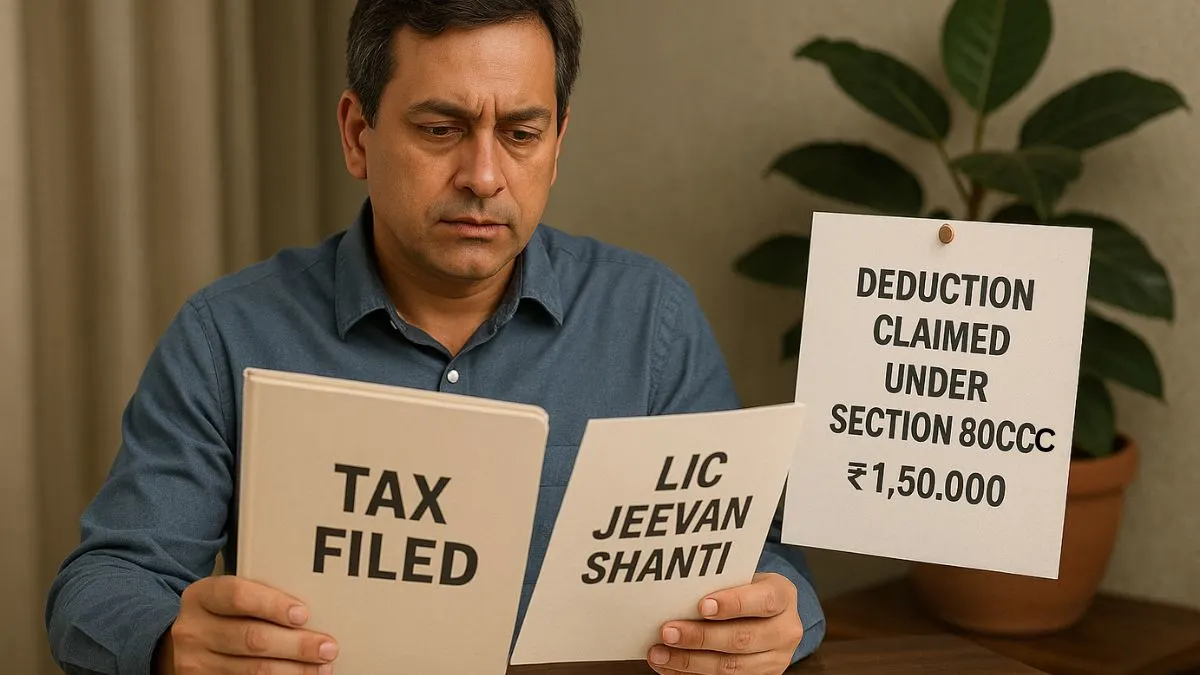

If you invest in an annuity plan offered by an insurer like LIC or other approved pension providers, you can claim a deduction under this section. The provision is clear—deduction in respect of contribution to certain pension funds will be allowed, provided specific criteria are met.

The best part?

You don’t need to be a pensioner to claim this benefit. As long as you're contributing to an eligible plan, you can avail of the deduction under Section 80CCC.

Limit of Deduction under Section 80CCC

Section 80CCC allows individuals to claim a deduction up to a maximum of ₹1.5 lakh per financial year. This offers a cumulative tax deduction of up to ₹1.5 lakh per year when combined with deductions under Section 80C & Section 80CCD.

This means if you've already invested in PPF, ELSS, or paid school tuition fees under 80C, you must account for those when claiming deductions under 80CCC. The total ceiling for 80C, 80CCC, & 80CCD(1) combined is ₹1.5 lakh.

Here’s the keyword to remember: offers tax deductions up to Rs 1.5 Lakhs per year under this scheme. "

What Qualifies for Dedication?

Under Section 80CCC, you can claim tax deductions for investments made in:

- Annuity plans & pension plans offered by insurers

- Any scheme that pays a pension from your invested corpus

However, it is important to note that interest or bonuses accrued on these policies are not eligible for deduction under Section 80CCC.

Also, upon maturity or surrender of the policy, the pension amount or annuity received is taxable in the year of receipt. So while the investment brings immediate tax relief, the returns are taxable in the future. "

Difference Between Section 80C & 80CCC

Though both sections provide tax-saving opportunities, they cater to different instruments.

- Section 80C includes PPF, EPF, NSC, ELSS, & life insurance premium.

- Section 80CCC, on the other hand, specifically targets contributions made to approved pension funds.

Still, the combined deduction limit remains capped at ₹1.5 lakh annually.

Key Takeaways for Smart Tax Planning

- Provides us with the opportunity to claim certain tax deductions while investing in retirement instruments.

- Allows individuals to claim a deduction up to a specific limit for pension investments.

- Provides deductions for the investments in the pension scheme under licensed insurance companies.

- Encourages disciplined savings toward retirement goals through annuity plans & pension plans.

- Helps in reducing overall tax liability with deduction under section 80CCC of the Income Tax Act.

If you're considering building a pension corpus, this section is worth exploring in detail.

Final Thoughts

Section 80CCC is an underrated yet powerful tax-saving tool for those planning for their golden years. With the right annuity or pension plan, you not only secure your future but also reap present-day tax benefits.

Want help filing your ITR with 100% accuracy & maximum deduction claims? Let our experts at Callmyca.com simplify the process for you. Trust us—it’s faster, smarter, & easier than doing it alone!