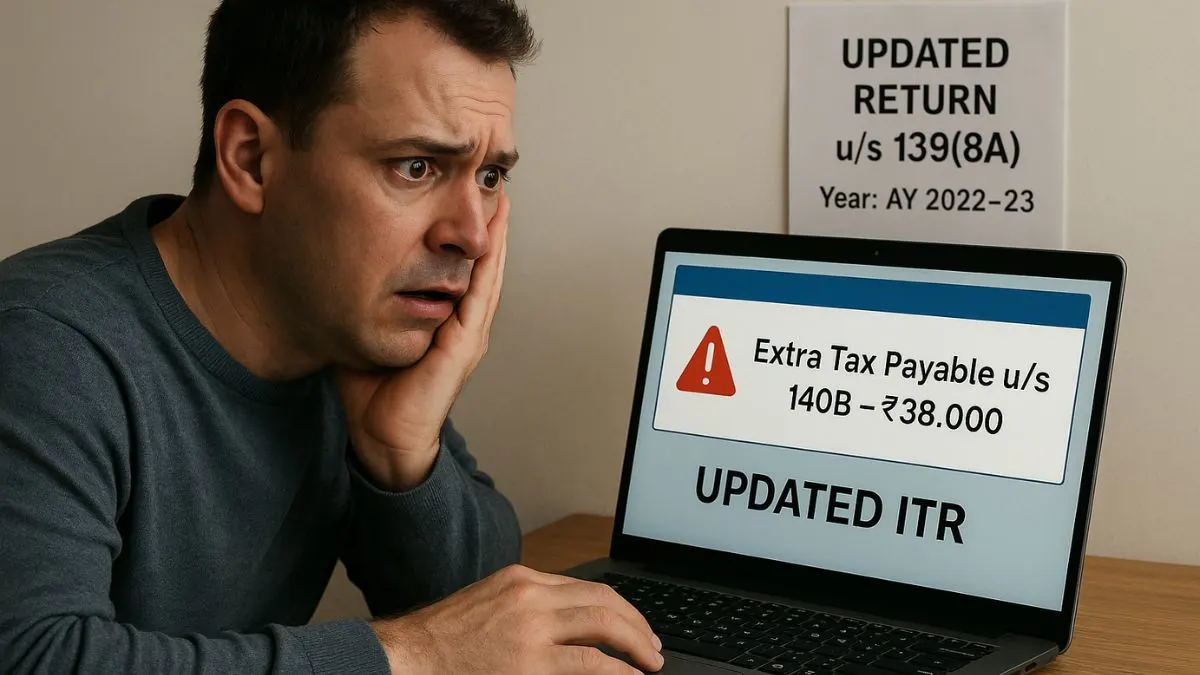

Missing the due date for filing your Income Tax Return (ITR) is not the end of the world. Thanks to Section 140B of the Income Tax Act, you still have a chance to come clean, pay your taxes, & avoid more severe consequences. Introduced as part of the Finance Act, this section is designed to help taxpayers file an updated return even after the original deadline has passed.

Whether you forgot to include some income, made errors in tax computation, or missed filing altogether, Section 140B empowers the tax authorities to re-assess a tax return while giving taxpayers a structured path to voluntarily correct their filings.

What is Section 140B of the Income Tax Act?

Section 140B of the Income Tax Act outlines the provisions for filing an updated return under Section 139(8A). This is different from revised returns & belated returns. An updated return is a newer concept that gives individuals & companies an opportunity to rectify mistakes or declare missed income even after the assessment year ends.

In simple terms, Section 140B allows taxpayers to file their income tax returns after the due date has passed, but with some conditions & additional tax liabilities.

Who Can File Under Section 140B?

Not every taxpayer is eligible to file under this section. Here's who can benefit:

- Individuals or businesses who missed the original ITR filing deadline

- Taxpayers who want to declare previously unreported income

- Those who need to rectify errors in earlier filed returns (if not under scrutiny)

- Anyone wanting to pay additional tax voluntarily to avoid penalties later

However, if a proceeding for assessment or reassessment has already started against you, then you cannot file an updated return under this section. "

Key Features and Scope

- You can file the updated return within 24 months from the end of the relevant assessment year.

- This return must be filed electronically along with proof of payment of additional tax, interest, & fees, if applicable.

- Section 140B specifies the mechanism for computing tax liabilities on the updated return. It includes the tax amount, interest under Section 234A/B/C, & an additional tax (25% or 50% of the tax & interest, depending on the timing).

- Taxpayers must pay the tax using the Challan No. ITNS 280, & how to pay 140B challan online, is now a commonly searched query.

140B Tax Calculation: Explained Simply

Let’s say you forgot to report some income & want to update your return:

- Recalculate your income with the missed sources added.

- Calculate the tax on the updated income.

- Add applicable interest under Sections 234A/B/C.

- Add additional tax:

- 25% if filed within 12 months from the end of the relevant AY.

- 50% if filed between 12–24 months.

- Total it all up & pay via challan.

140B tax calculation is simple if you understand the structure, & it's vital for staying compliant.

Common Queries and How-To Searches Around Section 140B

A lot of people ask:

- How to pay the 140B challan online?

- What is Section 140B(3) of the Income Tax Act?

- Is there a video on how to pay the 140B challan online?

These searches show the practical concerns of taxpayers. Filing under Section 140B of the Income Tax Act of India is not just about understanding the law—it’s about execution. You must be accurate with amounts, select the right assessment year, & ensure the challan is correctly linked to your PAN.

Why This Section Matters

Section 140B is part of the Indian government’s move to make compliance easier & more transparent. By offering this route:

- The government improves revenue collection.

- Taxpayers get a chance to avoid harsher penalties & legal action.

- It increases voluntary compliance & gives peace of mind.

Essentially, Section 140B income tax allows you to fix your mistake before the taxman finds it. "

Final Thoughts

Section 140B of the Income Tax Act is a crucial tool for taxpayers who, for any reason, couldn’t or didn’t file accurate returns on time. With clear procedures, specified tax calculations, & an online challan payment facility, it brings both accountability & opportunity to the Indian tax ecosystem.

If you’re unsure how to proceed or find yourself wondering how to pay tax under Section 140B of the income tax, it’s best to consult a professional or use platforms that simplify tax filing.

💡 Need help figuring out how to pay tax under Section 140B or file your updated return hassle-free? Get expert support with just a few clicks on Callmyca.com – where tax problems meet simple solutions.