Paying income tax is a civic duty, but the Indian government also offers relief to ensure that taxpayers in lower-income brackets aren’t unfairly burdened. One of the most impactful provisions in this regard is Section 87A of the Income Tax Act.

Whether you're a salaried employee or self-employed individual, if your total taxable income is up to ₹5 lakh, you could be eligible to pay zero tax, thanks to this section.

In this guide, we’ll explain what Section 87A is, who qualifies for it, how to claim it under the old and new regimes, and what’s changed in recent financial years. "

What Is Section 87A of the Income Tax Act?

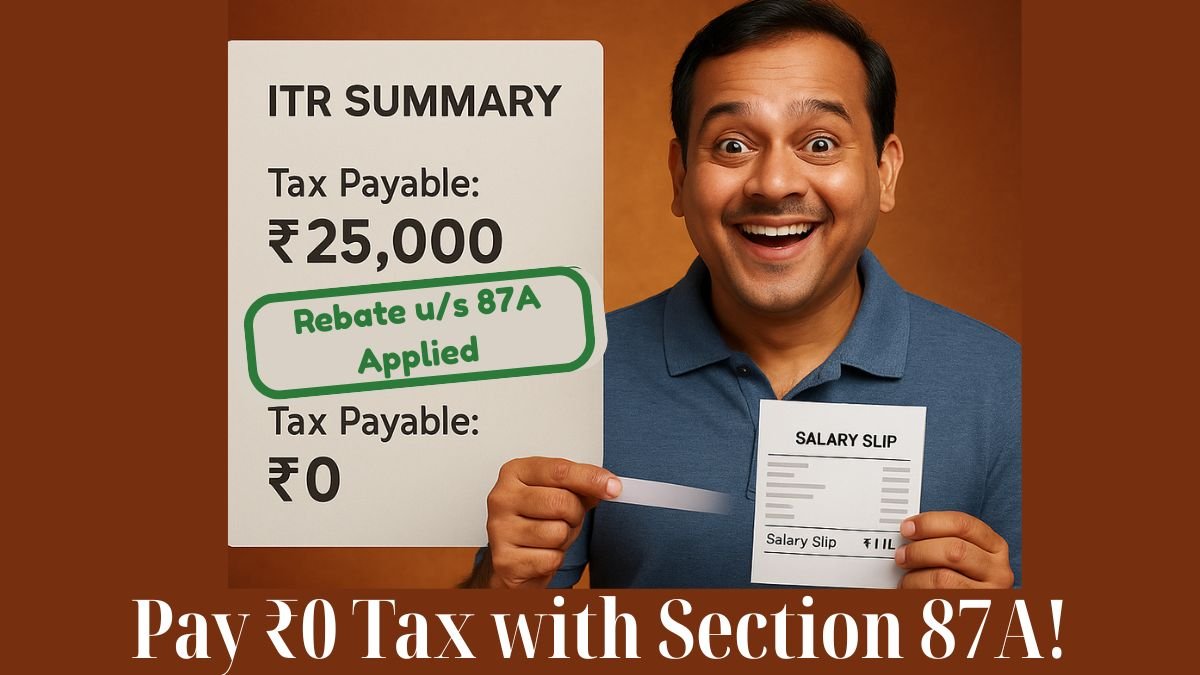

Section 87A was introduced to provide tax relief to resident individuals falling under lower income brackets. It allows a tax rebate of up to ₹12,500 (old regime) or ₹25,000 (new regime), depending on the regime and the financial year.

So if your total taxable income (after deductions) is within the prescribed limits, you may not have to pay any tax at all.

This is especially useful for entry-level salaried professionals, freelancers, pensioners, and small business owners.

You Are Eligible to Claim the Rebate Under Section 87A If:

- You are a resident individual (not applicable for HUFs or NRIs)

- Your total income (after deductions under Chapter VI-A) does not exceed:

- ₹5 lakh under the old tax regime

- ₹7 lakh under the new tax regime from AY 2024–25 onwards

- You submit a declaration for claiming the Income Tax Rebate

Let’s understand this in detail based on both regimes.

Rebate Under Section 87A – Old Tax Regime

Under the old tax regime, the rebate under Section 87A is:

- Up to ₹12,500

- Available if your total income is up to ₹5 lakh

- Post deductions like Section 80C, 80D, 80TTA, etc.

Example:

Suppose your total income is ₹6.5 lakh, and you claim deductions of ₹1.6 lakh under various sections.

Your net taxable income becomes ₹4.9 lakh → You are eligible for full tax rebate under Section 87A

Rebate Under Section 87A – New Tax Regime

From Assessment Year 2024–25, the rebate amount was revised for those opting for the new tax regime.

- If your total taxable income is up to ₹7 lakh, you're eligible for a rebate under Section 87A, which stands at ₹25,000

- This makes your net tax liability zero

The aim is to make the new tax regime more attractive by offering full relief at a higher income level.

Example:

If your total taxable income is ₹6.8 lakh and you’ve not claimed any deductions, you still qualify for the ₹25,000 rebate under Section 87A in the new tax regime.

Section 87A for Senior Citizens

Yes, Section 87A is also available for senior citizens below the age of 80. Super senior citizens (80 ) are already exempt from paying taxes on income up to ₹5 lakh, so the 87A rebate isn’t needed for them.

How Is Section 87A Rebate Calculated?

Here’s how to determine your eligibility and rebate amount:

- Calculate gross total income

- Subtract deductions under 80C to 80U

- Arrive at net taxable income

- If this is within ₹5 lakh (old regime) or ₹7 lakh (new regime), apply the rebate:

- Old regime → up to ₹12,500

- New regime → up to ₹25,000

This rebate is directly reduced from your final tax liability, not from income.

Section 87A Rebate Limit for AY 2025–26

For Assessment Year 2025–26 (Financial Year 2024–25):

- Under old regime, 87A rebate limit is ₹12,500 for income up to ₹5 lakh

- Under new regime, 87A rebate limit is ₹25,000 for income up to ₹7 lakh

Choose the tax regime wisely based on deductions available and your total income.

Submission of Declaration for Claiming Income Tax Rebate

There is no separate form required for the 87A rebate. But while filing your ITR:

- Tick the 87A rebate checkbox in the tax computation sheet

- Ensure your net taxable income matches the eligibility criteria

- E-verify the return to complete the process

You can also use the income tax calculator available on the Income Tax e-filing portal to check eligibility.

Common Queries Around Section 87A

What is Section 87A of the Income Tax Act with an Example?

As covered earlier, if your income after deductions is ₹4.95 lakh, and tax is ₹12,000 → You get ₹12,000 rebate → Tax payable = Zero

What if my income is ₹5.01 lakh?

Sadly, even ₹1 above the threshold disqualifies you. But you can explore marginal relief under Section 87A in the new regime (from AY 2024–25).

Is Section 87A available in both regimes?

Yes, but the rebate amount and income limit differ:

- ₹5 lakh limit (old regime)

- ₹7 lakh limit (new regime)

Final Thoughts

Section 87A of the Income Tax Act is one of the most beneficial tax relief provisions for middle- and lower-income groups. It can reduce your tax burden to zero if planned smartly.

Let’s recap:

- It provides tax relief to resident individuals falling under lower income brackets

- You are eligible to claim the rebate under Section 87A if your total taxable income is up to ₹5 lakh under the old regime or ₹7 lakh in the new regime

- The rebate under Section 87A, which stands at ₹25,000 in the new regime

- Proper submission of the declaration for claiming the Income Tax Rebate is essential

- Applies to salaried, self-employed, pensioners, and senior citizens (below 80)

👉 Confused about which tax regime suits you or how to claim 87A?

Visit www.callmyca.com for expert tax filing support, regime comparison tools, and personalised tax planning.