When it comes to taxes, the Income Tax Department of India ensures there are clear guidelines & consequences for non-compliance. One such provision that deals with the aftermath of unpaid taxes is Section 220(2) of the Income Tax Act, 1961. This section plays a critical role in enforcing the timely payment of tax demands & imposes an interest liability on defaulters.

What Is Section 220(2)?

Section 220(2) of the Income Tax Act relates to the interest liability on unpaid tax demand. When a taxpayer fails to pay the tax specified in the notice of demand under Section 156 of the Act within the allowed time frame (usually 30 days from the date of service of the notice), interest begins to accrue.

This interest is charged at the rate of 1% per month or part of a month, starting from the expiry of the 30 days until the actual payment is made. It’s a statutory interest—automatically applicable—without requiring a separate order from the Assessing Officer. "

When Does It Apply?

This provision deals with the consequences of non-payment of income tax by a taxpayer. Some common situations where Section 220(2) kicks in include:

Non-payment of self-assessment tax.

Demand raised post-assessment (under scrutiny or reassessment).

Any shortfall in tax payment is discovered during the assessment.

If a taxpayer fails to pay the amount mentioned in the notice of demand, interest under this section will be automatically levied, regardless of the reasons behind the delay.

Impact of Late Payment

The late payment of demand for tax, interest and penalty not only attracts additional financial burden through Section 220(2), but may also lead to further consequences under other provisions such as:

Penalty under Section 221.

Attachment of bank accounts or property.

Initiation of recovery proceedings.

Hence, taxpayers must treat the notice of demand seriously and ensure timely payment to avoid falling into a spiral of interest, penalty, and litigation. "

Is There Any Relief?

Yes, there is some scope for leniency. The tax authorities have the discretion to waive or reduce interest payable by a taxpayer under certain circumstances. This is usually done under:

Section 220(2A), which empowers the Principal Commissioner or Commissioner to grant relief based on genuine hardship or other valid grounds.

But these are rare and require a formal application supported by documents and a convincing reason for default.

Practical Example

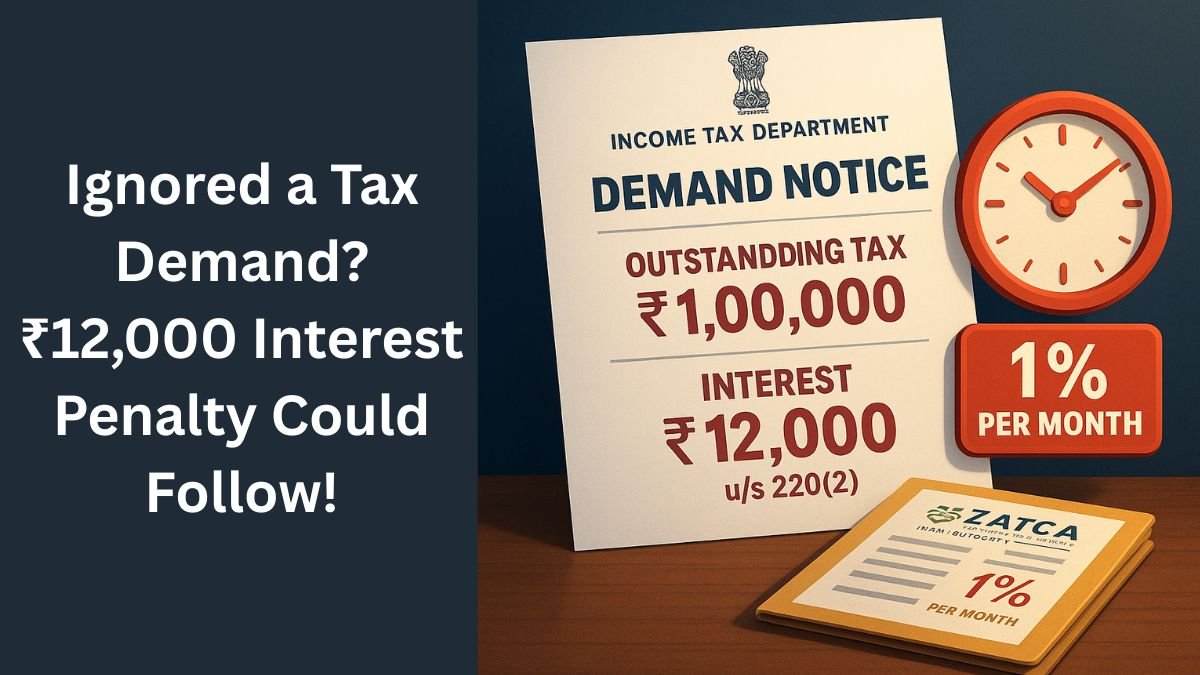

Let’s say Mr. A receives a demand notice under Section 156 for ₹1,00,000 in tax dues on 1st May. He is required to pay by 31st May (30 days). If he pays on 10th August, he has delayed payment by 3 months.

Under Section 220(2), Mr. A is liable to pay interest of:

1% x 3 months x ₹1,00,000 = ₹3,000 as interest.

Final Thoughts

Section 220(2) of the Income Tax Act is not a punitive provision but a mechanism to encourage tax compliance and ensure the government’s revenue flow isn’t disrupted. It acts as a financial deterrent for delays and motivates taxpayers to meet their obligations within the prescribed timeline.

If you’ve received a demand notice or are unsure about interest liability under Section 220(2), our tax experts at Callmyca.com can help you respond professionally, calculate interest, and even assist with waiver applications. Visit our site to learn more.