Whether you run a small business or manage invoicing for a large company, knowing how to create and issue a credit note is crucial. A credit note helps correct billing errors, acknowledges returned goods, and maintains accurate accounting records. But how exactly does a proper specimen of a credit note look?

This article will guide you through everything you need to know—from format to content—along with tips for accessing a free credit note template in Word, Excel, Google Docs or PDF.

What Is a Credit Note?

A credit note (also known as a credit memo) is a commercial document issued by the seller to the buyer. It acts as a legal confirmation that a certain value has been credited to the customer’s account.

This could happen because:

- Products were returned

- Goods were damaged

- An invoice had an error

- A discount or refund was agreed upon after invoicing

Once issued, the credit note becomes an official part of your accounting records.

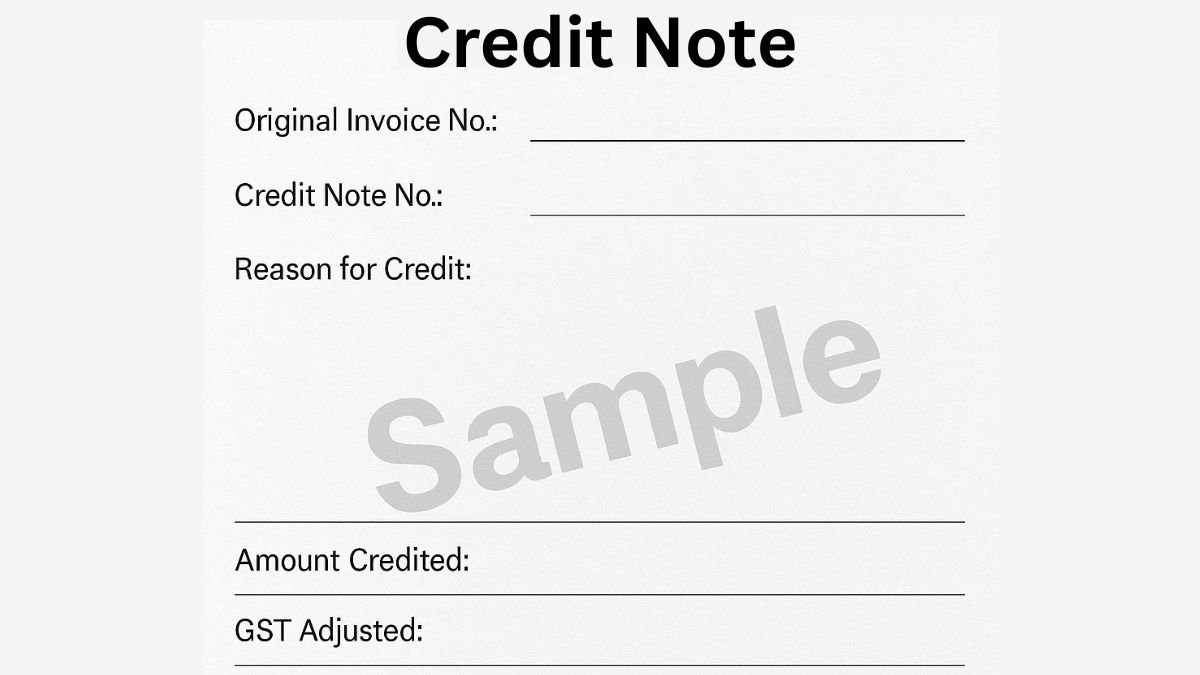

Basic Structure: Specimen of Credit Note

A well-prepared specimen of a credit note includes all the general details of an invoice, but with a few distinctions that mark it as a credit document. Let’s break it down:

Header Section

- Business Name & Logo

- Business Address

- GSTIN or Tax ID

- Contact Number and Email

- Header with business details and credit note number

Body Section

- Credit Note Number

- Date of Issue

- Customer Name and Address

- Original Invoice Number (that’s being corrected or referenced)

- Reason for issuing the credit note (e.g., “Product returned due to damage”)

- Itemised list of:

- Product/service description

- Quantity

- Unit price

- Total value credited

Footer Section

- Authorised Signature or Stamp

- Company seal (optional)

- Terms and conditions (if any)

- Payment adjustment or refund method

Credit Note Format in GST

If your business is registered under GST in India, the credit note format in GST must include additional fields:

- GSTIN of the supplier and the recipient

- Tax rate (CGST/SGST/IGST)

- HSN/SAC codes

- Revised taxable value

- Amount of tax credited

- Place of supply

This is essential to ensure proper Input Tax Credit (ITC) adjustments in monthly returns.

Downloadable Formats: Ready-to-Use Templates

Creating credit notes manually can be tedious. That’s why many prefer using pre-formatted credit note templates. You can get a free credit note template in Word, Excel, Google Docs or PDF from various trusted sources online.

Here’s what’s available:

- Credit note format Word free download – Easy to edit and print

- Credit note format in Excel – Great for auto-calculations

- Credit note format PDF download – Best for official sharing

- GST credit note format in Word – With all GST compliance fields

Most formats can be customised to include your branding, tax details, and product lists.

Class 11 and Educational Use

For academic purposes, students may search for specimens of credit note class 11. In textbooks, the example typically includes:

- Hypothetical buyer and seller names

- Hand-drawn or typed tabular format

- Basic numeric values and descriptions

- Reason for issuing the credit note

These are excellent for learning the foundational structure before diving into software-based formats. "

Simple Credit Note Format for Small Businesses

If you’re a freelancer, a startup, or a small retail shop, you might only need a simple credit note format. This includes:

- Seller and buyer details

- Date

- Credit note number

- Original invoice reference

- Short reason (e.g., “Overbilling correction”)

- Amount credited

It’s fast, functional, and gets the job done for internal records and client transparency.

Credit Note vs Debit Note: Quick Comparison

Often confused with debit notes, a credit note is issued by the seller, whereas a debit note is issued by the buyer. If you're exploring templates, you may also come across specimen of debit note—useful when understanding how the buyer initiates a return or reduction in payable amount.

Final Tips for Using Credit Notes Effectively

- Always maintain a unique credit note number for tracking

- Keep soft and hard copies for at least 5–7 years

- Issue the note promptly after identifying the error or return

- Inform the client with a copy and reference the original invoice

- If you're under GST, file it correctly in GSTR-1 and adjust it in GSTR-3B

Using templates helps eliminate guesswork and maintain a professional image, whether you're issuing a note in response to a return, pricing error, or post-sale discount.

Final Thoughts

A credit note is more than just a reversal document—it’s a tool of transparency, accuracy, and trust. With the right format and templates, issuing credit notes becomes simple and compliant with GST or accounting norms.

So next time you face a billing correction or return scenario, don’t panic. Just pull up your free credit note format in Word, fill in the details, and send it off!

👉 Need professional support with invoice and credit note formats or GST compliance?

Visit www.callmyca.com to access templates, automation tools, and expert advice.