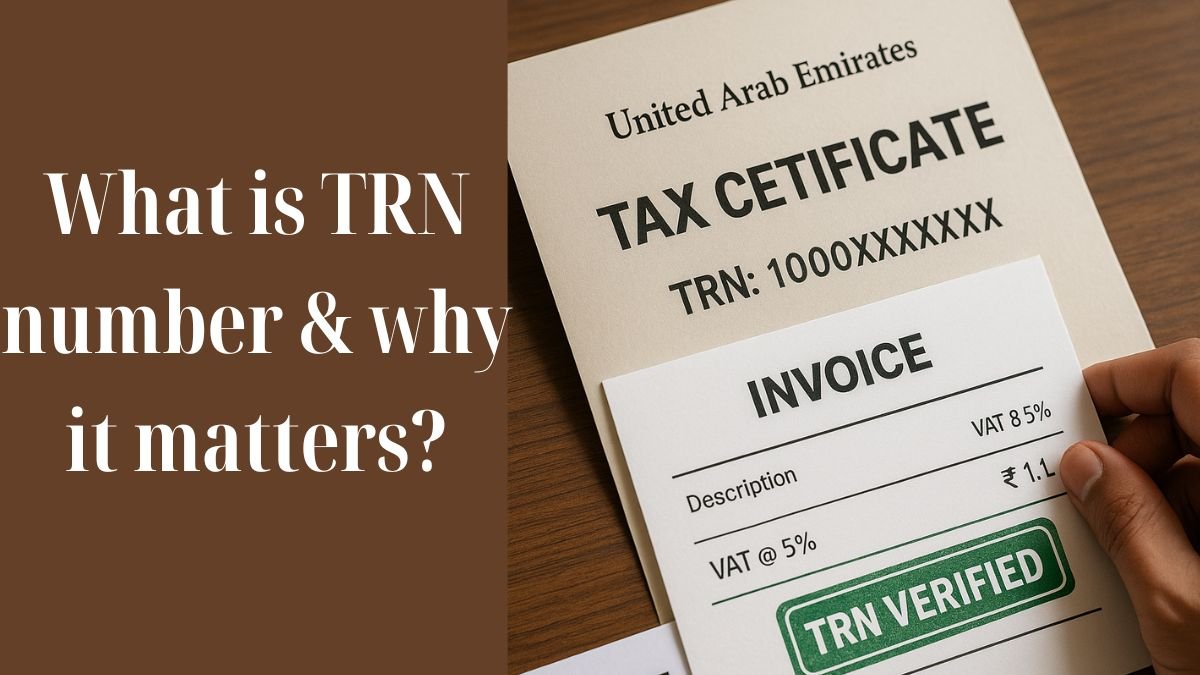

In the world of taxation and compliance, abbreviations like TRN, GST, and PAN often confuse. One such term that’s crucial for businesses and individuals involved in the tax ecosystem is the TRN number.

So, what exactly is a TRN number? How is it used? And how can you track or verify it, especially under GST? This article will break it all down in a simple, no-jargon way.

What Is a TRN Number?

TRN stands for Temporary Reference Number. It is a 15-digit Temporary Reference Number (TRN) issued by the tax authorities to help businesses and individuals complete their registration process.

In India, the TRN number in GST plays a critical role during the GST registration process. It serves as a temporary ID until a permanent GSTIN (Goods and Services Tax Identification Number) is issued. "

In other contexts, like the Provident Fund Organisation or international taxation, a TRN may also refer to a unique alphanumeric code assigned to each financial transaction or taxpayer temporarily.

When Is a TRN Number Issued?

The TRN number is issued by the Revenue when you register for tax as a sole trader, trust, partnership, or company. In the case of GST registration, the TRN acts as a temporary tracking code to complete the application in phases.

If you're registering through the GST portal:

- You first generate the TRN using your PAN and mobile/email verification

- The 15-digit Temporary Reference Number (TRN) is then used to log in and continue your application

So, whether you're starting a small business or a large enterprise, you will likely receive a TRN during the tax registration process.

TRN Number in GST

One of the most common uses of TRN is during GST registration. If you're wondering “how to find the TRN number in GST” or “GST TRN number status,” here's a step-by-step guide:

How to Generate a TRN Number in GST:

- Visit the GST portal

- Click “Register Now” under the “Taxpayers” tab

- Choose “Temporary Reference Number (TRN)”

- Enter your details (PAN, email, mobile)

- You’ll receive a TRN after OTP verification

How to Find TRN Number in GST:

If you forget your TRN:

- Check your email/SMS for the TRN number confirmation

- Log in to the GST portal and choose “Existing User” > “TRN Login”

TRN Number Tracking & Status

If you're midway through the registration process and want to check progress, you can use the TRN number tracking through the GST portal.

To Check GST TRN Number Status:

- Go to www.gst.gov.in

- Select “Services” > “Registration” > “Track Application Status”

- Choose “TRN” as your option

- Enter the 15-digit TRN number and the captcha

- Click “Proceed” to view the status

The system will show whether your application is saved, submitted, or pending verification.

TRN Number Login for GST

To resume a saved GST application:

- Go to the GST portal

- Choose “TRN Login”

- Enter your TRN and OTP

- You’ll be redirected to your saved application form

This is especially helpful for businesses that prefer to complete their registration over multiple sessions.

TRN Number Example

A sample TRN number example under GST might look like:

621051974302185

This 15-digit number is unique for each registration attempt and is valid for 15 days only. If not used within this period, it expires, and a new TRN must be generated.

TRN Number in Other Systems

Although widely used in GST, TRN numbers are also relevant in:

- Banking systems for temporary financial references

- Provident Fund Organisation, where a temporary number is issued before assigning a UAN

- Foreign tax registration (in the UAE, for example, TRN refers to Tax Registration Number for VAT)

Thus, depending on the country and system, a TRN may represent either a temporary or permanent taxpayer ID. "

TRN Number vs GSTIN

Here’s a quick comparison for clarity:

|

Feature |

TRN Number |

GSTIN |

|

Stands For |

Temporary Reference Number |

Goods & Services Tax Identification Number |

|

Validity |

Temporary (usually 15 days) |

Permanent |

|

Purpose |

For the GST registration process |

For ongoing GST compliance |

|

Issued To |

Applicants in process |

Registered taxpayers |

Why Is TRN Important?

- Allows you to start GST registration without completing it in one go

- Let's you track application status easily

- Keeps your data secure with OTP-based access

- Ensuresa smooth transition from application to registration

Whether you're a sole trader, trust, partnership or company, the TRN number is your first step toward tax compliance.

Final Thoughts

To summarise:

- TRN stands for Temporary Reference Number

- It is a 15-digit Temporary Reference Number (TRN) used for GST registration and tax processes

- The TRN number is issued by the Revenue when you register for tax as a sole trader, trust, partnership or company

- It serves as a unique alphanumeric code assigned to each financial transaction or application

- TRNs are widely used in Provident Fund Organisation, banking, and international tax platforms

👉 Need help with GST registration, TRN tracking, or understanding tax structures?

Visit www.callmyca.com for expert assistance with tax compliance, TRN login help, and document filing.