Investors sometimes try to “time” buys and sells just to shave tax, not because the trade makes economic sense. To shut that door, the law brings in Section 94 of the Income Tax Act, 1961. It’s a targeted anti-avoidance rule for certain transactions in securities—dividends, interest, and related income—so that the right person pays the right tax at the right time.

Why Section 94 Exists

At its core, Section 94 is about fairness and integrity in tax:

- Gains or benefits from artificial arrangements remain taxable in the hands of the real owner.

- Temporary transfers (just for tax breaks) don’t move the tax needle.

- And critically, the owner is under no greater liability than if the transaction hadn’t been executed at all.

In short: no engineered losses, no slip-throughs.

Who It Covers (Scope & Applicability)

It applies across the board—individuals, firms, companies, trusts—whenever securities are bought, sold, or transferred in a way that manufactures a loss or shifts income.

Section 94 focuses on three patterns:

- Dividend stripping

- Bonus stripping

- Short, pre-payout transfers meant only to cut tax

When the pattern fits, the law neutralizes the tax advantage and restores the income to the true economic owner.

Also Read: TDS on Benefits and Perquisites

“Avoidance of Tax by Certain Transactions in Securities” — In Plain English

Think of a short relay to dodge tax:

- A sells shares to B right before dividend day.

- B pockets the dividend.

- The shares return to A soon after.

Economically, A is still the investor—but the dividend shows up under B’s name. Section 94 looks through this relay and taxes A.

The Main Tools Inside Section 94

There are several moving parts. The big three:

- Section 94(1)

Covers temporary transfers of securities/rights. The guardrail: the owner’s tax liability is set as if the transaction never happened—no more, no less. - Section 94(7) – Dividend Stripping

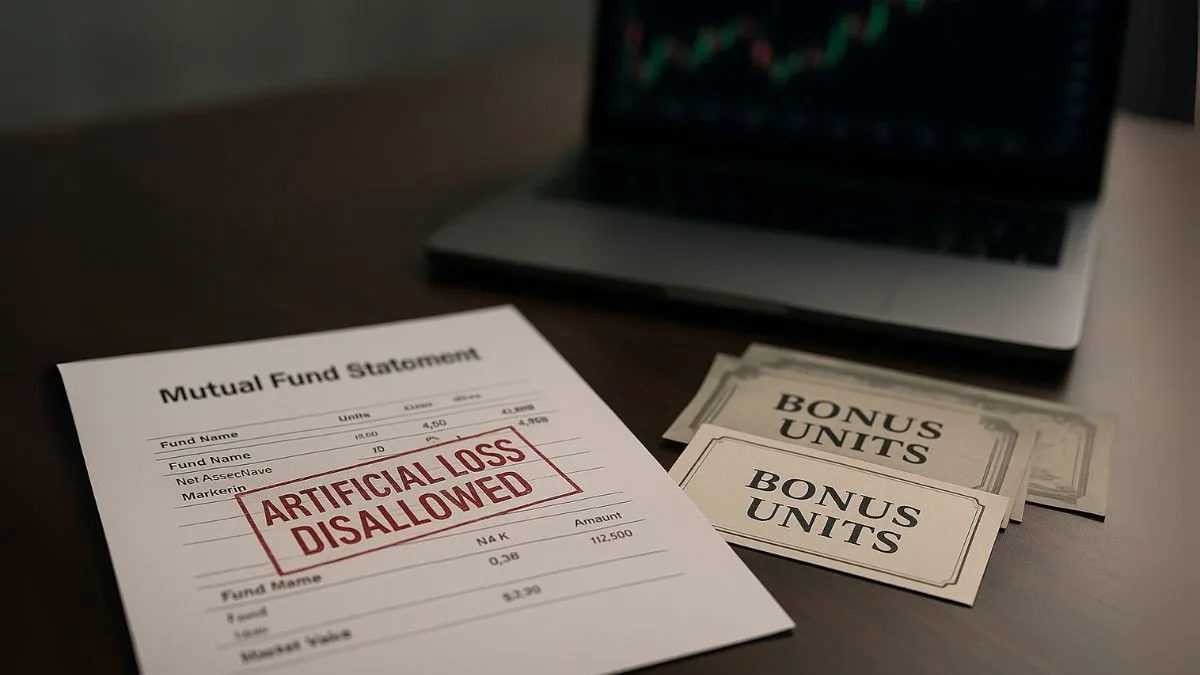

You buy units/shares just before a dividend, collect it, then sell right after at a lower price & claim a loss. This loss is disallowed if sold within the prescribed window. - Section 94(8) – Bonus Stripping

You buy mutual fund units before a bonus issue, receive bonus units, then sell the original units at a loss while keeping the bonus stash. That engineered loss is ignored.

Together, these provisions defuse short-term, tax-only trades.

Worked Examples

1) Dividend Stripping (94(7))

- Raj buys 10,000 MF units at ₹10 = ₹1,00,000 two days before dividend.

- Fund declares ₹10 per unit dividend = ₹1,00,000"

- Raj sells the units for ₹90,000 & claims ₹10,000

Outcome: Since the sell happens within the specified period, the loss is disallowed under 94(7). The engineered set-off fails.

2) Bonus Stripping (94(8))

- Priya buys 5,000 units @ ₹100 = ₹5,00,000.

- Fund issues 1:1 bonus → total 10,000 units.

- She sells original units at ₹90 (creating a book loss) & keeps bonus units.

Outcome: That capital loss tied to the original units is ignored under 94(8). No paper loss against other income.

Also Read: TDS on Purchase of Immovable Property

How Section 94 Protects the System

- Unwinds artificial losses (dividend/bonus games).

- Pins tax on the right owner.

- Blocks short-term title shuffles meant only to shrink tax.

And it still respects the rule that no one pays more than they would have without the gimmick.

The Policy Logic (Rationale)

- Closes well-known stripping

- Keeps the playing field fair between genuine investors & clever structures.

- Protects revenue by limiting tax base erosion from notional losses.

It’s a preventive rule, not a punitive one.

Where Section 94 Doesn’t Bite (Exceptions)

- Genuine, long-term

- Commercial transfers with substance.

- Bonus stripping applies to mutual fund units (not every security).

The law aims at manipulations, not legitimate portfolio management.

What the Courts Have Said

In CIT v. Walfort Share & Stock Brokers (SC), the Supreme Court backed 94(7) as a specific anti-avoidance measure against dividend stripping. The Court drew a line between real investments & loss creation exercises, endorsing the legislature’s intent.

Practical Impact

- Investors: Encourages real investing, not tax playbooks.

- Government: Preserves the tax base."

- Market: Promotes confidence—artificial losses don’t pollute returns.

Bottom line: the owner’s tax stays fair, while quick-flip tax games don’t fly.

Also Read: TDS on Contractor and Subcontractor Payments

Real-World Snapshot

A group company moves shares to a sister entity days before dividend, collects the payout there, then moves them back. On paper, income shifts. In reality, Section 94 lets the department look through and restore tax to the true holder.

Key Takeaways

- Section 94 targets avoidance of tax by certain transactions in securities.

- 94(7) (dividend stripping) and 94(8) (bonus stripping) disallow engineered losses.

- Ensures the owner is under no greater liability than warranted—just removes the dodge.

- Applies across taxpayers; hits short-term, tax-only structures, not bona fide investing.

Conclusion

Section 94 is a smart, narrow rule that keeps investment taxation honest. It deters strip-and-flip tactics, keeps tax with the right person, & supports a cleaner market. In a world of fast strategies and structured trades, it’s the quiet safeguard that keeps intent aligned with outcome.

👉 CallMyCA.com — We’ll help you plan entries/exits, avoid dividend/bonus stripping pitfalls, and claim every legitimate deduction the right way.