Section 194IA of the Income Tax Act: TDS on Purchase of Immovable Property Explained

When you purchase a property, taxes are the last thing you want to think about. But the Indian Income Tax Act ensures you're not just a buyer—you’re also a tax deductor. Yes, under Section 194IA of the Income Tax Act, even a common man becomes responsible for deducting TDS when purchasing property.

This section plays a critical role in regulating large property transactions & ensuring tax compliance in real estate deals. "

What is Section 194IA?

Section 194IA is a clause in the Income Tax Act that deals with TDS on the purchase of certain immovable property. According to this section, the buyer has to deduct TDS at 1% of the total sale amount when they purchase an immovable property.

But not all property transactions are covered. There are some key conditions: "

Applicability of Section 194IA

- Type of Property: It applies to payment on the transfer of certain immovable property other than agricultural land. So, buying a flat, house, commercial shop, or land? You’re covered.

- Value Threshold: This section is triggered when the buyer purchases immovable property costing more than ₹50 Lakh.

- Who Deducts TDS? The buyer of the immovable property is responsible, not the seller.

- When to Deduct? At the time of payment or credit, whichever is earlier.

- TDS Rate: A flat 1% TDS must be deducted on the total sale consideration. If PAN is not available, TDS @ 20% may apply.

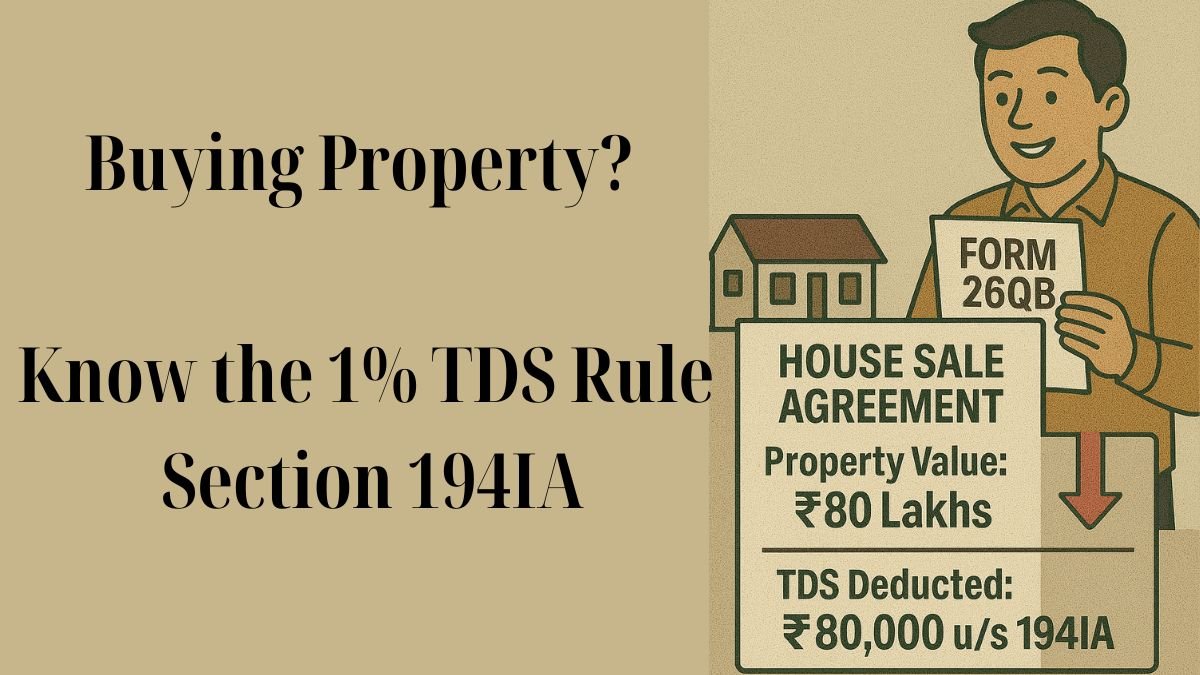

Example for Better Understanding

Suppose Ravi purchases a flat in Delhi worth ₹80 Lakhs. Since the amount exceeds ₹50 Lakhs, Ravi must deduct ₹80,000 (1%) as TDS while making the payment to the seller & deposit it with the government.

How to Comply?

No need to have a TAN (Tax Deduction and Collection Account Number). Buyers can simply deposit the TDS through Form 26QB—an online form available on the TIN-NSDL portal.

After that, they must issue Form 16B (TDS certificate) to the seller within 15 days.

Exceptions to Section 194IA

This section doesn’t apply if:

- The property is agricultural land

- The sale price is below ₹50 Lakh

- The transaction is covered under other TDS provisions like 194LA or 194LB

Why Was Section 194IA Introduced?

Real estate is one of the sectors where black money thrives. This section was introduced in 2013 to bring more transparency to high-value property transactions & ensure that the seller reports the sale & pays appropriate capital gains tax.

It also offers the deduction of TDS on the purchase of immovable property as a tracking mechanism for the government.

Consequences of Non-Compliance

If the buyer fails to deduct or deposit TDS:

- Interest at 1% per month is applicable for late deduction.

- Penalty & prosecution may also follow.

- The seller may face delays in claiming credit for TDS in their ITR.

Final Thoughts

Buying a home is a big step, & so is understanding your tax responsibility. Whether you're purchasing your dream flat or investing in a shop, Section 194IA ensures TDS is deducted properly on high-value real estate deals. This not only helps you stay compliant but also keeps your paperwork clean during resale or income tax scrutiny.

So next time you're signing a sale deed, remember: you’re not just a buyer—you’re a responsible tax deductor too.

To