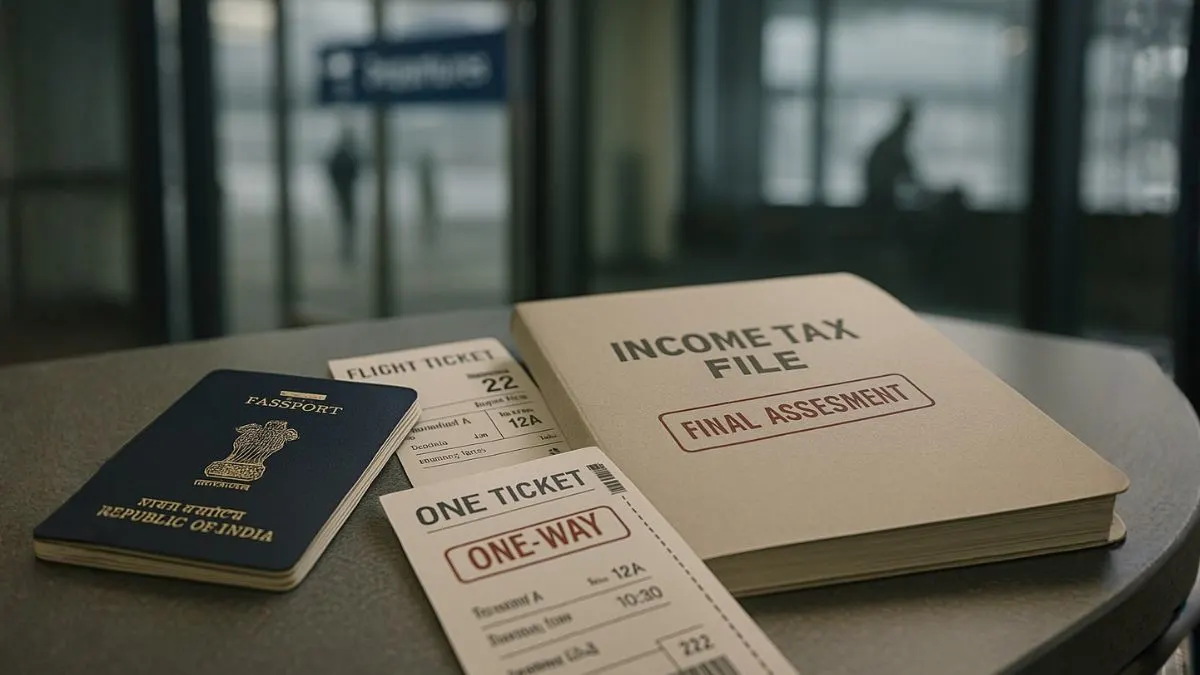

When a business shuts down, its tax duties don’t vanish. Even during termination, dissolution, or winding-up, the law ensures that the profits earned till the closing date are properly taxed.

That’s exactly where Section 174 of the Income Tax Act steps in.

This section makes sure that every person, firm, company, or association that stops doing business is still assessed for income tax up to its final day of operation.

It’s essentially a safety net for the government — protecting revenue when a business ceases to exist.

Interestingly, Section 174 (India) echoes the spirit of IRC Section 174 (US), which deals with the amortization of research & experimental (R&E) costs.

Different jurisdictions, same core idea: taxpayers must report income honestly and handle R&D expenses correctly, even when businesses shut down or restructure.

Demystifying Section 174 of the Income Tax Act

Section 174 of the Income Tax Act 1961 deals with computation of income on cessation or discontinuation of a business or profession.

It enables the Assessing Officer (AO) to quickly determine & collect tax payable up to the date of closure.

The provision applies to individuals, firms, companies, associations of persons (AOPs), or bodies of individuals (BOIs) engaged in business in India.

Put simply: if your business shuts down halfway through the year, you can’t wait for the next assessment cycle.

The tax department can assess and collect taxes immediately.

Also Read: Deduction on Capital Expenditure for Scientific Research

Applicability of Section 174

Section 174 applies in four typical situations:

- When a business or profession is closed within the financial year.

- On cessation of operations by any AOP or BOI."

- When a foreign company or branch winds up its Indian operations.

- When an individual leaves India permanently, raising the risk of tax non-recovery.

Essentially, it ensures that income up to the closure date is assessed & taxed right away.

Objective of Section 174

The goal is simple — protect government revenue when a taxpayer ceases business.

The Assessing Officer can immediately:

- Estimate the income earned till discontinuance,

- Compute tax liability, and

- Demand & recover tax without waiting for the regular assessment timeline.

In short, this keeps revenue “alive” even when a business entity shuts its doors or moves abroad.

Theory of Assessment under Section 174

Once the Assessing Officer gets information that a business or profession has stopped functioning, here’s what happens:

- The AO calculates total income up to the closure date.

- The assessment is made as if the enterprise ran for the full year.

- Tax slabs applicable to individuals, firms, or companies are used.

- An order is passed, and recovery begins immediately.

This early assessment avoids the risk of tax lapsing if the taxpayer vanishes before the financial year ends.

Special Provisions – Partnerships & Associations

Section 174 isn’t limited to proprietorships.

It covers partnership firms, AOPs, and BOIs as well.

If a partnership dissolves mid-year or an association splits, tax is levied on income up to the date of dissolution.

Partners or members remain jointly and severally liable for unpaid taxes.

So, even if the firm disappears, the tax liability doesn’t.

Also Read: 100% Deduction on Capital Expenditure for Specified Businesses

Section 174 vs Regular Assessment

Normally, income is assessed after the year ends.

But under Section 174, assessment happens right when business stops.

This is called a protective assessment, because it protects the government’s right to collect dues before the taxpayer relocates, dissolves, or disappears.

For instance, if a company ceases operations in December 2024, the AO can begin assessment immediately — not wait until April 2025.

Connection Between Section 174 and R&D Expenses

Although Section 174 mainly deals with business discontinuation, it indirectly affects R&D expense treatment during closure.

Businesses invest heavily in research, prototypes, and trials. These costs are usually capitalized & amortized over time."

When the business closes, such expenses must be properly apportioned following accounting and tax standards.

The same principle applies globally — whether in India or under US IRC Section 174 — research costs must be clearly recorded and fairly spread out.

A Quick Look at IRC Section 174 (U.S.)

Under the U.S. Internal Revenue Code, Section 174 governs amortization of research and experimental costs.

It requires companies to spread R&D expenses over multiple years instead of claiming them all at once.

While India & the U.S. differ in detail, the universal takeaway is identical:

Research and development costs must be documented & capitalized for fair taxation.

Why R&D Documentation Is So Important

Whether you’re in India or abroad, R&D documentation is mandatory.

Proper records help:

- Allocate costs correctly between capital and revenue.

- Substantiate deduction or amortization claims.

- Allow tax authorities to verify compliance easily.

In India, R&D deductions fall under Section 35, but when a business shuts down, these can intersect with Section 174 for closure-year assessments.

How R&E Expenses Are Treated in India

When a business ceases operations, R&D expenses are handled as follows:

- Capital R&D – Can still be amortized under Section 35(7) even after closure.

- Revenue R&D – Deductible in the year of discontinuance if related to discontinued operations.

This dual approach allows genuine deductions while ensuring fair tax collection.

Also Read: Director's Liability for Company Tax Dues

Example – How It Works

Let’s say Innovatech Labs Pvt. Ltd., a research-based company, shuts down in October 2024.

It spent ₹ 2 crore on R&D earlier that year.

Under Section 174, the AO can assess income up to October 2024.

Meanwhile, the company must still capitalize & amortize its R&D expenses as per law.

Any unamortized portion can be carried forward or adjusted if the IP or assets are transferred.

This example shows how business closure and R&D amortization interact within the income-tax framework.

Relationship Between Section 174 and Section 176

While Section 174 covers assessment at discontinuance,

Section 176 deals with taxability of income received after closure — such as outstanding bills or arrears.

Together, they ensure that both pre-closure and post-closure profits are taxed fairly.

Judicial Insights

Indian courts view Section 174 as a preventive measure, not a penalty.

In CIT v. K. Venkateswara Rao (1990), the court held that tax authorities have the right to assess income immediately on discontinuance to protect government revenue.

The section has also been applied to dissolved partnerships & foreign companies exiting India — ensuring accountability and fairness.

Global Perspective

Across the world, tax systems agree on one principle:

When a business closes or restructures, its income until that date must be taxed, and R&D or capital costs must be properly documented and amortized.

Thus, both India’s Section 174 and US IRC Section 174 promote transparency, accurate reporting, and revenue protection during business exits.

Key Takeaways

- Section 174 applies when a business closes mid-year.

- Enables immediate tax assessment & collection.

- Applicable to individuals, firms, companies, and associations.

- R&E expenses must still be amortized or deducted appropriately.

- IRC Section 174 (U.S.) mirrors the same idea for R&D amortization.

- Businesses must maintain detailed R&D documentation to claim benefits.

Also Read: How Shipping Companies Are Taxed Without PAN in India

Conclusion

When a business shuts down, its tax responsibility doesn’t end. Section 174 ensures that every rupee of earned income is accounted for before closure — keeping the system transparent and fair.

At the same time, research and experimental expenses must be recorded & capitalized correctly, echoing similar rules under U.S. IRC Section 174. In both cases, good documentation and compliance save you from post-closure disputes.

If your company is closing down or managing R&D-linked deductions, don’t navigate it alone. Our experts can help you file final assessments, amortize correctly, and stay audit-ready.

👉 Visit CallMyCA.com — our tax professionals make business closures & R&D deductions simple, compliant, and stress-free.