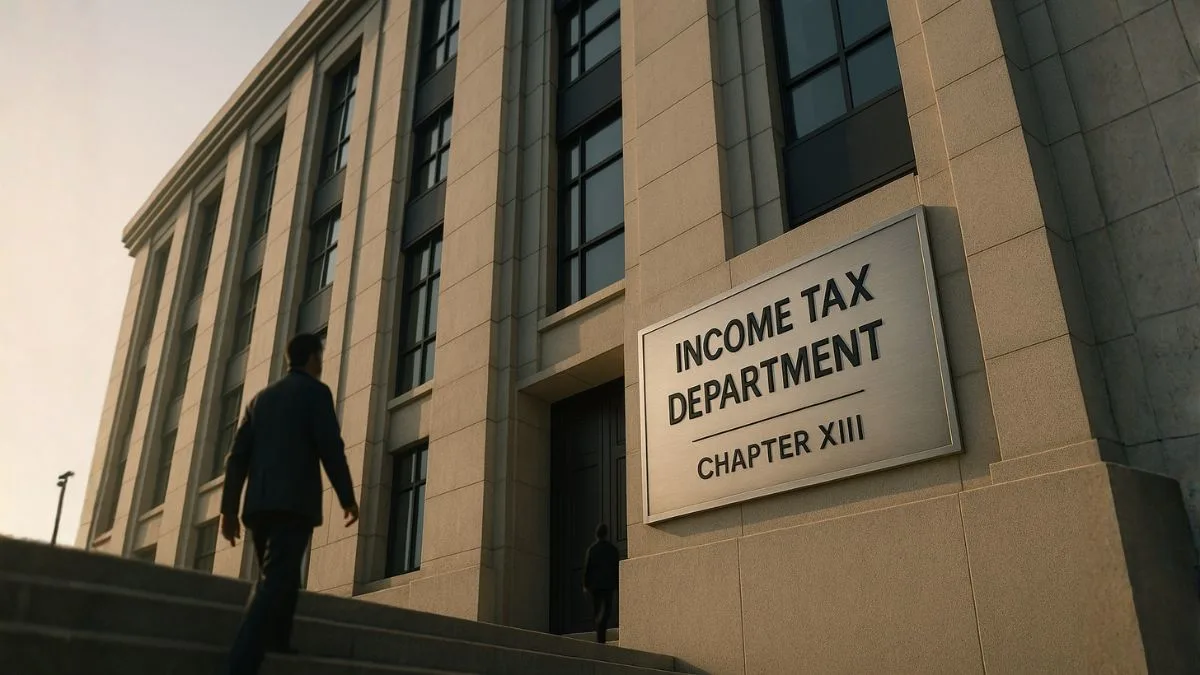

If you've ever wondered how the income-tax system maintains order across millions of taxpayers, Chapter XIII is where the foundation lies. This chapter deals with the Income-tax Authorities & their jurisdiction, powers, and functions. Covering Sections 116 to 138, it acts as the backbone of tax administration in India.

From defining the hierarchy of officers to explaining how cases get transferred or how authorities gather information, Chapter XIII ensures that the entire system operates with structure, clarity, and legal accountability. Most taxpayers never read it—but its impact touches everyone who files a return, receives a notice, or interacts with the tax department.

The Structure of Chapter XIII: What It Covers

Even though the chapter sounds technical, its purpose is simple:

Create an organised, transparent, and accountable tax administration framework."

Here’s a breakdown of its core components.

Classes of Income-Tax Authorities (Section 116)

This part lays down the hierarchy, almost like a family tree of the income-tax department.

It lists key authorities such as:

- Central Board of Direct Taxes (CBDT)

- Directors-General / Chief Commissioners

- Principal Commissioners / Commissioners

- Joint Commissioners / Deputy Commissioners

- Assessing Officers (AOs)

This hierarchy ensures that responsibilities are clear & decisions move in an orderly manner, especially during assessments, appeals, and investigations.

Also Read: The Chapter That Cuts Your Tax Like Magic: Chapter VI-A Deductions

Appointment and Control of Authorities

Chapter XIII also explains how these officers are appointed & who controls their functioning. The CBDT acts as the central controlling body, issuing directions, notifications, and instructions so that tax laws are implemented uniformly across the country.

If you’ve ever noticed that certain rules apply in the same way whether you’re in Delhi or Kochi, it’s because of the strong administrative control initiated under this chapter.

Jurisdiction: Who Handles Which Case?

Sections 120 to 130A deal extensively with jurisdiction—one of the most important parts of the tax administration process.

Jurisdiction can be assigned based on:

- Territorial area

- Classes of persons (e.g., companies, NRIs, large taxpayers)

- Classes of income

- Special circumstances like faceless assessments

This framework ensures that cases don’t overlap & taxpayers know who their authority is.

The Era of Faceless Jurisdiction

A modern highlight introduced later in the Act is faceless assessment, where cases are handled digitally without physical interaction.

Chapter XIII’s flexible jurisdiction rules made this transformational change possible.

Powers of Income-Tax Authorities

This is where the chapter gets practical. The authorities have specific legal powers so they can verify returns fairly and prevent tax evasion.

These powers include:

- Calling for information from individuals, employers, banks, and institutions

- Conducting surveys to verify facts on the ground"

- Discovery & inspection of evidence

- Enforcing attendance and examining witnesses

It’s not about intimidation—it’s about ensuring transparency & compliance.

Many taxpayers don’t realise that every notice, inquiry, or information request has a legal foundation. Chapter XIII is exactly that foundation.

Also Read: Powers of Tax Authorities During Investigation

Transfer of Cases

One of the realities of tax administration is that cases often need to be transferred—maybe due to workload balancing, reassignment, or special scrutiny.

Chapter XIII contains detailed provisions on:

- Who has the authority to transfer a case

- How the transfer must be communicated

- Why transfers can occur

This ensures fairness, prevents bias, and maintains administrative efficiency.

But What About “Determination of Tax in Special Cases”?

Sometimes people confuse Chapter XIII with the concept of “special taxation cases”.

To clarify:

- The administrative Chapter XIII (Sections 116–138) deals with authorities, power, & jurisdiction.

- There is also a part of the Act related to determination of tax in special situations, but that falls under different chapters.

This confusion arises because tax law terminology evolves, but the backbone remains the authorities defined under this chapter.

Why Chapter XIII Matters to Ordinary Taxpayers

Even if you’re not an expert, this chapter impacts your tax journey more than you think.

It helps ensure:

- Your case goes to the right officer

- There’s no misuse of power

- Notices are legally valid

- Officers follow standard procedures

- The tax system feels structured rather than chaotic

Think of Chapter XIII as the operating manual of the tax department—if it didn’t exist, both taxpayers & officers would be lost.

Also Read: Powers and Jurisdiction of Income Tax Authorities

A Relatable Real-Life Scenario

If you’ve ever received a notice and wondered, “Why me?”, remember that jurisdiction isn’t random.

For example:

Someone living in Jaipur but investing heavily in Mumbai-based companies may get inquiries from a different jurisdiction."

Or during faceless assessments, you may receive communication from an officer in another state entirely.

This happens because the tax law—guided by Chapter XIII—assigns officers strategically based on income patterns, types of investments, or administrative convenience.

Conclusion

Chapter XIII of the Indian Income-tax Act may sound technical, but its purpose is simple: To ensure that the income-tax system functions smoothly, fairly, and with clear accountability.

By defining authorities, their powers, and their jurisdictions, this chapter creates a structure that benefits both taxpayers & administrators. The next time you file a return or receive a notice, remember—there’s an entire organisational framework working behind the scenes to make the system consistent and transparent.

If you ever feel overwhelmed by notices, jurisdiction issues, or assessment queries, the experts at Callmyca.com are always ready to guide you with clarity & confidence.