Whenever a person earns income outside India — maybe through a foreign assignment, consultancy work, or a special contract — the first thing that comes to mind is, “How will this be taxed back home?”

The Income Tax Act offers relief through certain deductions, especially for individuals working abroad under eligible agreements. But to claim these benefits, you must prove that the money actually came into India within the required time. That proof comes in the form of Form 10H, a Certificate of Foreign Inward Remittance issued by a bank.

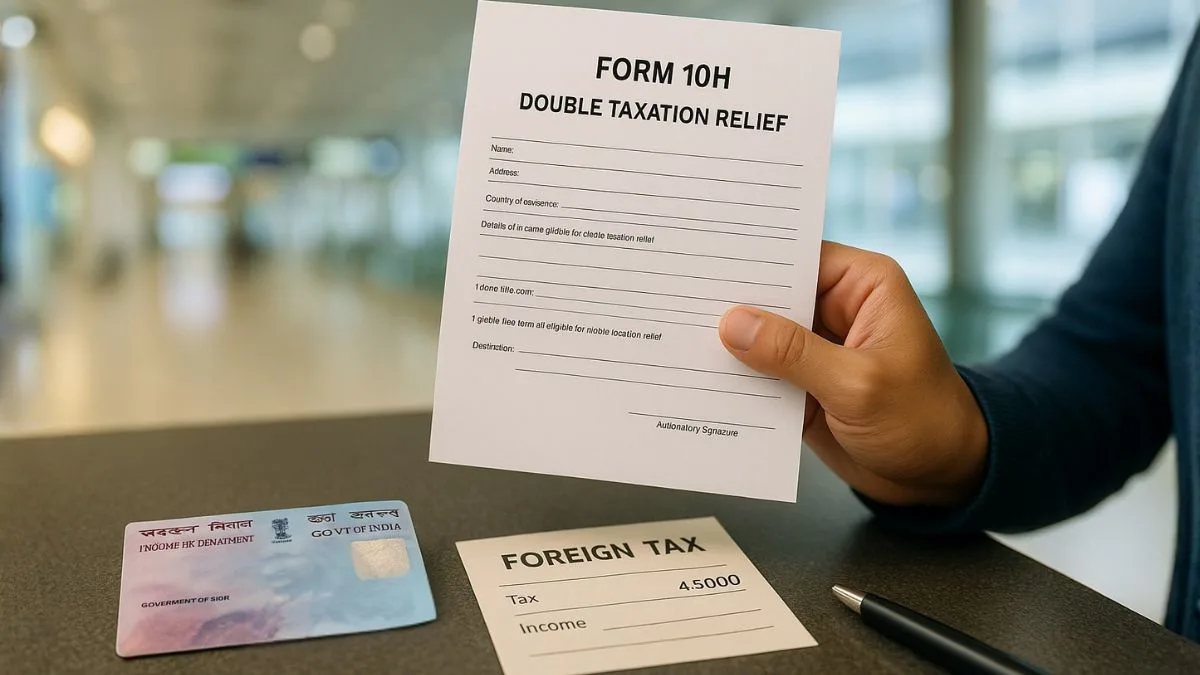

What Is Form 10H?

Form 10H is a Certificate of Foreign Inward Remittance, issued by an authorised bank, confirming that income earned outside India has been received in India.

It is not just a compliance requirement — it’s your evidence. Evidence that the foreign income was:

- Earned under eligible employment or consultancy

- Brought into India within the permitted period

- Eligible for deductions under the Income Tax Act

At its core, Form 10H is used to claim deductions on income earned outside India, brought within 6 months, & it is specifically prescribed under Section 80RRA.

This is why it is often requested during tax filing or assessments involving foreign income.

Why Form 10H Exists

When the government introduced Section 80RRA, the intention was to encourage Indian professionals to work abroad and bring their skills — and income — back into India. But naturally, the department needed a reliable way to verify if the income was actually brought into the country.

That’s where Certificate of Foreign Inward Remittance (Form No. 10H) comes in. It acts as a bridge between you, your bank, & the tax department.

Also Read: A Complete Guide to TCS on Overseas Remittances and Tour Packages

When Do You Need Form 10H?

You need this form when:

- You earned foreign income as a professional, consultant, or technician

- You want to claim deductions under Section 80RRA

- You received the money within six months, or within an extended time allowed by the RBI

- You need proof during scrutiny, reassessment, or filing

If you want tax relief on foreign income you’ve brought into India, Form 10H is non-negotiable.

What Exactly Does Form 10H Contain?

Even though it sounds complicated, the information inside is straightforward:

- Your name & address

- Details of the foreign income received

- Amount of money remitted

- Date of inward remittance

- Bank branch and certificate number"

- Currency details and mode of receipt

- Confirmation that the remittance was indeed received in India

This is why banks issue it — they are the ones who actually witness the money coming in.

A Small Real-Life Scenario

A client once shared how she worked in Dubai for a year under a consultancy contract. She returned to India assuming her bank statements were enough proof for claiming her deduction.

But during her filing, the CA asked,

“Do you have Form 10H?”

She looked blank.

She thought it was optional.

It wasn’t.

A 15-minute visit to the bank solved everything. The form became the one document that protected her deduction claim.

Sometimes tax processes aren’t complicated — we just don’t know which paper matters.

Also Read: Tax Relief on Foreign Retirement Income for Indian Residents

How to Obtain Form 10H

It’s easier than most people think:

- Visit your bank (where the foreign remittance landed).

- Most major banks know exactly what Form 10H is.

- Request a Certificate of Foreign Inward Remittance.

- Provide remittance details & identification.

- Ensure the certificate reflects correct dates and amounts.

- This is important for Section 80RRA claims.

- Keep both physical and digital copies.

- You may need it during future assessments.

Why Is Form 10H Linked to Section 80RRA?

Section 80RRA allows Indian citizens working abroad in certain technical or professional roles to claim a deduction on the income they earn there — but only if the income is brought into India.

Form 10H is the tool that proves this condition. Without it, the deduction may be denied, even if the income was legitimately earned.

Common Mistakes People Make

- Assuming bank statements are enough

- Bringing money into India but not within six months"

- Forgetting to collect Form 10H before the assessment year ends

- Believing it’s optional under Section 80RRA

Being aware of these prevents unnecessary tax complications.

Also Read: Section 80RRB: The Tax Deduction Rewarding Patent Holders

Key Takeaways

- Form 10H is a Certificate of Foreign Inward Remittance.

- It is essential for claiming deductions on foreign income under Section 80RRA.

- It must show that the money was brought into India within six months.

- Banks issue it, not the tax department.

- Keep this form safely — it is often requested during scrutiny.

Conclusion

Foreign income always comes with a learning curve. Form 10H simplifies that curve by acting as your evidence, your protection, and your key to claim rightful deductions.

If you’re unsure about foreign income taxation, Section 80RRA filings, or how to request Form 10H, the experts at CallMyCA.com can guide you step-by-step — without the stress & without the jargon.