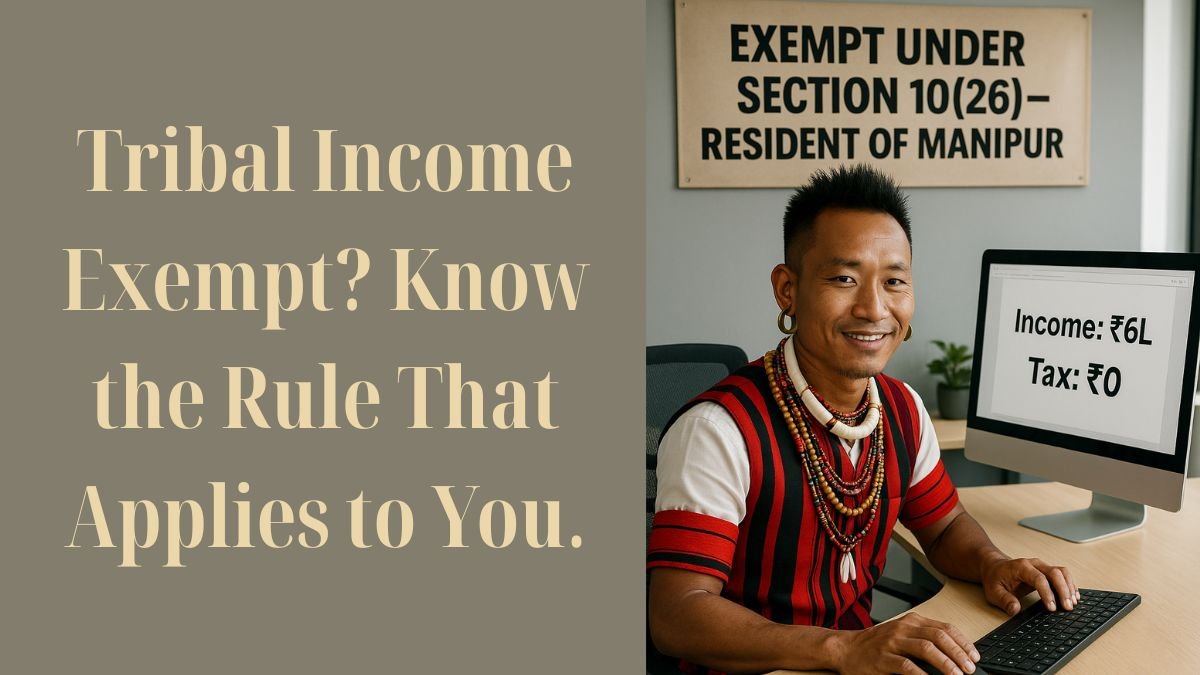

When it comes to income tax exemptions in India, Section 10 of the Income Tax Act is full of specific provisions for different categories of people. One such important but lesser-known provision is Section 10(26) of the Income Tax Act, which is specifically crafted to support members of Scheduled Tribes living in certain regions of India.

This section provides not just financial relief but also a recognition of the socio-economic diversity within the country. Let’s understand what this section means, who can benefit from it, & how.

🔍 What is Section 10(26) of Income Tax Act?

Section 10(26) of the Income Tax Act provides for tax exemption to members of Scheduled Tribes. This provision is a part of the broader effort by the Government of India to uplift & support tribal communities who have historically been marginalised.

It exempts any income of a Scheduled Tribe individual residing in certain specified areas from income tax, subject to some conditions. This includes not just salary income, but also business or professional income, & other income sources, provided the person is residing in the eligible area and meets the criteria. "

✅ Who Can Claim Exemption under Section 10(26)?

According to the Act, Section 10(26) provides tax exemption to members of Scheduled Tribes in India, but not all tribal individuals across the country are eligible. This exemption is specifically available only to those:

- Who belong to a Scheduled Tribe as defined under Article 366(25) of the Indian Constitution;

- Who are residing in the specified states or Union Territories, such as:

- Nagaland

- Manipur

- Tripura

- Mizoram

- Arunachal Pradesh

- Meghalaya

- Assam

- And other Union Territories like Lakshadweep

- Whose income is earned within these areas?

This means if a person from a Scheduled Tribe moves out and earns income in metro cities like Delhi or Mumbai, the exemption under this section won’t apply. "

🏢 Income of Corporations under Section 10(26)

Interestingly, the exemption is not just limited to individuals. Section 10(26) also covers “any income of a corporation established by a Central, State or Provincial Act”—if it is meant for promoting the interest of the Scheduled Tribes.

So if there’s a corporation that has been established by law specifically for the welfare of tribal communities, its income may also be exempted under this provision. This can include development boards, cooperative societies, or tribal welfare corporations set up by governments.

🧾 Types of Income Covered

As per Sec 10(26) – Any income as referred to in section 10(26) includes:

- Salary earned within the specified areas;

- Income from business or profession carried out within those regions;

- Income from property, including rent or agriculture, located within those areas;

- Interest income from deposits if the principal source lies in the region.

However, if any part of the income is earned outside the notified areas, that portion becomes taxable as per the regular tax slab applicable to the individual.

📌 Purpose and Significance

The main purpose of Section 10(26) is to reduce the tax burden on tribal citizens and encourage economic activity within tribal areas. The exemption helps in improving:

- Access to education and employment opportunities;

- Support for local businesses and entrepreneurship;

- Financial independence without the stress of taxation.

It also acts as a tool for equitable economic development, ensuring that historically underprivileged communities receive the necessary support to build wealth and security.

🧠 Key Takeaways

- Section 10(26) of the Income Tax Act is aimed at Scheduled Tribes in specified regions;

- Exemption is available only if the income is earned within the notified areas.

- Corporations established by government Acts for tribal welfare are also eligible for exemption.

- Income earned outside the specified region is taxable.

- The provision is a part of India’s commitment to promote inclusive growth and social equity.