In today’s global economy, many Indians build their careers overseas. But when it's time to come home for good, a critical question arises—what happens to the tax status of your foreign income & investments?

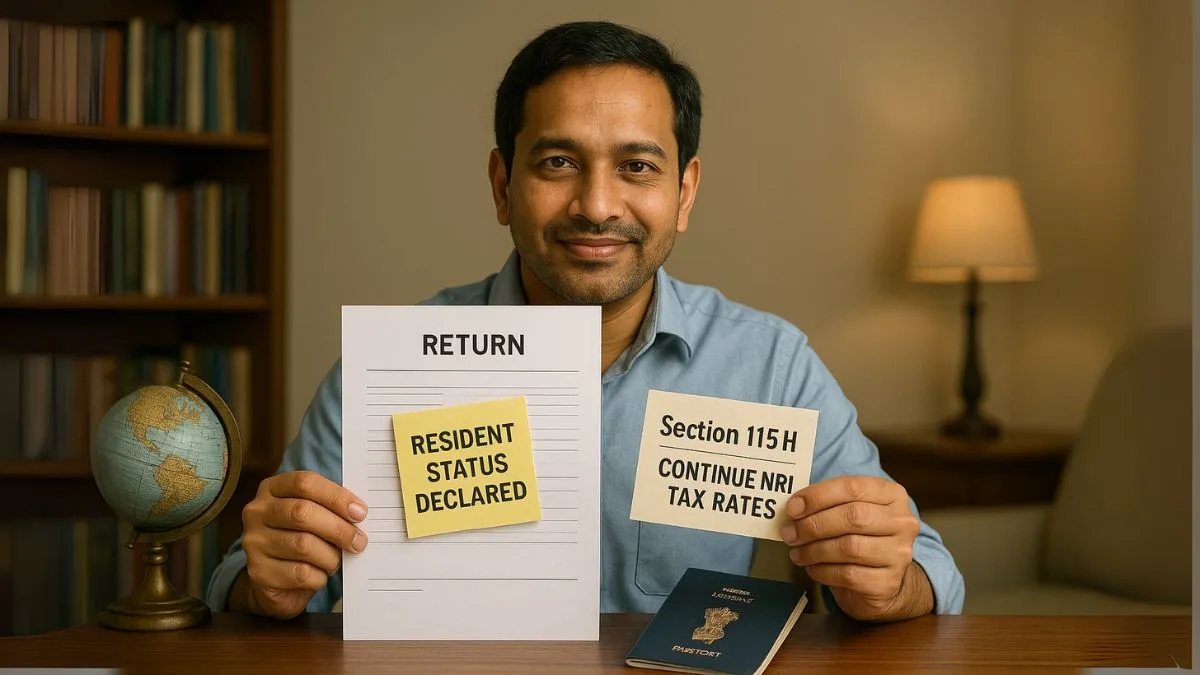

Enter Section 115H of the Income Tax Act—a powerful yet underutilised provision that allows returning NRIs to continue enjoying special tax benefits, even after becoming residents.

If you're planning to shift your financial base back to India, understanding how Section 115H works could save you significant taxes & safeguard your foreign income. Let’s break it down simply & clearly.

What is Section 115H of Income Tax?

Section 115H of the Income Tax Act, 1961, is designed specifically for individuals who were previously non-resident Indians & are now returning to India. It allows individuals to avail of concessional tax rates on certain incomes even after they become residents again. This provision provides taxation of income on specified assets that were acquired when the individual was an NRI.

In simpler terms, if you’ve earned income from foreign assets while you were a non-resident & continue earning from them after returning to India, you can still enjoy concessional rates under section 115H under the Income Tax Act.

Benefits Under Section 115H of Income Tax

The biggest benefit under section 115H of the Income Tax is the retention of lower tax rates on income earned from specified foreign assets. This is crucial because without this benefit, returning NRIs might have to pay higher tax rates applicable to resident individuals in India.

Some key benefits under section 115H of the Income Tax Act include:

- Tax concession on foreign assets’ income even after becoming a resident.

- Helps avoid double taxation.

- Encourages NRIs to return to India without tax anxiety.

- Provides clarity on the tax treatment of foreign investments.

Who Can Claim Section 115H?

The section is applicable only under specific conditions:

- You were a non-resident Indian in previous years.

- You have now become a resident of India.

- You have specified assets acquired while you were a non-resident.

- You opt for taxation under section 115H of the Income Tax Act by filing a declaration in your income tax return for the year in which you become a resident.

This is especially useful for NRIs returning to India for retirement or long-term relocation.

Income Covered Under Section 115H

Now, you might be asking, what kind of income qualifies under this section? The income under section 115H usually includes:

- Interest from foreign bank accounts

- Dividends from shares held overseas

- Rent or capital gains from property located abroad

So, if you continue to receive income from these assets post-return, the special deduction under section 115H of the Income Tax Act can help you minimise your tax burden."

Section 115H for Residents: A Transitional Bridge

When you become a resident Indian, your global income becomes taxable in India. But with Section 115H, there’s a bridge between your non-resident & resident status. This section ensures that you're not suddenly burdened with higher tax on income from assets that were lawfully acquired while you were abroad.

So even though you are now a resident, you continue to enjoy the tax benefits of an NRI, at least on specific types of income.

How to Claim Deduction Under Section 115H

Claiming the deduction under section 115H of Income Tax is simple, provided you meet the criteria:

- File your income tax return (ITR) in the year you become a resident.

- Mention your interest in availing benefits under this section.

- Keep proper documentation of your assets & income sources.

- Mention the source & acquisition date of the foreign asset.

If done correctly, you can avoid penalties & over-taxation, & make the most of the India income Tax Act section 115h."

Section 115H of Income Tax: 1961 to 2024

Though part of the Income Tax Act 1961, this section remains relevant in 2024 & beyond. With increasing global migration, tax rules like section 115H of the Income Tax Act 2016 & onward versions continue to evolve, but the core benefit stays the same—encouraging the Indian diaspora to come back home without heavy tax implications.

It’s important to note that this section doesn’t apply automatically. The taxpayer must opt for it consciously, hence it’s essential to be aware of your rights & responsibilities.

Final Thoughts

If you’re a returning NRI or planning to relocate to India soon, don’t miss out on the benefits of section 115H under the Income Tax Act. It’s a tax-saving opportunity that could help you hold onto more of your hard-earned money.

While it may sound complicated at first, with the right guidance, you can easily claim this benefit & stay compliant with Indian tax laws.

👉 Thinking about shifting back to India or confused about how section 115H of the Income Tax applies to your situation? Talk to expert CAs at Callmyca.com who’ll help you maximise your benefits & file your return correctly—before you miss out on what’s legally yours!