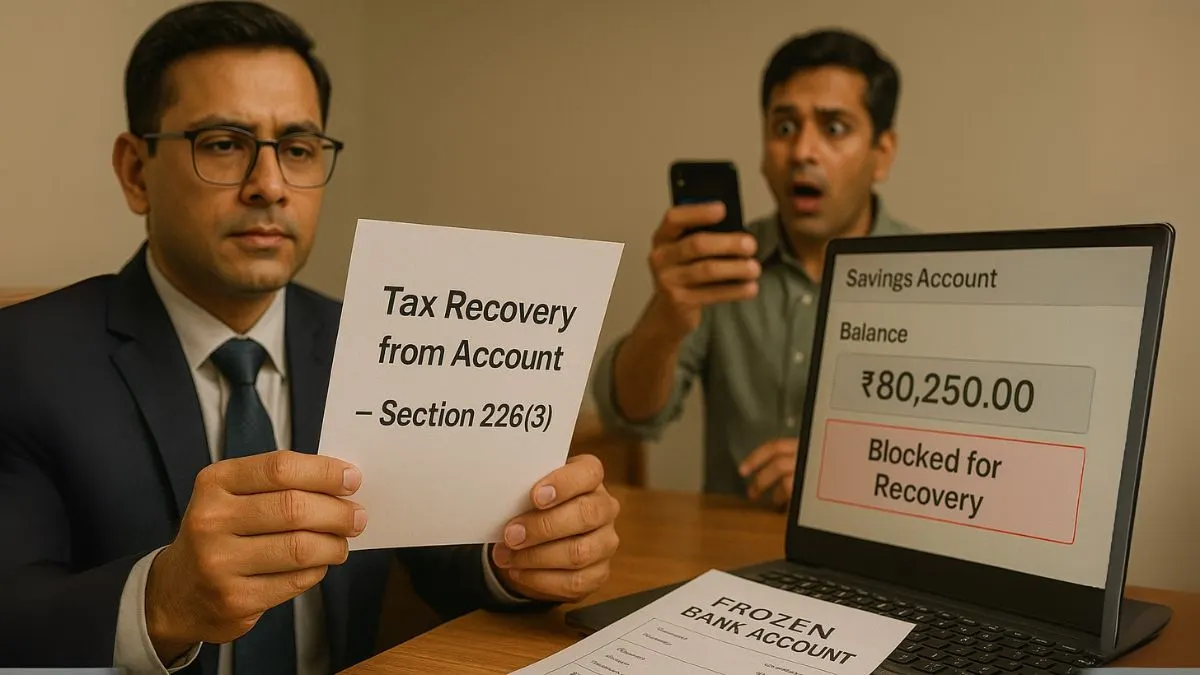

Imagine starting your day, checking your bank account, & finding it frozen. No fraud. No scam. Just a stark notice from the Income Tax Department under Section 226(3) of the Income Tax Act.

This provision grants the tax authorities the power to recover outstanding dues directly from third parties, like your bank, without any prior warning. It’s unsettling, isn’t it? Let’s take a closer look at this powerful section, its implications, & what steps you can take to safeguard yourself from unexpected disruptions.

What Is Section 226(3) of the Income Tax Act?

Section 226(3) empowers the Income Tax Department to recover unpaid taxes directly from anyone who owes money to the taxpayer. That means banks, employers, clients, tenants—anyone holding or due to pay money to the defaulter—can be legally bound to pay it to the government instead.

This includes situations where:

- The taxpayer has defaulted on their dues,

- The department has tried & failed to recover it through traditional means,

- The department identifies a person or entity that holds money or assets on behalf of the taxpayer.

Simply put, this section allows the department to bypass you & collect taxes from third parties, once a valid notice is issued."

Real-Life Example

Let’s say you’ve made a fixed deposit with your bank. It’s due to mature in six months. But in the meantime, you default on your income tax dues.

The department can issue a notice under Section 226(3) to your bank, instructing them not to release that FD amount to you, even at maturity.

Why? Because the fixed deposit with the bank is yet to mature can be covered under Section 226(3), & the bank now becomes liable to pay that amount to the Income Tax Department instead of you.

Who Can Receive the Notice?

The person responsible for deducting tax at source (TDS) is usually the target. This includes:

- Employers (salary or bonus dues)

- Banks (FDs, savings)

- Clients (pending invoices)

- Tenants (rent)

- Business partners (profit shares)

If the department is aware that someone owes you money—or is about to—they can serve notice to that person under this section. That person is then legally required to pay the dues to the department instead of you."

When Does the Department Use Section 226(3)?

The department typically uses this power:

- When tax demand is outstanding,

- When reminders or regular recovery attempts have failed,

- To avoid lengthy legal proceedings or asset seizures,

- In cases involving large sums, wilful default, or repeat offences.

It’s a high-impact tool, often used in time-sensitive recovery situations.

What Happens After the Notice?

Once the notice under Section 226(3) is served:

- The recipient (bank, client, etc.) is prohibited from releasing funds to the taxpayer.

- They are legally bound to pay the amount to the Income Tax Department.

- If they fail to comply, they can be treated as an “assessee-in-default”—which means they’ll owe the tax themselves!

So, if your bank gets such a notice & still releases your funds to you, the bank will be liable for the tax, not you."

Rights of the Taxpayer

Although the section seems harsh, the law isn’t one-sided. As a taxpayer:

- You can appeal or challenge the notice, especially if it was wrongly issued.

- You can settle the dues immediately to avoid third-party involvement.

- If the money blocked isn’t lawfully yours (e.g., held in trust for someone else), you can prove it & request a withdrawal of the notice.

But to exercise these rights, time is of the essence. Most people only realise it when it’s too late.

Section 226(3) in Case Laws

There have been several case laws around Section 226(3), often reinforcing the department’s power to recover from third parties. However, courts have also stressed that the department must follow due process, especially when dealing with salary, retirement benefits, or essential income.

Employers, banks, & clients are advised to carefully examine any such notice & respond following the law.

Final Thoughts

Section 226(3) is a powerful recovery mechanism under the Income Tax Act—but it’s not arbitrary. The law empowers the department to act swiftly, especially when dues remain unpaid. But with that power comes responsibility, & as a taxpayer, you too have rights & remedies if acted upon wrongly.

Have doubts about a tax notice or want to make sure your bank accounts & FDs stay protected from such recovery actions?

👉 Talk to an expert now on Callmyca.com & get help from real Chartered Accountants who know how to safeguard your rights.