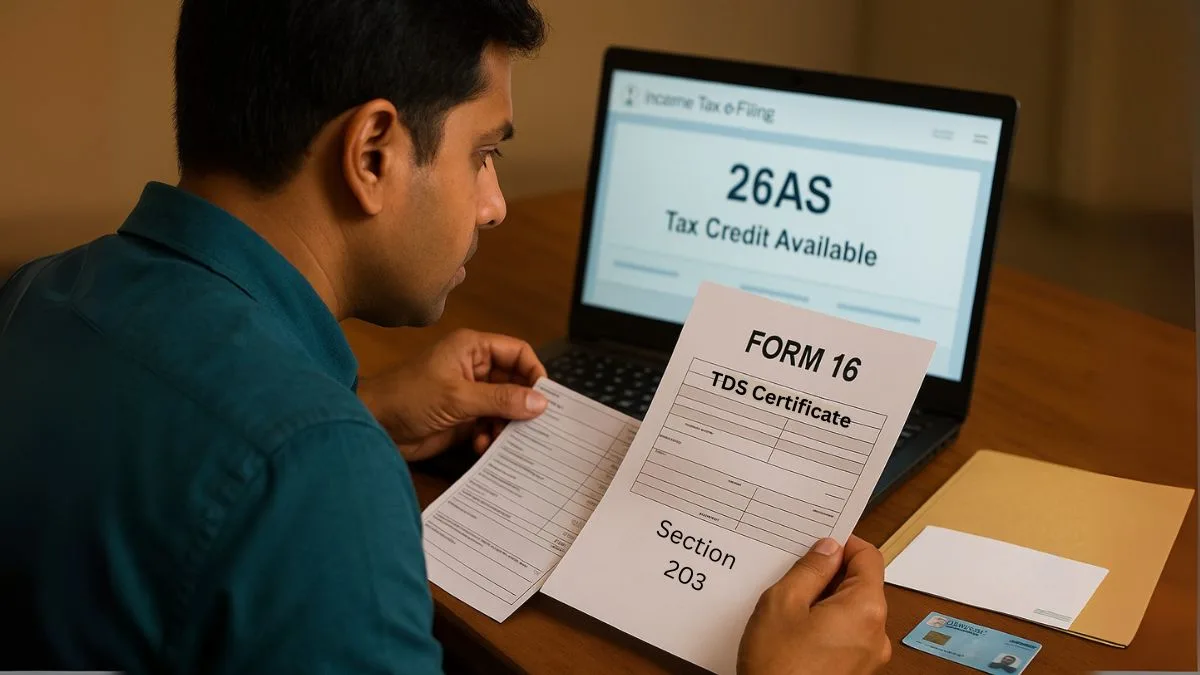

When it comes to the Indian Income Tax Act, Section 203 is one of those often-overlooked yet crucial provisions. It centres around something we all receive but seldom fully understand—the TDS certificate. Whether you're a salaried employee, a freelancer, or a business owner, TDS (Tax Deducted at Source) likely applies to your income. But how do you prove that tax has been deducted & deposited with the government? That’s where Section 203 of the Income Tax Act, 1961 steps in, ensuring you have the necessary documentation to confirm your tax payments.

Let’s dive deep into the meaning, scope, & real-world application of this section.

What is Section 203 of the Income Tax Act?

Section 203 mandates that anyone deducting tax at source must issue a certificate to the person from whom tax has been deducted. This certificate is known as the TDS certificate, & it serves as official proof that tax has indeed been deducted & paid to the government on your behalf.

This is not just a formality. It is a legal requirement, & non-compliance can lead to penalties under the Act. According to Section 203(1), every person responsible for deducting tax must furnish a certificate containing prescribed particulars."

What is a TDS Certificate?

The TDS certificate is issued in various forms based on the type of transaction & the deductee:

- Form 16: For salaried individuals.

- Form 16A: For non-salary deductions.

- Form 16B: For TDS on the sale of property.

- Form 16C: For TDS on rent payments by individuals/HUFs under Section 194-IB.

Under Section 203(1) of the Income Tax Act, deductors must provide this certificate in the prescribed format within a specified time frame.

Time Limit for Issuing TDS Certificate

The Income Tax Act lays out specific deadlines for issuing the TDS certificate. As per Section 203 of the Income Tax Act 1961, these deadlines are usually quarterly or annually, depending on the form type:

- Form 16: Annually (generally by 15th June of the financial year following the deduction)

- Form 16A: Quarterly

- Form 16B & Form 16C: Within 15 days from the due date of furnishing the challan-cum-statement in Form 26QB/26QC

Failure to issue the certificate on time may attract penalties under section 272A(2)(g)."

Importance of Section 203 TDS Certificate

Why does this certificate matter so much?

- It allows the taxpayer to claim the deducted tax as a credit while filing Income Tax Returns.

- It acts as documentary proof of tax deduction, especially during tax audits or verification by the Income Tax Department.

- For salaried individuals, Form 16 is a must-have while applying for loans or visa processing.

In short, Section 203(1) of the Income Tax Act ensures transparency, accountability, & record maintenance in the Indian taxation system.

Real Life Example: Why You Shouldn't Ignore Section 203

Imagine you're a freelancer who has worked with a big corporate client. They pay you ₹1,00,000 but deduct ₹10,000 as TDS. Without the TDS certificate under section 203, how will you prove the deduction?

When you go to file your ITR, you won’t be able to claim the TDS unless the certificate is provided. This could lead to paying extra taxes — a nightmare for anyone!

Penalty for Non-Compliance

Under section 203(1) of Income Tax, not issuing the TDS certificate on time can cost the deductor ₹100 per day of default. But the penalty amount shall not exceed the actual TDS deducted.

This makes it crucial for both deductors & deductees to keep track of TDS certificates under Section 203 of the Income Tax Act, 1961."

Conclusion

Section 203 of the Income Tax Act might seem like a backend process handled by your employer or accountant, but it's a legal shield for your finances. It ensures that the tax deducted from your income is accounted for & available as credit.

Whether it’s Form 16 under section 203, or TDS certificate under section 203, this tiny slip of paper (or PDF) holds the power to reduce your tax burden, ease compliance, & save you from future tax disputes.

Need help managing your TDS certificates or filing returns?

Let the experts at Callmyca.com handle your taxes while you focus on what you do best. Talk to our CA now—before it costs you a penalty!