When we talk about income tax for businesses in India, one term often creates confusion: Minimum Alternate Tax, or MAT. To simplify how MAT credit can be adjusted, Section 115JD of the Income Tax Act, 1961 comes into play. It outlines how businesses can benefit from MAT credit carried forward to future years, ensuring they aren't overburdened when tax liabilities increase unexpectedly. “

What Is Section 115JD?

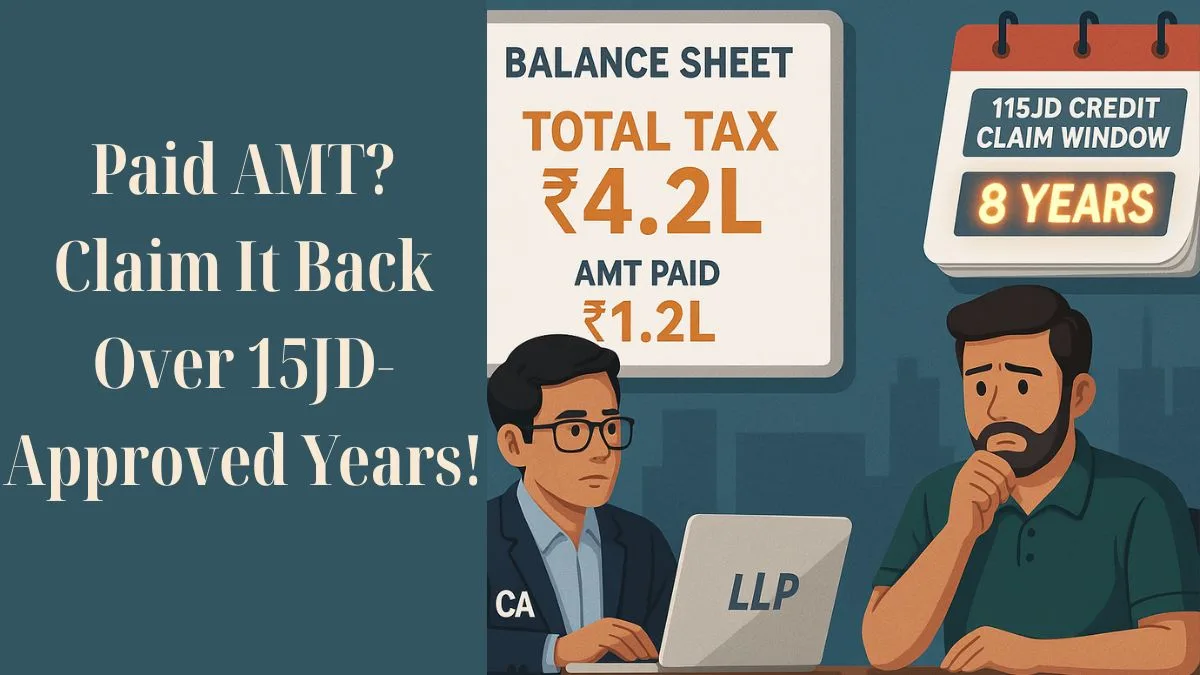

Section 115JD of the Income Tax Act governs the computation of Minimum Alternate Tax (MAT) credit & its adjustment against regular tax liability. This provision ensures that if a company has paid MAT in a year when normal income tax was lower than MAT, it can claim a credit of that excess amount in the years when its regular tax liability is higher than MAT.

In simpler words, businesses are allowed to "carry forward" the extra MAT paid & use it later to reduce their tax burden. “

MAT Credit – How Does It Work?

When a company’s tax computed under normal provisions is less than what they pay as MAT under Section 115JB, the difference (excess MAT paid) becomes a credit. This MAT credit can be carried forward for the next 15 assessment years as per the current law.

And here’s the important part—the assessee shall be liable to pay such tax together with interest & fee payable, if MAT credit isn’t adjusted properly or if returns are delayed.

This ensures proper compliance & keeps the government revenue system smooth and predictable.

Purpose of Section 115JD

This section was introduced to ensure that MAT is not a tax burden for businesses in the long term. It also:

- Gives businesses relief by allowing MAT credit to reduce future tax liability.

- Encourages companies to maintain consistent tax compliance.

- Helps in avoiding double taxation in subsequent financial years.

Who Can Claim MAT Credit Under Section 115JD?

- Companies or LLPs that paid MAT in earlier years under Section 115JB.

- Businesses whose regular tax liability in a later year exceeds MAT.

- Assessees who file income tax returns within the prescribed timelines.

Practical Example:

Let’s say a company’s tax liability for FY 2022–23 is ₹3 lakh under the regular method, but the MAT payable is ₹5 lakh. The company pays ₹5 lakh as per MAT. Now, in FY 2024–25, its regular tax liability is ₹7 lakh and MAT is ₹6 lakh. The company can now claim ₹2 lakh as MAT credit from the earlier excess paid & pay only ₹5 lakh (₹7 lakh – ₹2 lakh).

This beneficial mechanism allows tax smoothing over the years.

MAT Credit Carry Forward Limit

Under Section 115JD, MAT credit can be carried forward for up to 15 years. However, it must be set off in years where the regular income tax exceeds MAT.

So, don’t forget: carry forward, yes, but not forever.

Interest and Fee under Section 115JD

The assessee shall be liable to pay such tax together with interest & fees if the MAT credit isn’t adjusted properly or if there is a delay in compliance. Hence, it’s crucial to maintain proper records of MAT paid & credits available.

Final Word

Section 115JD is a powerful tool for businesses, ensuring they get fair treatment when they’ve paid more tax under the MAT provisions. It allows smoother tax planning across years & helps maintain financial stability.

💡 Need help with MAT credit adjustment, filings, or tax strategy? Our experts at Callmyca.com can assist you with end-to-end compliance & planning. Book your service today for personalised assistance!