When it comes to taxation, the Income Tax Act, 1961, tries to draw a clear boundary between taxable & non-taxable income. Section 14A of the Income Tax Act is one such tool that prevents taxpayers from claiming undue deductions. But what exactly does it cover? Why is it such a buzzword during assessments?

Let’s break it down in a simple & engaging way so that even a non-tax geek can understand.

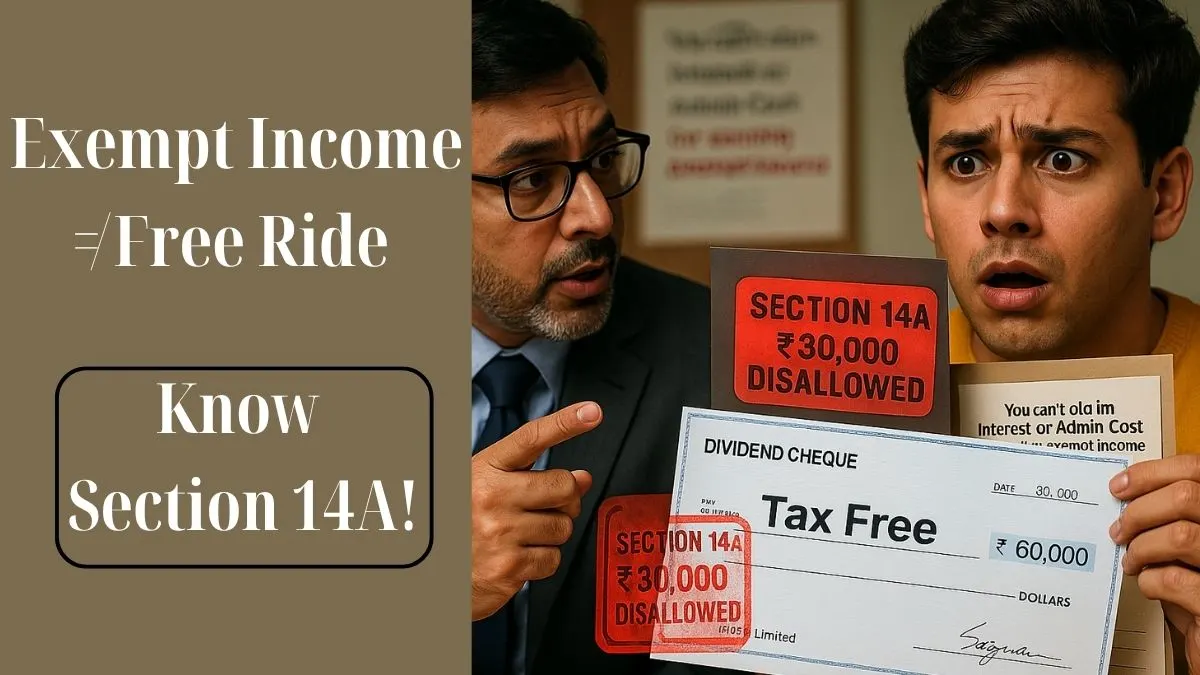

📌 What is Section 14A of the Income Tax Act?

Section 14A of the Income Tax Act, 1961 deals with expenditure incurred about income not includible in total income.

Simply put:

If you're earning tax-free income (like dividends from tax-exempt securities or agricultural income), you can’t claim deductions for expenses used to earn that exempt income. The law provides for the disallowance of expenditure in such cases.

The core logic? You shouldn’t get a tax break on income that isn’t taxable in the first place. “

🧾 Example of Section 14A Application

Let’s say you’re an investor who earns ₹10 lakhs in tax-free dividends & you took a loan to buy those shares. The interest on that loan is ₹1 lakh. Can you claim that ₹1 lakh as an expense deduction?

Nope.

Section 14A disallows the expenditure because the dividend income is not includible in total revenue.

📚 Legal Evolution and Amendment

Initially, there was confusion. Courts were divided over whether the Income Tax Officer could disallow expenditure related to exempt income if Section 14A was not explicitly applied.

Then came the Finance Act, 2001, which inserted Section 14A retrospectively with effect from April 1, 1962.

The idea was to prevent taxpayers from deducting taxes on purchases or investments that generate exempt income. “

But it didn’t stop there. The section was later fine-tuned with Rule 8D, which laid down a specific formula to compute the disallowed amount.

🛠 Rule 8D: The Formula Behind the Scenes

Under Rule 8D, the Assessing Officer can calculate disallowance using a standard method if:

- You claim a large exempt income, &

- You fail to prove that no expense was incurred to earn that exempt income.

The formula includes:

- Direct expenses attributable to exempt income

- 1% of the average monthly value of investments (from which exempt income arises)

While Rule 8D adds objectivity, it’s also received criticism for being too harsh or mechanical in some cases.

💬 Judicial View: Supreme Court & Case Law

There have been several Supreme Court judgments on Section 14A of the Income Tax Act, especially concerning what qualifies as “expenditure incurred about exempt income.”

The courts have clarified that:

- Disallowance is not automatic.

- There must be a nexus between expenditure & exempt income.

- If no such expenditure is incurred, disallowance should not be arbitrary.

Hence, mere earning of exempt income doesn’t trigger disallowance under Section 14A unless expenses can be linked to it.

🔍 How to Stay Compliant?

Here are a few things to keep in mind:

- Maintain documentation: Be ready to prove your claims.

- Avoid clubbing all expenses together: Separate those related to exempt & taxable income.

- Be cautious in disclosures: Your audit report & computation should clearly state any exempt income & the related expenses.

- Watch out for assessments: This section is commonly triggered during scrutiny cases.

🔁 Section 14A and Tax Planning

Smart tax planning is not about evading tax—it’s about optimising deductions legally. Trying to claim expenses against exempt income can backfire under this section, especially with automated Rule 8D calculations.

So while investing in tax-free options, it’s also important to track the source of funds, interest costs, & your overall income structure.

🔗 Final Word – Plan Smart, File Right

If you're unsure whether your expenses fall under Section 14A disallowance, don’t leave it to chance.

Let the experts at Callmyca.com help you figure it out.

Whether it’s ITR filing, scrutiny response, or exemption advisory—we’ve got your back.

Book a service today & file taxes stress-free! ✅