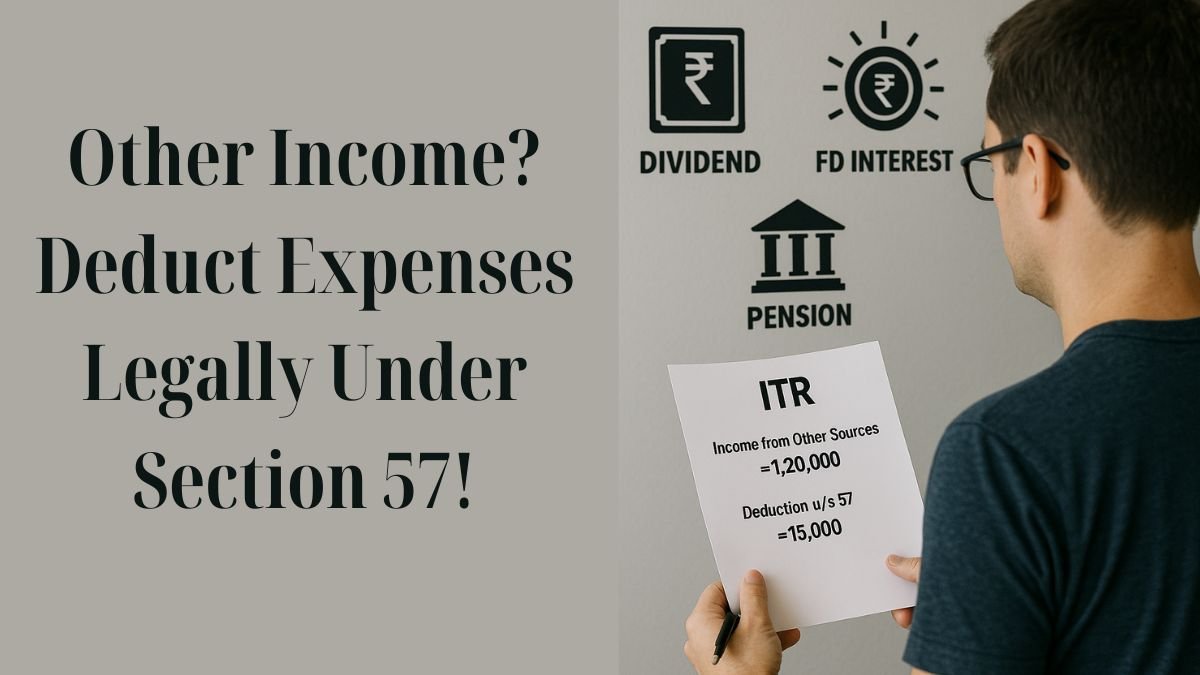

When you think of taxable income in India, the first categories that usually come to mind are salary, business profits, or capital gains. But there’s a lesser-known head of income that often holds hidden tax-saving potential—“Income from Other Sources”, governed by Section 57 of the Income Tax Act.

Let’s break this down simply.

What is Section 57?

Section 57 of the Income Tax Act deals with the deductions allowed from the income that falls under the head "Income from Other Sources". This is a residual category used when the income doesn’t fit neatly into other heads like salary, house property, or capital gains. Examples include:

- Interest income (on savings accounts, fixed deposits, etc.)

- Dividend income

- Family pension

- Royalty from intellectual property

- Rental income (not from house property)

- Gifts exceeding ₹50,000 from non-relatives

Section 57 allows you to claim certain deductions of expenses incurred while earning these types of income. "

What Deductions Can You Claim Under Section 57?

Not all expenses are deductible. Only expenditures that are directly related to the income earned are allowed. For example:

- If you earn interest from bonds or FDs, you can deduct commission or remuneration paid to a banker or agent.

- In the case of family pension, a standard deduction of one-third of the pension amount or ₹15,000 (whichever is less) is allowed.

- Authors, playwrights, or inventors who earn royalty or copyright fees can deduct expenses incurred for producing their work.

This is where a peculiar line becomes relevant—“Failure to display a work or to display it to the satisfaction of the author” may affect your eligibility for such deductions if the terms of the contract or income-earning activity are not met. "

Why is Section 57 Important?

Imagine you earned ₹1 lakh in interest from FDs and paid ₹2,000 as agent commission. Without Section 57, you’d be taxed on the full ₹1 lakh. With it, you get to deduct ₹2,000, reducing your taxable income.

It provides valuable deductions for income from other sources, ensuring that you're taxed only on your real income, not the gross receipts.

Also, Section 57 allows deductions for costs incurred in generating income other than salaries, such as maintenance charges on leased assets, litigation costs, or collection charges.

Real-Life Examples

- Case of Freelance Royalties

Suppose you’re a freelance writer who receives ₹50,000 in royalties. You spent ₹10,000 promoting and distributing your book. Under Section 57, you can deduct those expenses & pay tax only on ₹40,000. - Interest and Commission

You invest in bonds & earn ₹2 lakhs as interest, but pay ₹5,000 in brokerage and service charges. These costs are deductible under Section 57.

A Note on the Term “Imprisonment for Life…”

You may notice a confusing keyword: “imprisonment for life shall be reckoned as equivalent to imprisonment for twenty years.” While this line appears in some interpretations of law, it doesn’t directly connect with Section 57. It may have appeared due to an overlap with judicial rulings involving sections around penalty or procedural default.

How Does Section 57 Compare With Other Deduction Sections?

Unlike Section 80C, which focuses on savings-based deductions, or Section 24(b), which deals with home loan interest, Section 57 is unique in that it covers non-salaried, non-business income.

It’s a lifesaver for retirees, freelancers, authors, and investors, allowing them to reduce their tax burden on passive income.

Common Mistakes to Avoid

- Claiming unrelated expenses: Only costs directly connected to the earning of income are allowed.

- Claiming double deductions: If already claimed under another head, don’t repeat here.

- Missing out on Form 15G/15H (if eligible): Helps avoid unnecessary TDS.

In Summary

Section 57 may not make headlines during Budget speeches, but it’s an essential tool in your tax planning kit. Whether you earn from dividends, family pension, royalties, or other sources, this section ensures that you’re taxed only on your net income, not on your effort.

So the next time you find yourself earning money outside of a job or business, think of Section 57 of the Income Tax Act—and make sure you deduct every rupee you’re legally entitled to.