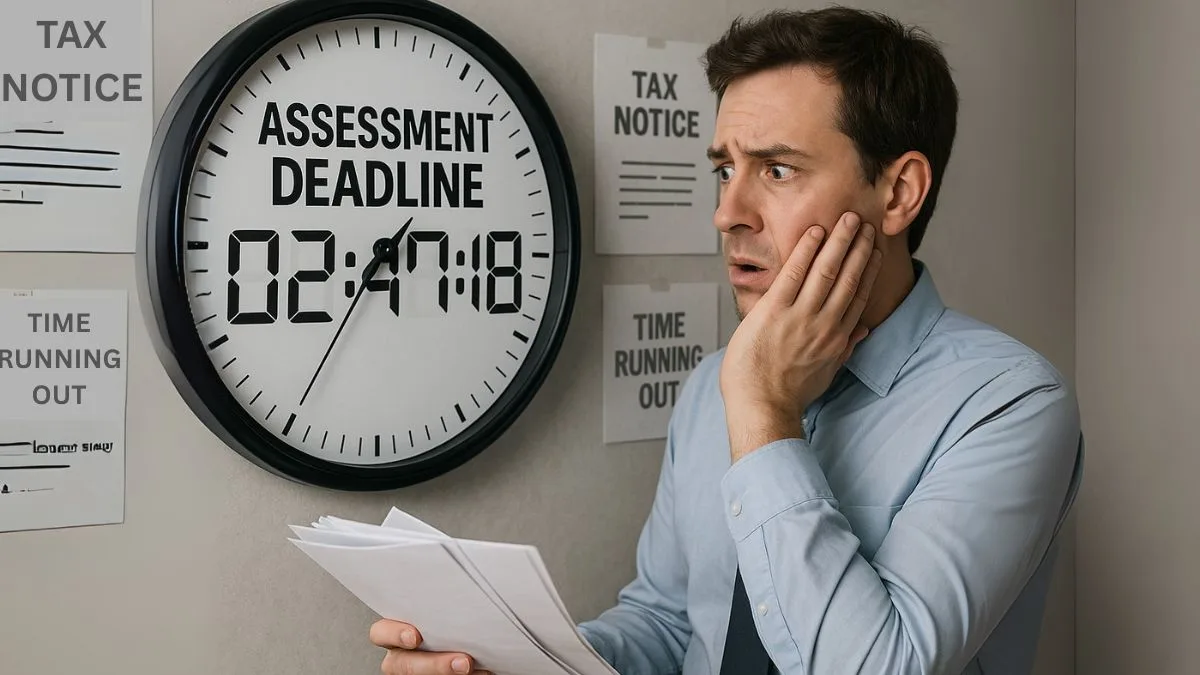

When it comes to income tax compliance in India, timelines matter as much as accuracy. One crucial provision that governs these timelines is Section 153 of the Income Tax Act. This section deals with the time limit for completion of assessment, reassessment, & recomputation of income, which every taxpayer, tax consultant, & business owner must understand to stay on the right side of the law.

What is Section 153 of the Income Tax Act?

Section 153 of the Income Tax Act provides specific time limits for the completion of assessments, reassessments, & recomputations by the Assessing Officer. This ensures that the tax authorities conclude proceedings within a reasonable period, offering both efficiency & certainty to taxpayers.

Under this section, no order of assessment shall be made under Section 143 or Section 144 after the expiration of the prescribed time frame. This restriction is pivotal in maintaining transparency & fairness in tax proceedings.

Time Limit for Completion of Assessment

The time limit for completion of the assessment refers to the maximum duration within which the tax authorities must finalise the assessment of an individual, firm, or company’s income. Typically, the assessment should be completed within 12 months from the end of the relevant assessment year."

For example, for Assessment Year (AY) 2022–23, the time limit extends till 31st March 2024. This deadline applies to both regular assessments under Section 143(3) & best judgment assessments under Section 144.

Time Limit for Reassessment and Recomputation

The time limit for completion of reassessment or recomputation of income follows a similar but distinct timeline. If the Assessing Officer decides to reopen the case under Section 147, the reassessment must typically be completed within 12 months from the end of the financial year in which the notice is served.

This ensures that no assessment, reassessment, or recomputation lingers indefinitely, allowing taxpayers to move forward with financial certainty.

Key Provisions under Section 153

- No order of assessment shall be made under Section 143 or Section 144 after the expiry of the timeline.

- The time limit for the completion of assessments ensures procedural efficiency.

- The Assessing Officer must act within this legally defined time frame, failing which the proceedings become invalid.

- It also applies to reassessments when cases are reopened under Section 147 or Section 148.

Why is Section 153 Important?

Section 153 protects the interests of both the government and taxpayers. On the one hand, it ensures that the government collects the right amount of tax within the stipulated period. On the other hand, it provides taxpayers with legal certainty that their case cannot be reopened or prolonged indefinitely without valid reasons.

This section also provides the time limit to the Assessing Officer, which curbs unnecessary delays & harassment for taxpayers."

Example to Understand Section 153 Better

Suppose an assessee receives a notice under Section 148 on 1st September 2023, for AY 2021–22. The reassessment must be completed by 31st March 2025. Such strict timelines are a relief to taxpayers who otherwise may remain uncertain about their tax liability for years.

Recent Updates and Judicial Views

In recent times, there have been various amendments in Section 153 of the Income Tax Act to streamline processes & reduce litigation. Courts have consistently emphasized adherence to these time limits to uphold fairness.

Several judgments have highlighted that if the time limit for completion of the assessment is breached, the entire proceedings become invalid, reinforcing the binding nature of this provision.

✅ Need help with Income Tax filing, reassessment notices, or any tax compliance? Our experts at Callmyca.com simplify the process for you. Get in touch today to ensure your tax matters are handled accurately & stress-free!