In Indian taxation, the Hindu Undivided Family (HUF) holds a unique position. It is recognized as a separate taxable entity under the Income Tax Act. However, when such a family undergoes a partition, questions arise: How should its income be taxed? Who will bear the responsibility of paying taxes?

The answer lies in Section 171 of the Income Tax Act, 1961. This provision specifically deals with the assessment after partition of a Hindu Undivided Family. It provides clarity on how income should be taxed when a HUF ceases to exist as a single unit. This ensures both compliance & fairness for taxpayers.

What is Section 171 of Income Tax Act?

Section 171 of Income Tax Act lays down rules for assessment after partition of a Hindu Undivided Family (HUF). If a HUF has been assessed as undivided in the past, and later undergoes partition, this section comes into effect.

Key points include:

- The Assessing Officer (AO) must verify whether a partition has actually taken place.

- If partition is valid, the income of the HUF until the date of partition is assessed as if no partition occurred.

- Post-partition, each member is assessed individually on the income received.

Thus, the law ensures continuity of taxation while respecting the reorganization of family assets.

Assessment After Partition of a Hindu Undivided Family

The most important function of Section 171 is governing the assessment after partition of a Hindu Undivided Family. The process is as follows:

- The family must claim that partition has taken place.

- The AO will conduct an inquiry to confirm the claim."

- If satisfied, the AO will record an order recognizing the partition.

- Income up to the date of partition is taxed in the hands of the HUF.

- Income after partition is taxed individually in the hands of family members.

This systematic approach prevents misuse of partition claims & ensures proper taxation.

Also Read: Income Tax Filing for HUF: A Hidden Route to Big Savings?

A Hindu Family Hitherto Assessed as Undivided

A critical condition for the application of Section 171 is that the family must be a Hindu family hitherto assessed as undivided.

This means:

- If a HUF has never been assessed to tax as an undivided entity, Section 171 does not apply.

- Only families with prior tax history as HUFs can invoke Section 171 upon partition.

This provision ensures that bogus claims of partition do not arise in families that were never officially recognized as HUFs under tax law.

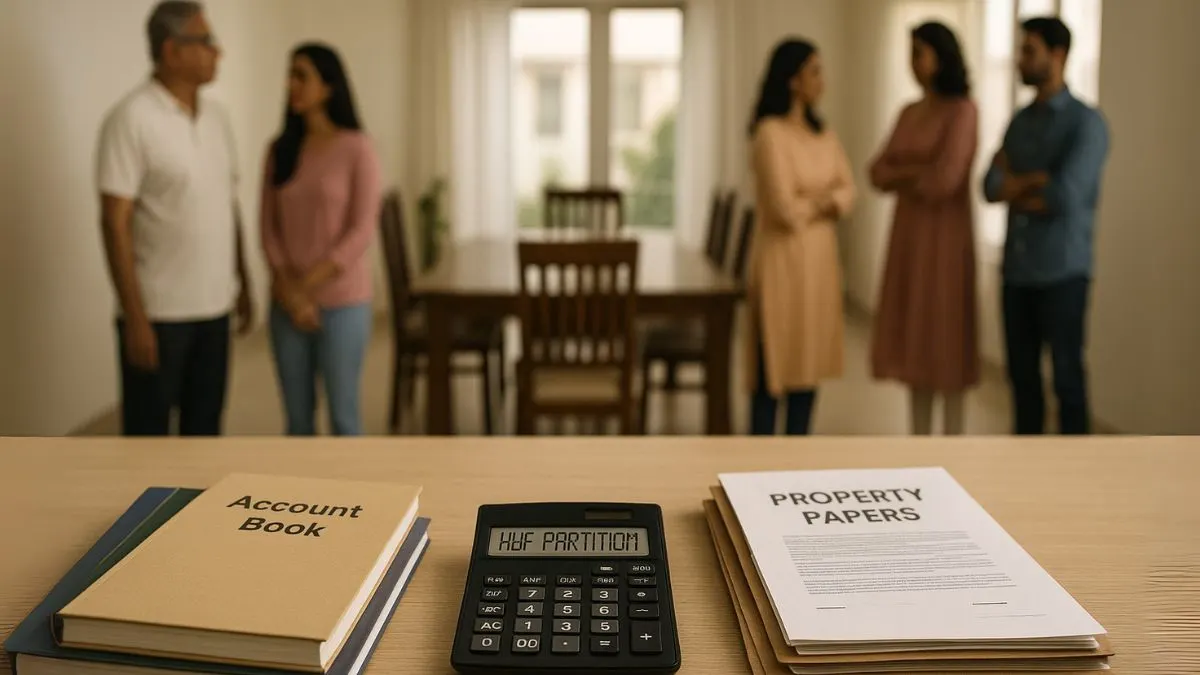

Defines the Partition of HUF

Section 171 clearly defines the partition of HUF for taxation purposes. It distinguishes between:

- Total Partition: Where all properties are divided among all members, and the HUF ceases to exist.

- Partial Partition: Where only part of the property is divided, or division takes place among some members only.

The Income Tax Act recognizes only total partition for tax purposes. Partial partitions are ignored to prevent tax evasion through splitting of assets.

Effects of Partition on an HUF’s Income

The effects of partition on an HUF’s income are significant:

- Income earned until the partition date is taxable in the hands of the HUF.

- After partition, the income is distributed & taxed in the hands of individual members."

- Members cannot escape tax liability by simply declaring partition unless verified by the AO.

This ensures tax continuity & avoids revenue loss to the government while giving taxpayers rightful recognition of their new individual status.

Also Read: TDS on Rent for Individuals and HUFs

Governs the Assessment of Income for HUFs Post-Partition

Another vital feature of Section 171 is that it governs the assessment of income for HUFs post-partition. Once the AO passes an order recognizing partition, the HUF is no longer assessed as a single entity. Instead:

- Each member is responsible for their share of income.

- Liability is divided among members in proportion to their share in assets.

- Any tax due before partition remains the responsibility of the family collectively.

This framework ensures that taxes are fairly distributed & collected without loopholes.

Not Applicable Where an HUF Has Not Been Assessed

One of the important clauses is that Section 171 is not applicable where a Hindu Undivided Family has not been assessed to income tax before.

This means:

- If a family never filed as a HUF, there is no need to pass an order under Section 171.

- Only those HUFs that have been officially assessed are subject to this provision.

This saves unnecessary administrative work & ensures the section is applied only to genuine cases.

Practical Example

Imagine the Sharma family, which was filing taxes as a HUF. In 2024, the family decided to partition their assets fully among members. The AO conducted an inquiry & confirmed the claim.

- Income earned until the date of partition (say ₹10 lakh) was taxed in the name of the HUF.

- After partition, each member reported their share of income individually.

This simple example shows how Section 171 of Income Tax Act ensures continuity while adapting to changes in family structure.

Also Read: GST Cut Trap: How Input Tax Credit Rules Could Hurt Consumers Instead of Helping

Why Section 171 Matters

- Fairness – Ensures proper taxation during family restructuring.

- Prevents Evasion – Stops misuse of partition claims to avoid taxes.

- Tax Clarity – Clearly defines how income should be split & taxed."

- Legal Safeguard – Protects both taxpayers & the Income Tax Department.

- Cultural Relevance – Recognizes the unique structure of HUFs in Indian society.

Conclusion

Section 171 of Income Tax Act is a crucial provision that deals with assessment after partition of a Hindu Undivided Family. It applies only to a Hindu family hitherto assessed as undivided, clearly defines the partition of HUF, and explains the effects of partition on an HUF’s income. It also ensures that the law governs the assessment of income for HUFs post-partition & is not applicable where a Hindu Undivided Family has not been assessed to income tax.

In essence, it provides fairness, continuity, and clarity in taxation when families undergo structural changes.

👉 Want to know how Section 171 impacts your HUF or family’s tax planning? Visit Callmyca.com today & let our experts guide you through smart tax-saving strategies.