India has a long tradition of charitable and philanthropic activities. Whether it is promoting education, running hospitals, or supporting underprivileged communities, many trusts & NGOs play a significant role in bridging social gaps. To encourage such work, the Income Tax Act provides various exemptions and deductions. One such key provision is Section 12A(1)(b) of the Income Tax Act, which provides tax exemption to certain charitable organizations.

This section ensures that the income of recognized charitable institutions is not taxed, provided they meet specific compliance requirements. In simple terms, it helps organizations save taxes & utilize those funds for social welfare projects. Let’s explore this provision in detail.

What is Section 12A(1)(b) of the Income Tax Act?

Section 12A(1)(b) deals with the registration & conditions that charitable institutions must fulfill to claim tax exemptions. It provides tax exemption to certain charitable organizations like NGOs, trusts, and religious institutions.

The exemption is not automatic. An organization has to apply for registration under Section 12A with the Income Tax Department. Once granted, the registration allows the entity to enjoy tax benefits on its income.

In short, Section 12A(1)(b) acts as a gateway to income tax exemption for charitable institutions.

Why Was Section 12A(1)(b) Introduced?

The government introduced this provision with two clear objectives:

- Encouragement of social work – Charitable organizations often rely on donations & grants. Tax exemptions help them channel maximum resources into their mission rather than paying heavy taxes."

- Regulation of NGOs and trusts – By mandating registration & regular audits, the government ensures transparency and accountability.

So, this section strikes a balance between promoting charitable activities & ensuring compliance.

Also Read: The Essential Guide for NGO Registration and Tax Exemption

Eligibility for Section 12A(1)(b)

Not every organization can claim this exemption. To qualify, the following conditions must be met:

- The institution must be engaged in charitable or religious purposes such as education, medical relief, or public welfare.

- The trust or NGO must be registered under Section 12A with the Income Tax Department.

- Annual accounts must be audited if the income exceeds the specified limit.

- The organization must apply its income only for charitable purposes & not for private gain.

Failure to comply with these conditions can result in withdrawal of exemption.

Benefits of Section 12A(1)(b)

- Full Tax Exemption – Income used for charitable purposes is fully exempt from income tax.

- Encourages Donations – Donors are more likely to contribute when they know the institution enjoys tax-exempt status.

- Recognition & Credibility – Registration under Section 12A(1)(b) increases the credibility of the trust or NGO.

- More Funds for Welfare – Tax savings can be redirected to educational, healthcare, or other welfare programs.

Registration Process under Section 12A

Here’s a step-by-step guide:

- Application Form – Submit Form 10A to the Income Tax Department.

- Documents Required – Trust deed, financial statements, activity reports, and PAN card.

- Verification – The Commissioner of Income Tax verifies the genuineness of the activities."

- Grant of Registration – Once satisfied, registration under Section 12A(1)(b) is approved.

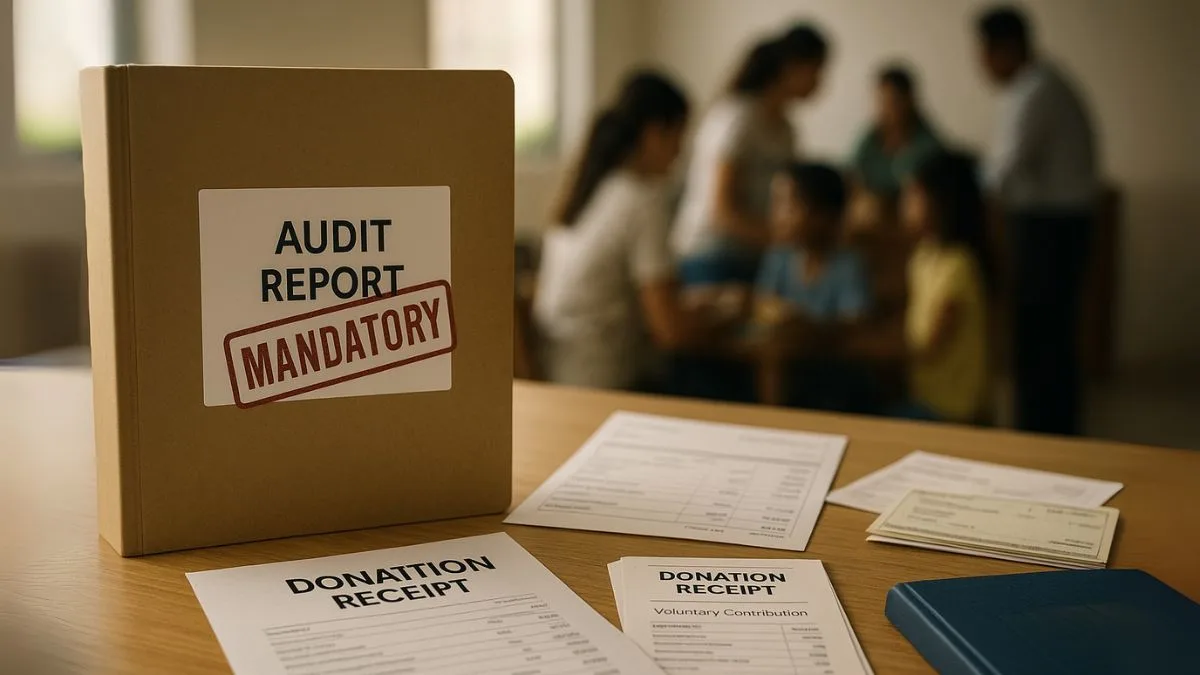

Audit Requirement under Section 12A(1)(b)

A key condition of Section 12A(1)(b) is that charitable organizations must get their accounts audited if the income exceeds the maximum exemption limit. The audit report has to be filed in Form 10B.

This ensures that the funds are being used for genuine purposes & adds transparency to the operations of the trust.

Also Read: Your Guide to Tax Benefits on Charitable Donations

Example for Better Understanding

Imagine an NGO, “Bright Future Foundation,” working for the education of underprivileged children.

- Annual donations received: ₹50,00,000

- Expenses on education programs: ₹45,00,000

- Administrative expenses: ₹5,00,000

Since the NGO is registered under Section 12A(1)(b) & its income is used entirely for charitable purposes, the entire amount is exempt from tax. Without this exemption, a large portion of its funds would have gone to taxes.

Difference Between Section 12A and Section 80G

- Section 12A provides tax exemption to the charitable organization itself.

- Section 80G provides tax deduction to the donor who contributes to the organization.

Together, they encourage both organizations & individuals to participate in social welfare.

Challenges Faced by Organizations

Even though Section 12A(1)(b) is beneficial, organizations face some hurdles:

- Complex Registration Process – Small NGOs often find the documentation & compliance difficult.

- Regular Compliance Burden – Mandatory audits, filing returns, and keeping detailed records can be challenging.

- Withdrawal of Exemption – Any misuse of funds can result in cancellation of registration.

Despite these challenges, the benefits far outweigh the drawbacks.

Recent Amendments and Updates

The government has made several changes in recent years to tighten compliance:

- Mandatory electronic filing of Form 10A."

- Renewal of registration every 5 years instead of permanent registration.

- Introduction of new forms for better reporting & monitoring.

These changes ensure that only genuine organizations continue to enjoy tax exemptions.

Also Read: Tax Treatment of Charitable Trusts & Institutions

Importance of Section 12A(1)(b) in India

India is home to millions of NGOs and trusts working in different sectors like education, environment, and healthcare. Section 12A(1)(b) of the Income Tax Act provides tax exemption to certain charitable organizations, thereby empowering them to contribute more effectively.

Without such provisions, many NGOs would struggle to survive due to financial constraints. This section is, therefore, a cornerstone in India’s social welfare framework.

Conclusion

Section 12A(1)(b) of the Income Tax Act plays a vital role in strengthening the charitable ecosystem of India. By providing tax exemptions to NGOs, trusts, and charitable organizations, it allows them to maximize their resources for welfare activities. However, organizations must comply with audit & registration requirements to continue enjoying these benefits.

For anyone planning to start or run a charitable trust, understanding Section 12A(1)(b) is crucial. It is not just a tax-saving tool but also a way to gain credibility & attract donors.

👉 Want to ensure your NGO or trust gets maximum tax benefits without missing compliance deadlines? Visit Callmyca.com and let our experts guide you step by step.