Every few months, you’ll see headlines about new government schemes—cash incentives, startup grants, export subsidies. Great news, right?

But here’s the tricky part every business owner wonders: “Do I have to pay tax on this?”

The answer lives quietly inside Section 2(24)(xviii) of the Income Tax Act, 1961.

This one little clause decides whether that “free money” you received is actually... well, free.

The Background — Section 2(24): What Counts as Income

Before we zoom in, let’s get the bigger picture.

Section 2(24) defines what the word ‘income’ really means for taxation. It’s not just salary or business profits—it includes a lot of other things like perks, rewards, windfalls, & yes, subsidies.

Over time, people started treating government assistance as capital receipts (meaning non-taxable). The government didn’t like that loophole, so clause (xviii) was inserted.

Now, assistance in any form—subsidy, grant, cash incentive, duty waiver, or reimbursement—comes under the income umbrella, unless it’s specifically exempt somewhere else.

What Section 2(24)(xviii) Actually Says

The law puts it like this:

“Income includes assistance in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement (by whatever name called) by the Central Government, State Government or any authority or agency, in cash or kind, to the assessee.”

Sounds like a mouthful, but it’s simple:

If the government (or any authority) gives you financial help—cash or kind—it’s income.

Unless there’s a specific section saying “no, this one’s tax-free.”

Also Read: Deeming Provisions on Employee Contributions

Why This Clause Exists

Honestly? Because too many people were calling subsidies “capital support” just to skip taxes.

The aim was fairness: if someone’s receiving financial help that improves profits or lowers costs, it’s only right to treat it as income (except for certain capital-based grants).

That’s how Section 2(24)(xviii) keeps things clean & consistent across industries.

Who It Applies To

This section isn’t only for large corporations. It applies to:

- Individuals receiving state grants,

- Firms getting export incentives,

- Companies availing duty drawbacks,

- Even NGOs or trusts if they receive cash reimbursements.

In short, if you received any form of assistance from government, board, or agency, this section applies to you.

Breaking Down the Common Types

Let’s make it real:

- Subsidy: Government helps you lower costs—like power subsidies or fertilizer discounts.

- Grant: A one-time sum, maybe for R&D, green energy, or tech innovation."

- Cash Incentive: Exporters or manufacturers get this often—like MEIS or EPCG schemes.

- Duty Relief/Reimbursement: When excise/customs refunds help you save operating cost.

All of these fall under the phrase “assistance in the form of a subsidy or grant or cash incentive.”

Capital Receipt vs. Revenue Receipt — The Big Filter

Now, here’s where most people slip.

Not every subsidy is taxable. The reason it’s given makes the difference.

|

Purpose of Assistance |

Type of Receipt |

Tax Treatment |

|

For setting up or expanding a business |

Capital Receipt |

Usually not taxable |

|

For day-to-day operations or recurring costs |

Revenue Receipt |

Taxable as income |

Landmark case: Sahney Steel & Press Works Ltd. v. CIT (1997).

The Supreme Court made it clear: look at the purpose, not the label.

So, if the government gives money to help you pay salaries, bills, or run smoother—it’s income.

If it’s to build a plant or buy machinery, it may stay non-taxable.

Also Read: Meaning of “Transfer” in Capital Gains Taxation

Quick Example

Imagine you run a textile company. You receive ₹10 lakh as a cash incentive under the MEIS export scheme.

→ It’s taxable under Section 2(24)(xviii).

But if the government gives you ₹10 lakh as a capital subsidy to set up a new weaving unit, that’s capital in nature, & likely non-taxable.

Related Sections to Know

- Section 28(iv): Covers value of non-cash business benefits.

- Section 41(1): Applies when liabilities are written off or waived.

- Together, they help the department decide how your subsidy or grant should be taxed.

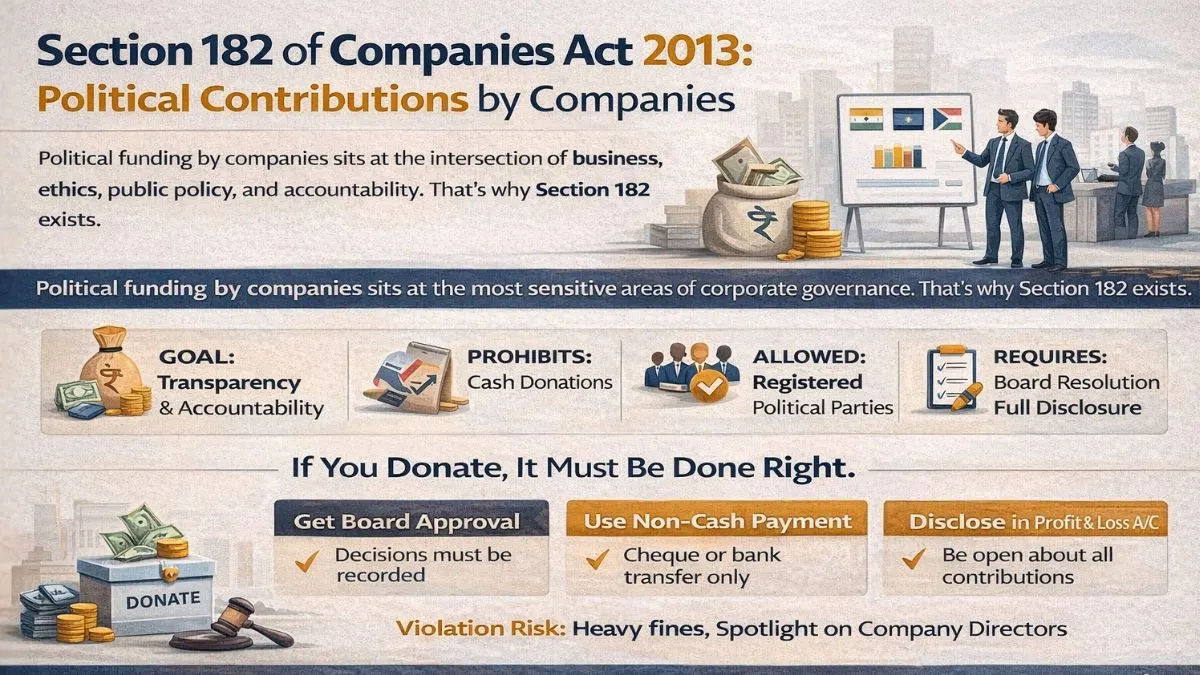

What About Electoral Trusts?

Good question. That’s under a separate clause — Section 2(24)(iia) — which deals with voluntary contributions to electoral trusts.

So, don’t mix that up. 2(24)(xviii) is purely about financial assistance, not donations.

Recent Updates & Trends

Post-2015, the scope widened a lot.

The law now covers assistance from any authority or agency, in cash or kind.

And businesses must disclose subsidies or grants clearly in their tax returns.

The goal? Total transparency.

No more hiding incentives behind creative accounting.

Also Read: The Hidden Definition of ‘Amalgamation’ That Reshapes Mergers & Taxes

How It’s Handled in Accounting

|

Type |

How to Record |

|

Revenue Subsidy |

Credit to Profit & Loss account |

|

Capital Subsidy |

Deducted from cost of asset or shown as liability until utilized |

💡 Keep every scheme notification, approval letter, & utilization proof. They save you during scrutiny.

Key Judicial Rulings

- CIT v. Ponni Sugars & Chemicals Ltd. (2008): Subsidy tied to loan repayment = capital receipt.

- CIT v. Meghalaya Steels Ltd. (2016): Incentives for operational support = revenue receipt (taxable).

- CIT v. Sahney Steel (1997): Purpose decides taxability, not the name of the subsidy.

For Startups & MSMEs

This is the part you shouldn’t ignore.

Most startup schemes give cash or reimbursement for operations—taxable by default.

Only capital-linked subsidies, meant for buying assets or setting up infrastructure, may stay out of tax.

So before claiming any exemption, read the scheme purpose twice—or talk to your CA once.

Global Alignment

Globally, countries follow the same logic:

If the government helps you earn more—it’s income.

If it helps you build something long-term—it’s capital.

Section 2(24)(xviii) aligns India’s tax practice with that global norm.

Also Read: The Definition of ‘Principal Officer’ That Holds the Key to Compliance

Key Takeaways

- Covers all subsidies, grants, cash incentives, & duty relief.

- Applies to any assessee receiving aid from government or authority."

- Purpose-based rule: capital = exempt, revenue = taxable.

- Keep detailed records for every subsidy or grant.

- Electoral trust donations fall under Section 2(24)(iia), not this clause.

In Short

Section 2(24)(xviii) isn’t here to punish taxpayers—it’s about fairness.

It ensures that financial aid gets the right tax treatment.

If you know the difference between capital & revenue, you can save yourself a ton of trouble (and tax) later.

Still unsure if your government subsidy or grant is taxable or exempt?

👉 Visit CallMyCA.com — our team of expert Chartered Accountants will review your documents, classify them under Section 2(24)(xviii), and help you stay compliant while saving the maximum tax legally.