Buying or selling a property in India isn’t just about the price you see on the agreement. Behind every transaction, there’s a tax obligation that many people often ignore — TDS on property. To close that gap and make property sales more transparent, the government introduced Section 194-IA and its implementation through Section 26QB of the Income Tax Act.

This section ensures that buyers deduct tax at source before paying the seller, helping the Income Tax Department track high-value property transactions and reduce black-money circulation in real estate.

What Exactly Is Section 26QB?

Section 26QB of Income Tax Act specifies the procedure for depositing & reporting TDS on property transactions. Whenever you buy a property worth ₹ 50 lakh or more, you must deduct TDS at the rate of 1 % from the sale value of the immovable property and deposit it with the government using Form 26QB.

So in simple terms:

➡ You buy a property.

➡ You deduct 1 % of the sale price as TDS.

➡ You pay that TDS online through Form 26QB within 30 days.

That’s how the Income Tax Department keeps track of property transactions nationwide.

Applicability of Section 26QB

This rule applies to:

- Any buyer of immovable property (residential or commercial) in India.

- Properties where the sale value exceeds ₹ 50 lakh.

- Transactions between resident Indians. (For NRIs, Section 195 applies instead.)

TDS is applicable on the transfer of immovable property, which includes land (building plots, apartments, commercial shops, etc.) but excludes agricultural land in rural areas.

Also Read: Penalty for Failure to File TDS/TCS Returns

Example — How TDS Under Section 26QB Works

Let’s say you’re buying a flat in Pune for ₹ 80 lakh.

You need to deduct 1 % TDS = ₹ 80,000 before paying the seller.

You then deposit this ₹ 80,000 to the Central Government through Form 26QB within 30 days from the month of payment.

The seller will get credit for this TDS in their Form 26AS once the buyer files Form 26QB correctly.

Who Should Deduct the TDS — Buyer or Seller?

This is a common confusion.

The law clearly states that the buyer is responsible for deducting and depositing the TDS under Section 26QB. The seller is not required to do so."

If there are multiple buyers or sellers, each buyer must file a separate Form 26QB for their share of the transaction.

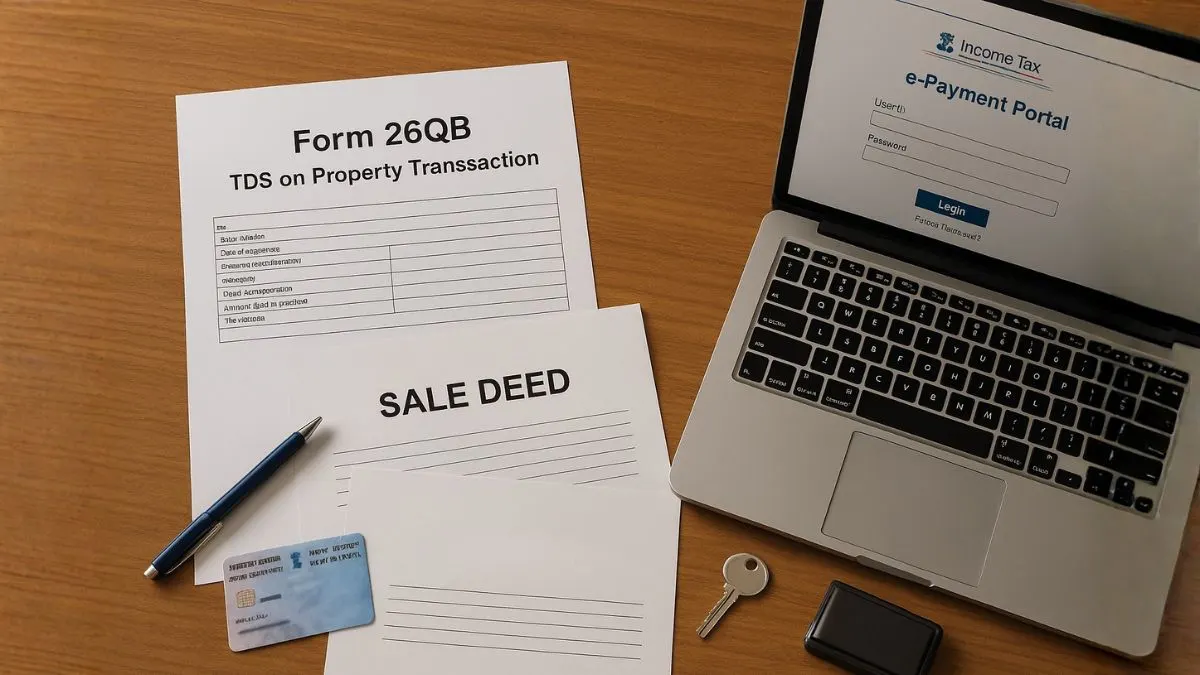

What Is Form 26QB and Why It Matters

Form 26QB is a special TDS return form for property transactions. It is used to report & remit TDS on property transactions directly to the government.

You don’t need to file a separate TDS return (like Form 24Q or 26Q) for this — Form 26QB itself acts as a return and challan.

It captures details such as:

- Buyer and seller PAN numbers

- Property address

- Sale value & payment details

- TDS amount and deposit date

After payment, you can generate a TDS certificate (Form 16B) from the TRACES portal & give it to the seller.

Timeline for Depositing TDS

The buyer must deposit the TDS within 30 days from the end of the month in which the payment was made.

Example: If you paid the seller on 10 October, you must file Form 26QB and deposit TDS by 30 November.

A delay can lead to interest and penalty, so it’s best not to wait till the last day.

How to File Form 26QB Online — Step-by-Step

Here’s a quick guide:

- Visit TIN-NSDL portal.

- Click on ‘TDS on Property (26QB)’ under Services.

- Select Form 26QB (Payment of TDS on Property).

- Enter details of buyer, seller, property and payment.

- Choose payment mode — net banking or e-payment through bank branch.

- After payment, save the acknowledgement number.

Later, download Form 16B from the TRACES portal & issue it to the seller.

Also Read: TDS on Purchase of Immovable Property

What Happens If You Don’t Deduct TDS

If you forget to deduct TDS or don’t deposit it on time:

- Interest @ 1 % per month for delay in deduction.

- Interest @ 1.5 % per month for delay in deposit.

- Penalty under Section 271H (up to ₹ 1 lakh).

- You won’t be able to register the property without the 26QB acknowledgment in some states.

So yes — it’s a small 1 % deduction, but it can cause big headaches if ignored.

Multiple Buyers or Sellers — How to Handle It

- If there are two buyers & one seller, each buyer must file a separate Form 26QB for their share.

- If there are two buyers & two sellers, you need four forms (2 × 2 combinations).

It sounds tedious, but it’s essential for accurate reporting & to avoid any mismatch in PAN records.

TDS Rate and Threshold Limit

- TDS Rate: 1 % of the sale consideration.

- Threshold: Applicable only if property value ≥ ₹ 50 lakh.

If the property is worth ₹ 49.9 lakh, you’re exempt. But if it’s ₹ 50 lakh or even ₹ 50,01,000 — TDS applies on the full amount, not just the excess.

Property Purchased on Loan — Who Pays the TDS?

Even if you’re buying through a home loan, you as the buyer are responsible for deducting TDS.

The bank will disburse the loan to the seller, but you must ensure that TDS is deducted & paid within 30 days of each instalment.

It’s best to coordinate with the bank to avoid duplication or missed deadlines.

TDS Credit for the Seller

Once the buyer files Form 26QB and pays the tax, the TDS appears in the seller’s Form 26AS & AIS statement. This credit can be claimed while filing their Income Tax Return.

So in a way, Section 26QB benefits both parties — the buyer complies with law, and the seller gets credit for tax already paid.

Also Read: Taxation of Property Owned by Co-Owners

Correction of Mistakes in Form 26QB

If you’ve entered the wrong PAN or property details, you can request correction through the TIN NSDL website. You’ll need approval from the assessing officer or TRACES to update the form.

Corrections are allowed for fields like buyer/seller name, amount, address, etc., but it’s better to triple-check before submission to avoid delays.

Common Mistakes to Avoid

❌ Not deducting TDS at the time of payment.

❌ Entering wrong PAN details (buyer & seller).

❌ Assuming builder will handle it.

❌ Late deposit of TDS or skipping Form 16B download.

These errors can lead to penalties or problems during property registration.

TDS on Under-Construction Property

Even for under-construction properties, TDS applies on each instalment paid to the builder. If you’re buying an apartment for ₹ 60 lakh & making monthly payments of ₹ 2 lakh, you must deduct 1 % TDS on every instalment — not just at possession."

The rule applies irrespective of construction status as long as the total value exceeds ₹ 50 lakh.

Refund in Case of Cancellation

If the property deal gets cancelled after you’ve already paid the TDS, you can claim a refund from the Income Tax Department. You’ll need to contact the TDS CPC and submit proof of cancellation and payment details.

Refunds usually take a few months, so always ensure your PAN and bank details are accurate in Form 26QB.

Why Section 26QB Is Important for the Economy

The real estate sector has always been a major source of undisclosed income in India. By mandating buyers to deduct TDS & report through Form 26QB, the government created a paper trail for every high-value property sale.

This step brought in better tax compliance, increased transparency, and helped curb illegal cash transactions in the market.

Also Read: Tax on Gifts, Cash, and Property Received Without Consideration

Quick Reference Table

|

Particulars |

Details |

|

Section |

26QB of Income Tax Act |

|

Applicable to |

Buyer of immovable property worth ₹ 50 lakh or more |

|

TDS Rate |

1 % of sale consideration |

|

Form to be used |

Form 26QB |

|

Payment Deadline |

Within 30 days of payment month end |

|

Penalty for Delay |

Interest Fine up to ₹ 1 lakh |

|

TDS Certificate |

Form 16B |

|

Exemption Limit |

Property value below ₹ 50 lakh |

|

Purpose |

Track & regulate real estate transactions |

Conclusion — A Small Step That Saves Big Trouble

Section 26QB may look like just a formality, but it carries huge importance in the eyes of the law. As a buyer, deducting 1 % TDS from the sale value of the immovable property & filing Form 26QB on time protects you from penalties and gives the seller smooth credit in their records.

Real estate transactions are big investments — don’t let a missed form create future stress.

If you want help with TDS filing, Form 26QB corrections, or property tax compliance, reach out to 👉 Callmyca.com. Our expert CAs make the process quick, accurate, and completely hassle-free so you can focus on your dream home, not the paperwork.