In income tax law, ownership isn’t always about whose name appears on the property papers. Sometimes, the person enjoying the property’s income or benefit — even without legal title — is treated as the owner for taxation.

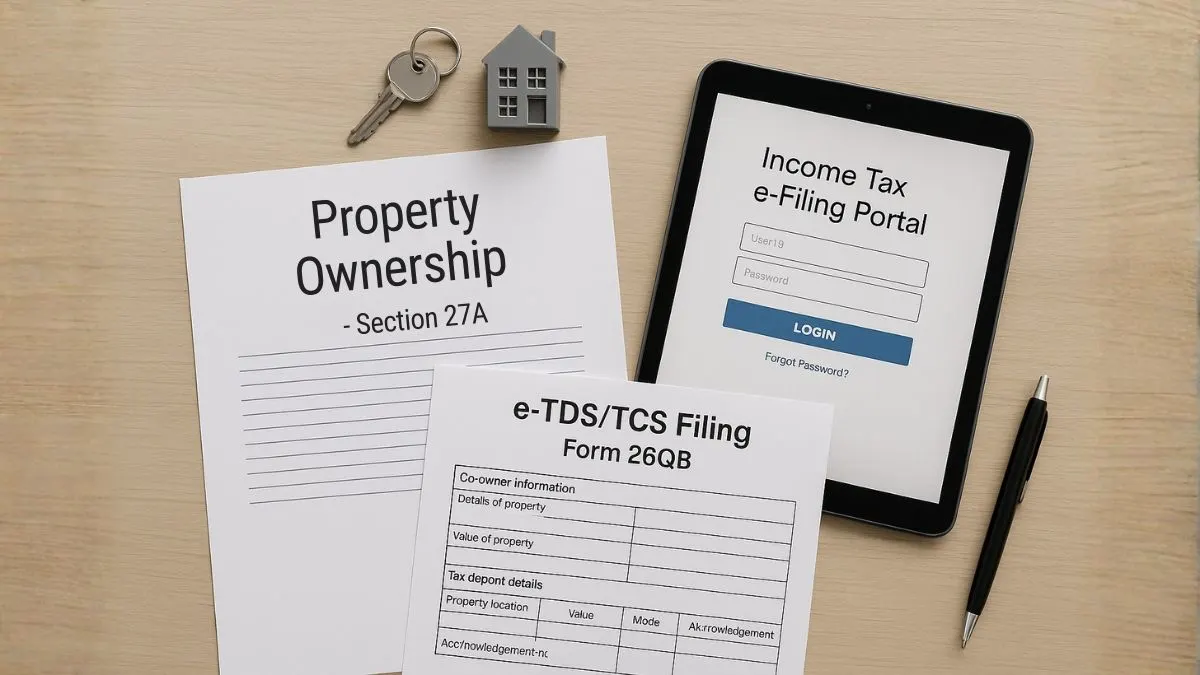

That’s where Section 27A of the Income Tax Act becomes relevant. It clarifies the meaning of the “owner of house property” & connects it to various compliance obligations, including TDS & TCS statements.

This section helps prevent tax leakage and ensures that income from property or rent is properly reported by the person who actually controls or benefits from the property.

Overview of Section 27A – Linking Ownership and Compliance

Section 27A of the Income Tax Act, 1961 defines cases where someone other than the legal owner is considered the owner for taxation purposes. It also outlines the requirement to furnish e-TDS/e-TCS statements, especially when deductions are made from rental income or related payments.

In short, the law looks beyond documents — it looks at substance over form.

If you hold rights, possession, or financial benefit from a property, the income is yours for tax purposes, even if the property isn’t registered in your name.

The Core Idea – Who Is the “Owner of House Property”?

Under Section 27A, the owner of house property includes:

- A person who has acquired possession through part performance of a contract (under Section 53A of the Transfer of Property Act).

- A lessee who enjoys ownership-like rights under a long-term lease (usually 12 years or more)."

- A person who transfers property to a spouse or minor child without adequate consideration.

- A member of a cooperative society who is allotted a specific building or flat.

These individuals may not hold the title deed but are still considered the deemed owner for tax purposes.

“Owner of House Property” Defined Under Section 27A

Section 27A brings clarity to an important term — owner of house property.

For taxation, ownership is determined by beneficial control and not just legal title.

For example:

- If you have purchased a house on instalments & already occupy it, you may be treated as the owner even if the registration is pending.

- If you lease property for 30 years with transfer rights, you’re treated as the deemed owner.

This ensures fair taxation of rental income & prevents tax evasion through technical ownership transfers.

Also Read: Section 53 — A Forgotten Provision on Capital Gains Exemption

Understanding “Annual Charge” in Relation to Property

The term annual charge refers to the recurring obligation or cost associated with the property, usually paid annually — like maintenance, interest, or fixed charges.

When calculating income from house property, such charges may influence net annual value (NAV). Section 27A ensures that the person responsible for these payments (the deemed owner) also reports related income or expenses accurately.

This closes loopholes where people might attempt to shift liabilities or benefits between family members or business entities.

Why Deemed Ownership Matters in Taxation

Deemed ownership ensures taxation of real income earners, not just those named on property papers. This concept prevents:

✅ False ownership transfers to evade tax

✅ Misuse of spouse or minor’s name for tax shelter

✅ Artificial separation of rent & property ownership

By linking control and benefit, Section 27A helps the tax department trace the actual owner of income & maintain accountability in house property taxation.

Connection Between Section 27A and e-TDS/e-TCS Returns

While Section 27 defines deemed ownership, Section 27A also aligns with compliance obligations under TDS and TCS filings.

If you’re an entity or individual deducting TDS on rent or property-related payments, you must use the Form for furnishing information with the statement of deduction/collection of tax at source.

This form summarises the details of e-TDS or e-TCS returns & must be filed electronically under Rule 31A/31AA of the Income Tax Rules.

In essence, the section combines the ownership definition with compliance duties — identifying who must deduct, report, and deposit TDS to the government.

Key Forms and Filing Requirements

|

Form Type |

Purpose |

Who Must File |

Frequency |

|

Form 24Q |

TDS on salary income |

Employers |

Quarterly |

|

Form 26Q |

TDS on payments to residents |

Businesses / Rent payers |

Quarterly |

|

Form 27Q |

TDS on payments to non-residents |

Deductors dealing with NRIs |

Quarterly |

|

Form 27EQ |

TCS statement |

Sellers collecting tax |

Quarterly |

|

Form 27A |

Physical summary of e-TDS/TCS return (used earlier, now digital) |

Mandatory for verification |

Submitted along with TDS/TCS filing |

Earlier, Form 27A acted as the cover sheet for TDS/TCS returns. Now, most filings are electronic, and this form is integrated into the digital upload process.

Compliance Procedure – Filing Form for e-TDS/TCS

1️⃣ Collect details of all deductions made during the quarter.

2️⃣ Use Form 27A or its digital equivalent to summarise deductor, TAN, total tax deducted, and challan details.

3️⃣ Validate the file using the File Validation Utility (FVU) from NSDL or the new CPC (TDS) portal.

4️⃣ Upload the file online via the Income Tax e-Filing or TRACES portal.

5️⃣ Generate acknowledgment — it serves as proof of filing.

Failure to file e-TDS/e-TCS returns can lead to penalties under Section 234E & late fees under Section 271H.

Also Read: Do You Qualify as a Resident? Discover How a Simple Clause Can Decide Your Tax Fate

Important Compliance Deadlines

|

Quarter (FY) |

Quarter Ending |

Due Date for TDS/TCS Return |

|

Q1 |

30 June |

31 July |

|

Q2 |

30 September |

31 October |

|

Q3 |

31 December |

31 January |

|

Q4 |

31 March |

31 May (following year) |

These deadlines ensure that all Form 27A or electronic equivalents are filed on time, helping the tax department match deductions with reported income.

Example – When Deemed Ownership Comes into Play

Let’s say Mr. Ramesh buys a house in his wife’s name to reduce tax liability but pays for it entirely & receives the rent.

According to Section 27A, even though his wife is the legal owner, Ramesh is treated as the owner for tax purposes."

He must report the rental income under “Income from House Property,” deduct TDS where applicable, and ensure the Form for furnishing e-TDS return reflects his details.

This prevents artificial transfers meant to reduce tax burden.

Real Estate and Leasing Cases

Long-term leaseholders often face questions about ownership. If a lease gives possession and control for 12 years, Section 27A treats them as owners.

That means the lessee must declare rental income or value of property use, even without formal registration. It also requires such lessees to deduct TDS under Section 194-I and report through Form 27A/e-TDS filing.

Practical Implications for Builders and Co-Operative Members

Builders, housing societies, & co-operative members commonly encounter Section 27A implications:

- If a co-operative society allots a flat to a member, the member becomes the deemed owner.

- The builder cannot claim income from that unit once possession is given.

- The member is now responsible for property tax, annual charge, and house property income declaration.

Even without registry, ownership is determined by beneficial enjoyment, not paperwork.

Common Mistakes Taxpayers Make

❌ Assuming property in spouse’s or child’s name removes their tax liability.

❌ Forgetting to deduct TDS on rent payments above ₹50,000 per month.

❌ Filing e-TDS return without validating Form 27A summary.

❌ Missing quarterly due dates for filing e-TDS or e-TCS statements.

Such errors may lead to penalties, interest, and mismatch notices under TRACES.

Also Read: The Cost of Delay in Filing TDS Returns

Legal Backing – Judicial Views on Deemed Ownership

Courts have reinforced Section 27A’s intent:

- In Podar Cement Pvt. Ltd. vs CIT (1997), the Supreme Court held that possession with control is enough to establish ownership for tax purposes.

- In Mysore Minerals Ltd. vs CIT (1999), beneficial ownership, not legal title, determined who should be taxed.

These cases show how Section 27A aligns with the principle that taxation follows real income & real control.

Section 27A and Annual Information Reporting

Under the Annual Information Statement (AIS) and Form 26AS, rent and property transactions are cross-verified with TDS data filed through Form 27A/e-TDS statements.

So, if TDS is deducted on rent but the property owner fails to declare it, the mismatch triggers a notice.

Hence, filing accurate e-TDS returns & declaring income consistently are both crucial.

Checklist for Section 27A Compliance

✅ Identify actual property owner or deemed owner.

✅ Deduct TDS on rent or payments under Section 194-I.

✅ File Form for e-TDS/e-TCS return within due dates.

✅ Verify ownership details & PAN in Form 27A summary.

✅ Reconcile data with Form 26AS and AIS.

This ensures smooth compliance & prevents penalties or disallowance.

Summary Table – Section 27A at a Glance

|

Particular |

Description |

|

Section |

27A of the Income Tax Act, 1961 |

|

Focus |

Definition of “owner of house property” and filing compliance for e-TDS/e-TCS |

|

Key Keywords |

Owner of house property, annual charge, e-TDS, Form for furnishing information with statement of deduction/collection of tax at source |

|

Who It Applies To |

Individuals, firms, companies, co-operative members, long-term lessees |

|

Core Principle |

Beneficial control = Ownership for taxation |

|

Related Forms |

24Q, 26Q, 27Q, 27EQ, 27A |

|

Linked Sections |

22 to 27 (Income from House Property), 194-I (TDS on Rent) |

Key Takeaways

✔ Ownership in tax law means control & benefit, not just paperwork.

✔ Section 27A ensures income is taxed in the hands of the person who enjoys property benefits.

✔ The Form for furnishing e-TDS or e-TCS returns connects ownership with compliance.

✔ Missing TDS filings or wrong ownership declaration can lead to serious scrutiny.

✔ Annual charge deductions & property taxes must align with ownership status.

Conclusion

In summary, Section 27A of the Income Tax Act serves a dual purpose — it defines who is the “owner of house property” for taxation & mandates accurate TDS/TCS compliance. By connecting ownership recognition with Form 27A filing, it ensures that the real beneficiary of property income remains accountable. Whether you’re a landlord, tenant, or business deducting TDS on rent, staying compliant under this section is crucial.

For professional guidance on ownership classification, TDS return filing, or property-linked tax planning, connect with India’s trusted experts at 👉 Callmyca.com — your one-stop platform for accurate, affordable, and reliable income tax compliance.