When it comes to income tax in India, the Income Tax Act, 1961, lays down several important provisions, especially for business owners & professionals. One such key section is Section 28 of the Income Tax Act. This section plays a significant role in determining how business-related income is taxed & what exactly qualifies as income from “profits and gains of business or profession.”

In this article, we’ll break down Section 28 in simple terms & highlight its real-world implications using practical examples and keyword-rich insights.

📌 What is Section 28 of the Income Tax Act?

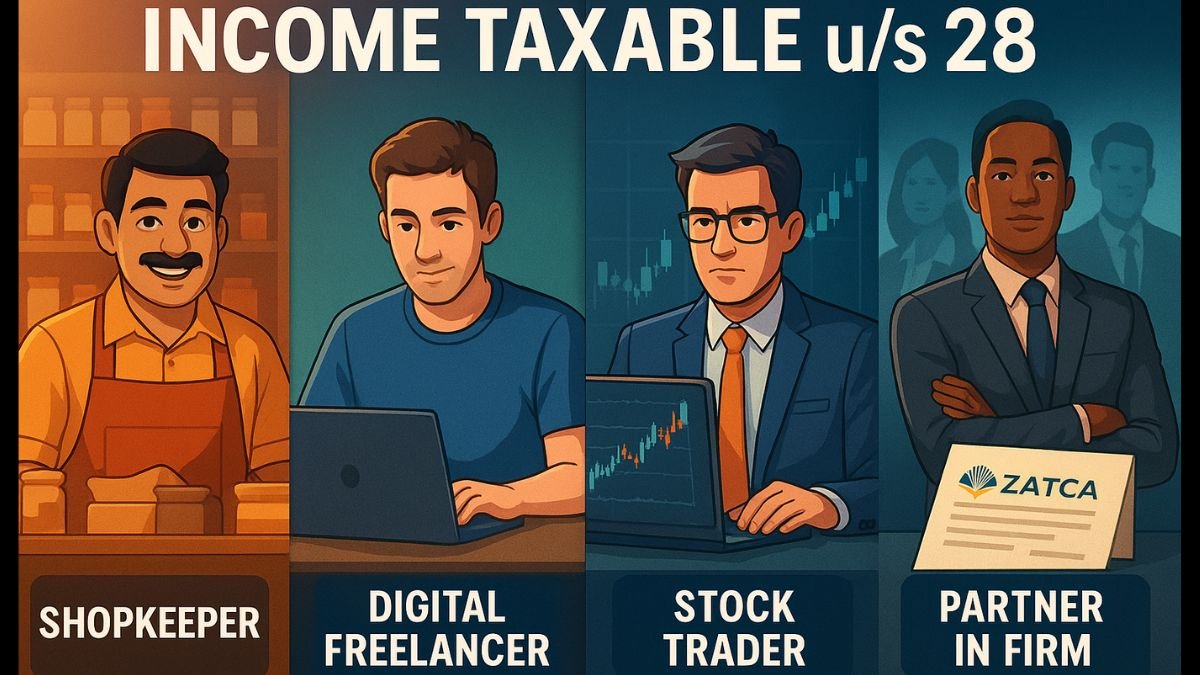

Section 28 of the Income Tax Act, 1961 deals with the taxation of profits and gains of business or profession. It identifies various categories of income that should be taxed under this head. In simple words, if you’re earning from a trade, manufacturing, freelancing, or professional service, your income may be taxable under Section 28. "

But it’s not just limited to business turnover or consultancy fees. Section 28 of the Income Tax Act also includes salary, commission, bonus, or any other form of compensation received by a partner from a firm.

🧾 Key Items Falling Under the Scope of Section 28

The scope of Section 28 is wider than many people realise. It includes:

- Profits and gains from any business or profession carried out during the financial year.

- Any compensation or other payment received due to the termination/modification of business contracts.

- Income received by a partner in the form of salary, bonus, commission or remuneration.

- Export incentives, duty drawback, or government subsidies related to the business.

- Income arising from speculative transactions.

So, if you're receiving any interest, salary, bonus, commission or remuneration in connection with a profession or business, it could be chargeable under Section 28.

🔍 Example to Understand Section 28 Better

Let’s say you are a Chartered Accountant running your consultancy. You earned ₹15 lakh this year through client billing. Additionally, you received ₹2 lakh as commission from a business partner for referring clients. You also received a bonus of ₹50,000 for helping with an acquisition deal.

According to Section 28 of the Income Tax Act, for example, all these components — the ₹15 lakh professional fee, ₹2 lakh commission, and ₹50,000 bonus — are to be included under the head of "Profits and gains from business or profession." "

📚 Explanation 3 to Section 28: Salary from Partnership Firms

Many people get confused about receiving a salary or bonus from a partnership firm. As per clause IV of Section 28 of the Income Tax Act, any remuneration received by a partner from the firm shall also be assessed as business income, not as salary under Section 15.

Hence, if you’re a partner in a firm and earning income that is earned in connection with a business or a profession, it will be taxed under this section, not as regular salary income.

🧾 Section 28 and Professional Services

For professionals like doctors, lawyers, designers, or freelance consultants, Section 28 of the Income Tax Act becomes relevant when income is derived directly from offering professional expertise.

So, whether you’re a solo consultant or part of a legal firm, income from your profession or consultancy will be evaluated under this section.

It doesn’t matter whether you're maintaining books of accounts or not — as long as the income is linked to a business or professional activity, Section 28 applies.

🛠️ Section 28 and Other Provisions

While understanding the core of this section, one must also be aware of references like:

- Section 28 of the Income Tax Act bare act – for legal interpretation.

- Section 28 of the Income Tax Act with an example – to understand practical application.

- Section 28 iv and via of the Income Tax Act, which extend the reach of taxable items under business income.

- Section 28 of the Income Tax Act, explanation 3 – dealing with compensation, benefits, and more.

💡 FAQs Related to Section 28 of Income Tax

Q1: Is interest on business capital taxable under Section 28?

Yes, interest earned on business capital is considered as business income if it is related to a business/professional activity.

Q2: Are capital receipts taxable under this section?

Generally, capital receipts are not taxable under this section unless they are converted into a revenue nature.

Q3: What about freelancers?

Freelancers offering professional services & earning income fall under the purview of Section 28.

📝 Conclusion

Section 28 of the Income Tax Act is an essential clause for anyone self-employed, running a business, or earning through professional means. Whether you're receiving salary, bonus, or commission in connection with a business, or any income arising from your professional work, this section governs how such earnings will be taxed.

Understanding this section helps you plan better, stay compliant, & minimise legal risks. So the next time you file your ITR or consult your CA, remember — Section 28 may be playing a bigger role than you think!