When it comes to supporting scientific research & innovation, the Indian government encourages contributions through meaningful tax incentives. One of the most valuable among these is Section 35(1)(ii) of the Income Tax Act, which allows 100% tax deduction for donations made to approved scientific research institutions.

Whether you’re a business looking to fund R&D initiatives or an individual passionate about science, this section opens the door to social contribution with financial benefits.

Let’s break it down simply—who can claim this deduction, how it works, & what you need to know to stay compliant.

What is Section 35(1)(ii) of the Income Tax Act?

Section 35(1)(ii) of the Income Tax Act, 1961, allows a deduction of 100% of the amount contributed to a scientific research association, university, college, or institution approved by the government, provided the funds are used for scientific research purposes only.

It is one of the few sections in the Income Tax Act that:

✅ Encourages corporate social responsibility through research funding

✅ Offers deduction without any monetary limit

✅ Promotes collaboration between industry & academia"

Key Features of Section 35(1)(ii)

Let’s look at the main highlights:

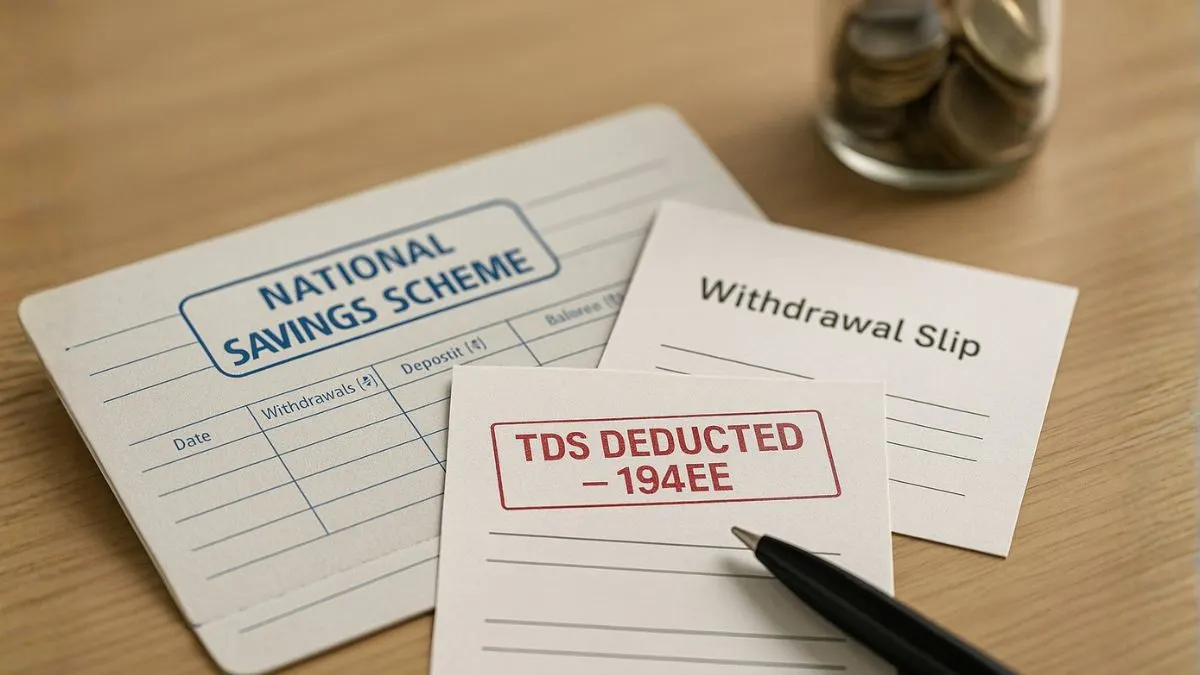

🔹 Applicable to both businesses & individuals

🔹 Deduction available for contributions, not for internal in-house R&D (which is covered under other sub-clauses like 35(1)(i) or 35(2AA))

🔹 The institution must be approved by the CBDT (Central Board of Direct Taxes)

🔹 The sums paid must be exclusively used for scientific research

🔹 The deduction is available under the old tax regime (not applicable in the new regime)

Types of Institutions Eligible Under Section 35(1)(ii)

The deduction can be claimed only if the donation is made to an institution or association that is:

✔ Registered in India

✔ Engaged exclusively in scientific research

✔ Approved by the Prescribed Authority (typically Department of Scientific & Industrial Research (DSIR))

✔ Notified by the CBDT in the Official Gazette

Examples include IITs, ISRO-backed research labs, & universities offering advanced science programs.

Practical Example

Let’s say XYZ Ltd., an Indian manufacturing company, donates ₹10 lakhs to an approved scientific institution.

- Under Section 35(1)(ii), XYZ Ltd. can claim 100% of ₹10 lakhs as a deduction while computing its business income."

- This directly reduces the taxable profits & hence, the overall tax outgo.

Important Conditions for Claiming Deduction

✅ The institution receiving the donation must utilise the amount solely for scientific research.

✅ The payment should be in modes other than cash (e.g., cheque, demand draft, bank transfer).

✅ Maintain a copy of the approval letter issued to the institution.

✅ Ensure the name of the institution appears in the CBDT’s notified list at the time of payment.

Difference Between Section 35(1)(ii) and 80GGA

While both offer tax benefits on donations, here’s how they differ:

|

Feature |

Section 35(1)(ii) |

Section 80GGA |

|

Who can claim? |

Businesses & professionals |

Individuals not earning business income |

|

Deduction rate |

100% |

100% (but with ₹10,000 cash limit) |

|

Requires approval |

Yes (CBDT notified institution) |

Yes (specific funds/research orgs) |

|

Part of business income? |

Yes |

No |

FAQs on Section 35(1)(ii)

Q1. Who can claim a deduction under Section 35(1)(ii)?

Any assessee (individual, company, partnership, etc.) contributing to a CBDT-approved scientific research institution.

Q2. How much deduction is allowed?

100% of the amount donated, with no upper monetary limit.

Q3. Is a donation to foreign institutions eligible?

No. The institution must be located & approved in India.

Q4. Can I donate in cash?

No. Donations in non-cash modes (cheque, bank transfer) are required.

Q5. Is this applicable in the new tax regime?

No, Section 35(1)(ii) deductions are not available under the new regime."

Government's Intent Behind Section 35(1)(ii)

The Indian government seeks to build a knowledge-based economy & a research-oriented industrial landscape. By offering full tax deduction on donations to scientific research, the government incentivises corporates & HNIs to:

- Fund pathbreaking innovation

- Support national missions like "Make in India" & "Digital India"

- Bridge the gap between industry & education

Conclusion

Section 35(1)(ii) of the Income Tax Act is a unique provision that combines tax planning with social responsibility. By making strategic donations to approved scientific institutions, you not only save on taxes but also contribute to India's intellectual & technological growth.

If you're looking to minimise your tax outgo while supporting the nation's research backbone, this section is your gateway.

👉Don’t just pay tax—fund the future. Let Callmyca.com help you claim 100% deduction under Section 35(1)(ii) & support cutting-edge scientific research while saving big on taxes. Book your free consult now!