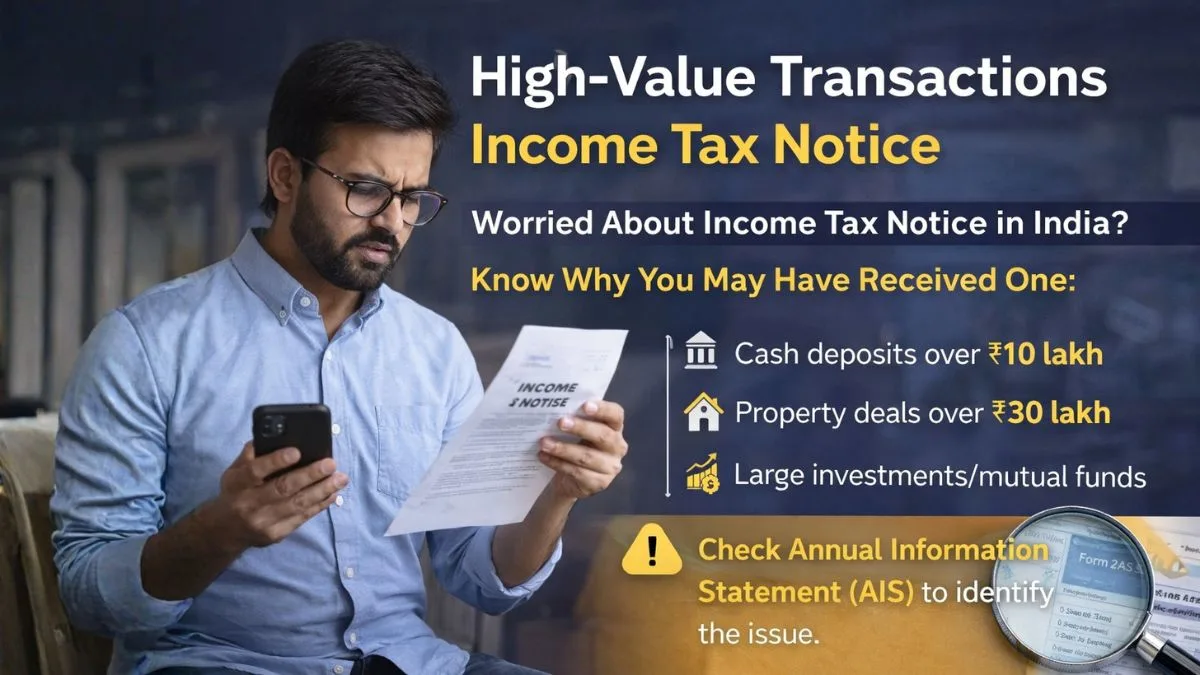

If you deduct money from your employees' salaries towards Provident Fund (PF) or ESI, you carry a legal responsibility that goes beyond payroll. And that responsibility is governed by a crucial provision—Section 36(1)(va) of the Income Tax Act.

This section doesn’t just define your role as an employer—it can also impact your tax deductions. One delay in PF/ESI deposit, & your deduction could be disallowed, increasing your tax liability significantly. Let’s understand this section in simple words & explore why timely compliance is not just good practice—it’s essential.

What is Section 36(1)(va) of the Income Tax Act?

Section 36(1)(va) provides for the deduction of employees’ contributions to PF, ESI, & other welfare funds only if deposited within the due date as per the relevant acts (e.g., EPF Act or ESI Act).

So when you, as an employer, deduct any amount from your employee’s salary:

- That amount becomes a trust deposit, not your business fund.

- You’re required to deposit it into the employee’s welfare account on time.

- If you delay—even by a day—the entire amount becomes disallowed as an expense.

This disallowance results in increased taxable income for your business, & ultimately, a higher tax bill."""

Keyword Insight: What Does Section 36(1)(VA) Cover?

Here's how the keywords align with the section:

✅ Amount paid by employees toward welfare schemes – refers to PF, ESI, Superannuation, etc.

✅ An employee’s contribution to the Provident Fund (PF) is deductible only if paid on time.

✅ Tax on any sum received by the assessee from any of his employees – implies legal responsibility for employers holding employee funds.

✅ Adds recognised fund balance to an employee’s total income – emphasises tax impact.

✅ Disallowance under section 36(1)(va) of the Income Tax Act – happens when deadlines are missed.

✅ Provides for the deduction of the employee’s contribution made by the employer, only within deadlines."

Understanding the Deadline

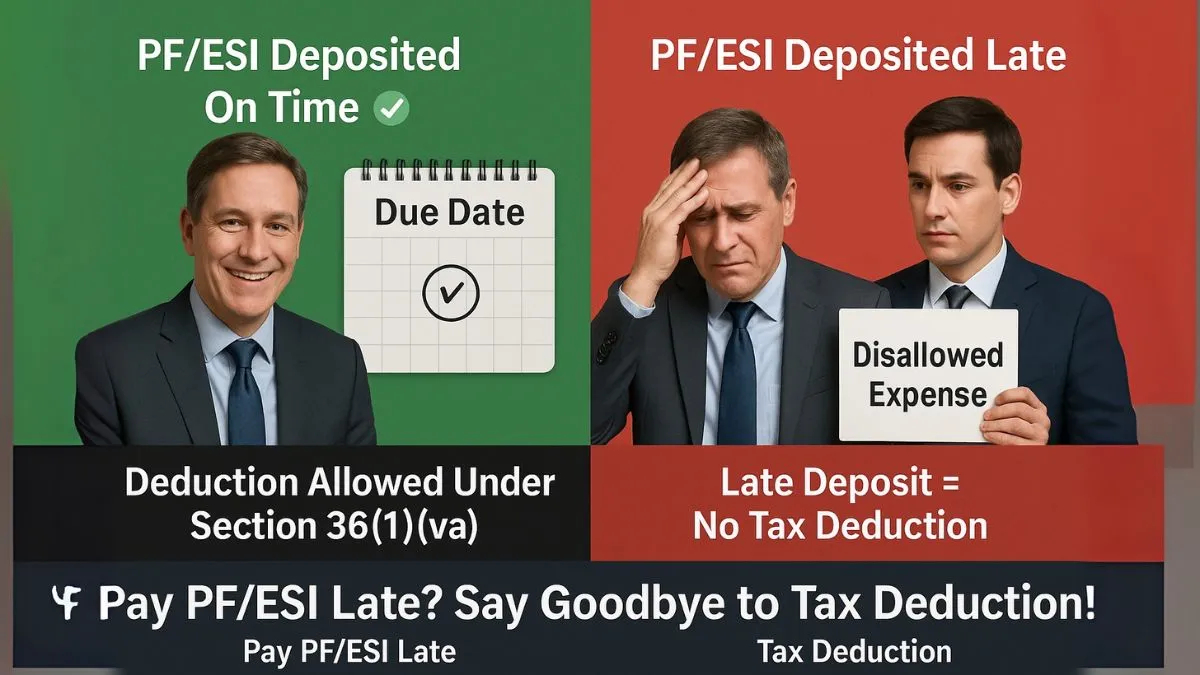

Unlike Section 43B, which allows deduction for employer contributions if paid by the ITR due date, Section 36(1)(va) requires strict adherence to labour law deadlines—usually the 15th of the next month.

So:

- PF/ESI for April must be deposited by May 15.

- If you deposit on May 16, that deduction is disallowed, even if you file your ITR in October.

This section leaves no room for delay or correction at the time of return filing.

Real-World Example

Imagine your business deducted ₹50,000 from employee salaries in July for PF but deposited the amount on August 20 instead of by August 15. This 5-day delay will result in the ₹50,000 being disallowed as an expense.

You now have to:

- Add ₹50,000 back to your taxable income.

- Pay extra tax on that amount.

- Bear the interest & compliance burden.

Difference Between Section 36(1)(va) & Section 43B

This is where many get confused.

|

Section |

Applies To |

Deduction Allowed If Paid By |

|

36(1)(va) |

Employee’s Contribution |

Due date under the PF/ESI Act |

|

Employer’s Contribution |

Due date of filing ITR |

👉 Late payment of employee contribution is never condonable, even if paid before the ITR due date.

Case Law & Supreme Court Clarification

Earlier, there was ambiguity—some courts allowed deductions if paid before return filing. But in 2022, the Supreme Court clarified:

Employee’s contributions must be deposited strictly by the due date under the respective Act, else it will be disallowed under Section 36(1)(va).

This judgment shut the door on leniency. Timely deposit is now non-negotiable.

What Can Be Deducted Under Section 36(1)(VA)?

Only the employee’s share of:

- Provident Fund (PF)

- Employees’ State Insurance (ESI)

- Superannuation Fund

- Welfare Schemes as notified

Employer’s contributions are not covered under this section—they fall under Section 43B.

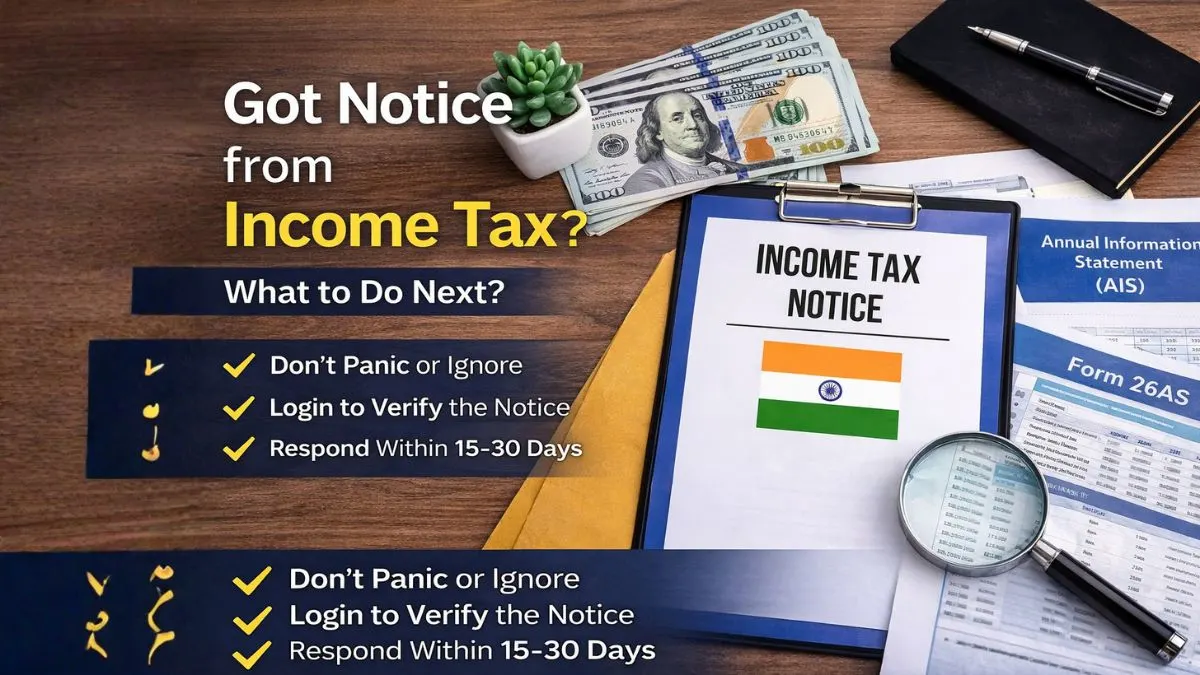

Compliance Best Practices

✅ Set auto-reminders for PF/ESI due dates.

✅ Reconcile challans with payroll every month.

✅ File returns accurately & maintains deposit proofs.

✅ Don’t rely on ITR deadlines—follow labour law due dates.

Frequently Asked Questions (FAQs)

Q1. What is Section 36(1)(va) of the Income Tax Act?

It allows deductions for employee contributions to welfare funds only if deposited on or before the statutory due date.

Q2. What happens if I deposit PF late, but before filing ITR?

The amount will still be disallowed under Section 36(1)(va).

Q3. What is the penalty for delayed PF deposit?

Besides disallowance, you may face penalties & interest under PF laws.

Q4. Does this apply to small businesses, too?

Yes, if you're deducting employee contributions, the timely deposit rules apply regardless of size.

Q5. Is there any way to claim it later?

Yes, if you deposit later, it becomes allowable in that year, but you lose the deduction in the year of accrual.

Conclusion

Section 36(1)(va) of the Income Tax Act is a strict reminder that when it comes to employee welfare, the government doesn’t entertain delays. If you’ve deducted PF or ESI from salaries, treat it as employee money, not business income.

Even a small delay in depositing this can result in disallowance, increased tax liability, & legal scrutiny.

Stay compliant, stay prepared.

👉Don’t risk losing deductions or paying extra taxes because of missed PF deadlines. Let Callmyca.com help you stay compliant with Section 36(1)(VA)—on time, every time. Book a free consultation today & protect your business from costly mistakes!