When businesses or professionals file their income tax returns, they often wonder—what expenses can they legally deduct?

That’s where Section 36 of the Income Tax Act steps in. It provides a detailed roadmap for various expenses that are allowed as a deduction, ensuring a fair calculation of income and promoting transparency.

If you're a trader, freelancer, small business owner, or run a professional service, this section is a must-read.

📚 What is Section 36 of the Income Tax Act?

Section 36 contains the list of deductions from income earned through the business or profession.

These deductions apply before calculating the final taxable income, making it a key tool in reducing your tax liability legitimately.

In simple terms, if you’ve spent money to run your business, & it’s covered under Section 36, you may be able to deduct it.

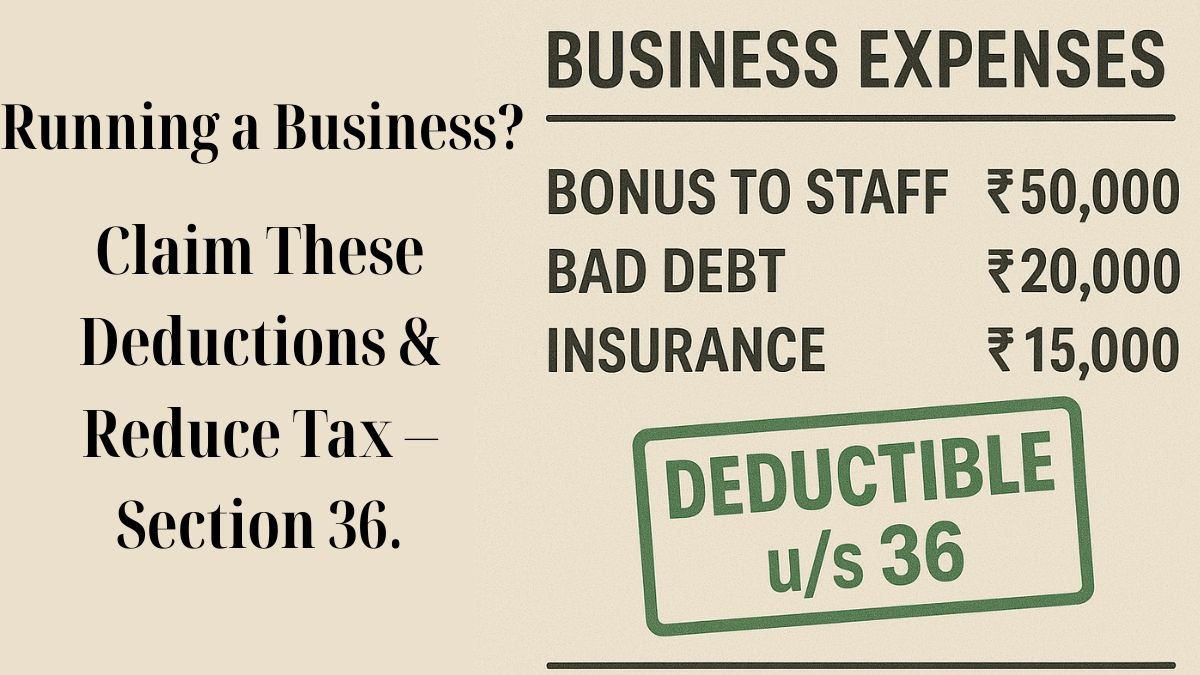

✅ Common Deductions Allowed Under Section 36

Here are some major categories where deductions are permitted:

- Insurance Premium for Employees

Premiums paid by the business for employees' health or life insurance are deductible. - Bonus or Commission to Employees

As long as it is reasonable & paid for actual services rendered. - Interest on Borrowed Capital

Loans taken for business purposes—interest paid on them is allowed as a deduction. - Employer Contributions

Contributions to provident fund, superannuation fund, gratuity fund, etc., are deductible (within limits). - Bad Debts

If a debt becomes irrecoverable & was previously included in income, it may be claimed as a deduction. - Repairs and Insurance of Machinery or Buildings

Any expense related to business assets can be claimed under this section.

All these fall under various expenses that are allowed as a deduction. "

📌 Notable Mentions (And Misconceptions)

Here’s a surprising addition—legal provisions such as “Agreements contingent on impossible event void” or “Right of private defence against the act of a person with unsound mind” are often mistakenly thought to fall under income tax law due to their reference in general legal texts.

Let’s clarify:

- Agreements contingent on impossible events void → This comes from the Indian Contract Act, not directly from Section 36.

- Right of private defence against the act of a person with an unsound mind → This relates to the Indian Penal Code, & has no relevance to business tax deductions.

It’s crucial not to confuse tax law with civil or criminal provisions. Section 36 strictly deals with permissible deductions for business & professional income.

⚖️ Disallowances Under Section 36

While deductions are allowed, not all expenses qualify.

Here are some expenses that can be disallowed:

- Personal expenses claimed under business

- Bonus payable but not paid within the time prescribed

- Employer’s contributions made after the due date

- Capital expenses disguised as revenue expenses

To avoid trouble, keep clear records and ensure your claims are substantiated. "

🧮 Practical Example

Let’s say Rahul runs a digital marketing agency. His income for the year is ₹20 lakhs.

His expenses:

- Office rent – ₹3 lakhs

- Salaries – ₹4 lakhs

- PF contribution – ₹50,000

- Interest on loan taken for business setup – ₹1 lakh

- Employee health insurance – ₹40,000

- Business promotion – ₹1 lakh

- Bad debts – ₹70,000

Under Section 36, many of these qualify as deductible expenses, & Rahul’s net taxable income may reduce to ₹9–10 lakhs instead of ₹20 lakhs. That’s a significant tax saving.

📄 Key Documentation to Keep

To claim deductions under Section 36:

✔️ Maintain invoices & receipts for all expenses

✔️ Keep salary and PF registers

✔️ Bank loan documents & interest certificates

✔️ Income ledger showing bad debt history

✔️ Proof of insurance payment & employee details

All of these prove authenticity & save you during scrutiny.

📜 Legal Text of Section 36

The bare act defines Section 36 as:

“The deductions provided under this section shall be allowed in computing the income referred to in Section 28, which includes profits and gains of business or profession.”

In short, Section 36 of the Income Tax Act contains the list of deductions from income earned through the business or profession, allowing legitimate expense claims that reduce the tax burden.

💬 FAQs

- Can I claim mobile bills or internet charges under Section 36?

If used exclusively for business, yes. But be sure to keep proof. - What if I claim a deduction and later it’s disallowed?

The disallowed amount will be added to your income and taxed. Penalties may also apply. - Is depreciation allowed under Section 36?

No. Depreciation is covered separately under Section 32.

📘 Section 36 in Hindi (Quick Glance)

"धारा 36 व्यापार या पेशे से अर्जित आय पर होने वाले खर्चों को घटाने की अनुमति देती है। इसमें बीमा प्रीमियम, ब्याज, कर्मचारी बोनस, खराब ऋण आदि शामिल हैं।"

🧾 Summary Table

|

Expense Type |

Deductible Under Section 36? |

|

Employee Insurance |

✅ Yes |

|

Bad Debts |

✅ Yes |

|

Personal Expenses |

❌ No |

|

Interest on Business Loans |

✅ Yes |

|

Donations |

❌ Covered under Section 80G |

✅ Final Thoughts

For business owners and professionals, Section 36 of the Income Tax Act is a powerful tool for legally reducing tax. It contains the list of deductions from income earned through the business or profession, and includes various expenses that are allowed as a deduction, if done correctly.

Steer clear of unrelated legal jargon like “agreements contingent on impossible event void” or “right of private defence against the act of a person with an unsound mind”—they don’t belong in this space.

Stick to the rules, claim what’s fair, and keep your compliance clean.

💬 Need help calculating eligible deductions under Section 36?

Connect with a CA from CallMyCA.com & simplify your tax life—stress-free.

(https://callmyca.com/business-tax-filing)