If you’ve ever wondered why your TDS credit doesn’t show up correctly in your income tax return, you’re not alone. Many taxpayers face confusion about when and where the credit for tax deducted at source should be claimed — especially when the income and the TDS belong to different years or persons.

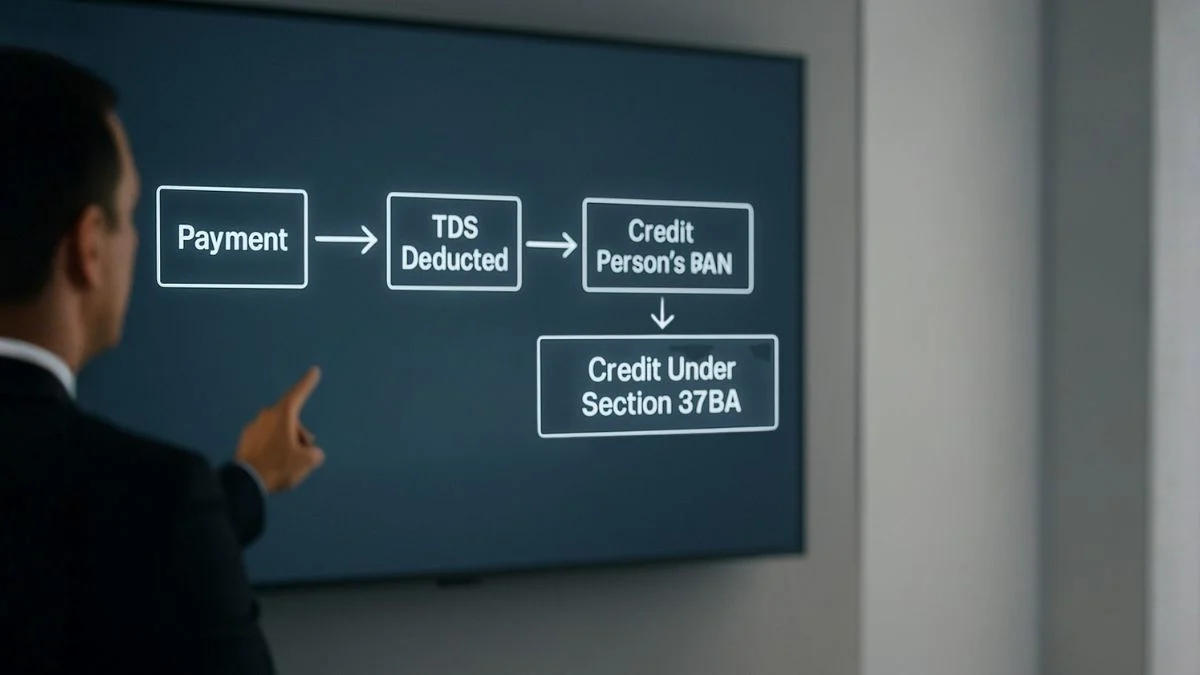

That’s exactly what Section 37BA of the Income Tax Act aims to solve. It tells you how, when, and in whose hands the TDS credit should be given.

In simple words — it makes sure the TDS deducted on your income is adjusted fairly & correctly when you file your taxes.

Let’s break this down in plain English.

What is Section 37BA of the Income Tax Act?

Section 37BA of the Income Tax Act deals with the rules regarding credit for tax deducted at source (TDS).

It clarifies how & to whom the credit of TDS should be given when:

- The income on which TDS was deducted is assessable in a different year, or

- The income belongs to more than one person, such as in joint ownership or partnership cases.

Simply put, Section 37BA ensures that the person who actually earns the income gets the benefit of the TDS credit — not someone else by default.

Why This Section Was Introduced

Earlier, there was widespread confusion.

TDS was deducted by companies or institutions, but by the time income was assessed, it wasn’t clear who should claim the credit — the person in whose name it was deducted, or the person who actually earned the income.

For example:

- Suppose a company deducts TDS in the name of “ABC Pvt Ltd,” but the income belongs to its partner or shareholder.

- Or TDS is deducted in one financial year, but the income is taxed in the next.

Without Section 37BA, there was no clarity on how to handle such cases.

This section solved that — by providing a structured rulebook for distributing & claiming credit for tax deducted at source correctly.

Also Read: Credit for Tax Deducted at Source (TDS)

Core Principles of Section 37BA

Here’s what Section 37BA lays down:

- TDS Credit Belongs to the Right Person

The credit should be given to the person in whose hands the income is actually assessable.

It doesn’t matter whose name the TDS certificate is in — what matters is who owns the income. - Credit in the Same Year as Income

The TDS credit must be allowed in the same assessment year in which the corresponding income is taxed.

If income is taxable in FY 2024–25, then TDS credit should also appear in that year’s return — not before or after. - TDS Can Be Apportioned

When income belongs to more than one person (like joint owners of property), the TDS credit can be split proportionately between them.

The rule requires both parties to provide a declaration & PAN to the deductor. - CBDT Empowerment

The Central Board of Direct Taxes (CBDT) has the authority to make rules to implement these provisions smoothly — which led to the introduction of Rule 37BA under the Income Tax Rules.

What is Rule 37BA? (Practical Implementation)

While Section 37BA provides the legal foundation, Rule 37BA gives it practical shape.

Here’s what Rule 37BA says:

- TDS credit shall be given to the person in whose hands the income is assessable.

Example: If TDS is deducted on rent from a property jointly owned by two people, both co-owners can claim TDS credit in their ITRs — based on their share of income. - If income is spread over multiple years, TDS credit will also be spread over those years in the same ratio.

Example: Suppose interest of ₹1 lakh is received for 3 years, but TDS of ₹10,000 is deducted upfront. The ₹10,000 TDS will be claimed proportionately — ₹3,333 each year. - If income belongs to another person, the deductee must file a declaration with the deductor to transfer credit correctly.

This prevents duplicate claims or mismatched credits in Form 26AS.

Example 1: TDS Deducted in One Year, Income Taxed in Another

Let’s say:

- A company deducts ₹10,000 TDS on your fixed deposit interest in March 2025.

- But the bank credits the interest to your account in April 2025 — that’s the next financial year."

Result:

You’ll claim that TDS credit in FY 2025–26, not 2024–25, because the income is assessable in the year you actually earned it.

This rule prevents unnecessary mismatches & double credit issues.

Example 2: Joint Ownership of Property

Suppose two brothers jointly own a property and receive ₹5 lakh as annual rent.

The tenant deducts ₹50,000 as TDS but credits it under the name of the elder brother.

Under Section 37BA read with Rule 37BA, both brothers can claim TDS credit proportionate to their ownership share — ₹25,000 each.

The tenant must be informed through a declaration, and both PANs should be provided.

This ensures fairness and prevents confusion during assessment.

Also Read: Deducted at Source Deemed as Income Received

Example 3: TDS Deducted in the Name of Shareholder

This is a common one.

Companies often pay dividends to shareholders & tax is deductible in the hands of shareholders.

If the company deducts TDS but the shares are held jointly (say, husband and wife), then the TDS credit should go to the person who is assessable for that income.

Section 37BA ensures that — making it clear that TDS credit belongs to the rightful taxpayer.

Relation Between Section 37BA and Section 199

While Section 199 establishes the general rule that credit of TDS shall be given to the person from whose income tax is deducted, Section 37BA refines this rule — it specifies the timing, proportion, and transfer mechanism of that credit.

In other words:

- Section 199 = You are entitled to TDS credit.

- Section 37BA = How and when you can actually claim it.

Together, they eliminate confusion & improve accuracy in tax assessments.

Key Benefits of Section 37BA

✅ Prevents double taxation.

✅ Ensures fairness between co-owners, partners, or shareholders.

✅ Avoids mismatched TDS entries in Form 26AS or AIS.

✅ Clarifies when credit should be claimed if income is deferred.

✅ Simplifies reconciliation for both taxpayers & assessing officers.

Basically, it helps ensure that every rupee of TDS deducted reaches the rightful taxpayer — at the right time.

Documents Required to Claim TDS Credit Under Section 37BA

When claiming TDS credit under Section 37BA, make sure to keep:

- Form 16 / 16A – TDS certificates showing deduction details.

- Form 26AS / AIS statement – to match the deduction with your PAN.

- Declaration (if applicable) – in case of joint ownership or transferred income.

- Proof of income recognition – like rent receipts or interest statements.

Without proper documentation, your TDS claim might get rejected or delayed.

Practical Challenges Taxpayers Face

Even with clear laws, implementation sometimes gets messy:

- Mismatch in Form 26AS: Deductor may file incorrect PAN or year.

- Credit in wrong year: Banks deduct TDS before income accrues.

- Co-ownership issues: Tenants or payers often credit the whole TDS to one owner.

- Software limitations: Some ITR portals earlier didn’t support splitting TDS credit — though that’s improving now.

That’s why reviewing your Form 26AS & AIS carefully before filing ITR is crucial.

Simple Tips to Avoid TDS Credit Issues

✔ Always give your correct PAN to the deductor.

✔ Inform the payer if income belongs to multiple people.

✔ Reconcile your TDS statement (Form 26AS) every quarter.

✔ Claim TDS credit only in the year income is taxable.

✔ File a declaration under Rule 37BA when credit is to be shared or transferred.

These small actions can save you from months of back-and-forth during assessments.

Also Read: A Relief for Compensated Landowners and Employees

How Section 37BA Helps Businesses and Investors

For businesses, Section 37BA avoids duplication of TDS credits when transactions are shared among partners or entities.

For investors, it ensures dividend or interest-related TDS is credited correctly — especially when tax is deductible in the hands of shareholders or joint account holders.

In both cases, the section builds transparency & accountability between deductors, deductees, and the Income Tax Department.

A Real-Life Example

Ravi invested in a company’s cumulative deposit scheme.

The company deducted TDS on accrued interest every year, but the income was credited to him only at maturity after three years.

Earlier, Ravi faced repeated mismatches when he claimed TDS upfront."

After Section 37BA, the law now clearly states that credit for tax deducted at source must be claimed in the year income becomes assessable — i.e., at maturity.

This one clarification saved countless taxpayers from unnecessary notices.

Conclusion

Section 37BA of the Income Tax Act may sound technical, but it plays a very human role — ensuring that your hard-earned TDS credit reaches you correctly. It connects the dots between deductors, co-owners, & assessment years — preventing mistakes that could delay refunds or inflate tax demands. Whether you’re a salaried professional, property owner, or business partner, understanding this section can help you claim your rightful TDS credit smoothly.

Still confused about how to claim your TDS credit under Section 37BA correctly?

Our experts at Callmyca.com can review your Form 26AS, income sources, and TDS records to ensure you get every rupee of tax credit you deserve — accurately and on time. 💡