The Indian Income Tax landscape is constantly evolving to keep pace with new financial instruments & investment trends. One of the latest changes is the introduction of Section 50AA of the Income Tax Act, which specifically deals with the charging of capital gains arising from the transfer, redemption, or maturity of Market Linked Debentures (MLDS).

In this blog, we’ll dive deep into the provisions of Section 50AA of the Income Tax Act, the taxation mechanism it introduces for MLDs, & how it impacts investors & financial markets.

What is Section 50AA of the Income Tax Act?

Section 50AA of the Income Tax Act was introduced as part of the Finance Act 2023, with the objective to bring clarity & uniformity in the taxation of Market Linked Debentures (MLDs). MLDs are debt securities where the returns are linked to market indices, equities, commodities, or other benchmarks.

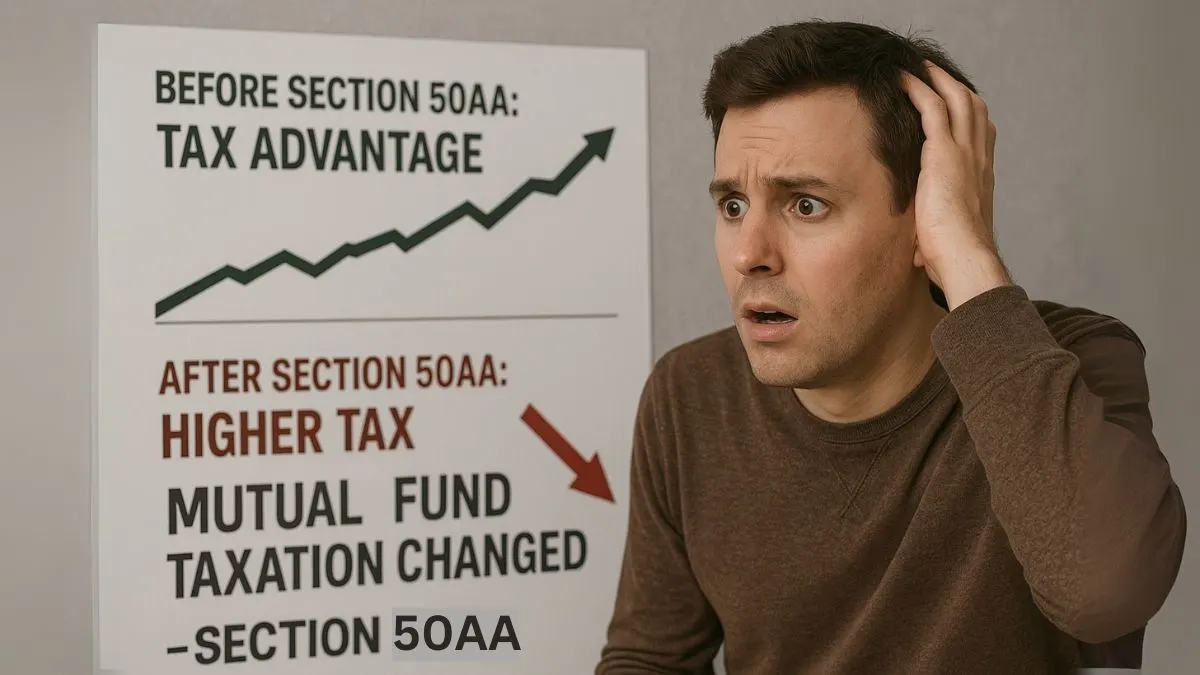

Earlier, investors could take advantage of favourable capital gains taxation on these instruments by claiming long-term capital gains (LTCG) after holding the debentures for over 12 months, & pay only 10% tax on listed securities. This arbitrage often led to revenue loss for the government.

To plug this loophole, Section 50AA was introduced. It deals with the charging of capital gains on the transfer, redemption, or maturity of these debentures as short-term capital gains (STCG), regardless of the holding period.

Key Highlights of Section 50AA:

- Applicability:

The section applies to Market Linked Debentures (MLDs) purchased on or after 1st April 2023. - Capital Gain Computation:

The capital gain arising from the transfer, redemption, or maturity of these debentures will be calculated by subtracting the cost of acquisition from the sale consideration or redemption amount. - Taxation:

All such gains will be treated as short-term capital gains, even if the MLDs are held for more than 36 months. This taxation is aligned with the applicable slab rate of the investor, making MLDs less tax-efficient. - No Indexation Benefit:

Since these gains are considered short-term, the benefit of indexation is not available. - Impact on High Net-Worth Individuals (HNIs) & Institutions:

The section has a significant impact on HNIs & financial institutions that previously utilised MLDs for tax arbitrage."

The Rationale Behind Section 50AA:

The government observed that MLDs were often structured to convert fixed income into equity-like taxation benefits. This created tax inefficiencies & an uneven playing field. To address this, Section 50AA of the Income Tax Act ensures that all MLDs are uniformly taxed as short-term capital assets.

Moreover, Section 50AA addresses the computation of capital gains for MLDs to remove ambiguity & ensure fair tax treatment across various asset classes."

Long-Term Capital Gains (LTCG) Tax Hike on Listed Securities

Another notable update relevant to capital markets is the increase in LTCG tax on listed securities. The long-term capital gains tax rate on listed securities has been raised from 10% to 12.5%, signalling the government’s intent to bring more parity in capital market taxation.

Practical Example:

Let’s understand with a simple illustration:

- Mr. A invests ₹10 lakhs in an MLD in April 2023.

- After 18 months, he redeems it for ₹13 lakhs.

- The capital gain of ₹3 lakhs will be taxed as short-term capital gain under Section 50AA, irrespective of the holding period.

Previously, this would have qualified for LTCG at 10%, but now it will be taxed at the applicable individual slab rate, which could be 20%, 30% or higher.

Amendment in Section 50AA of the Income Tax Act:

The introduction of Section 50AA through the Finance Act of 2023 was an amendment aimed at tightening tax compliance & streamlining capital gains taxation for instruments like MLDs that were earlier enjoying concessional tax rates through creative structuring.

This amendment in Section 50AA of the Income Tax Act is part of the government's broader vision to ensure transparency, equality, & fairness in taxation across different financial products.

Why Does It Matter to You?

If you are an investor holding or planning to invest in MLDs, it’s crucial to understand how Section 50AA of the Income Tax Act affects your returns. The tax impact could be substantial, especially for investors in higher income tax brackets. Knowing this will help you make informed decisions & possibly explore alternative investment options.

👉 Looking to maximize your tax savings & file your ITR hassle-free? Let the experts at Callmyca.com help you make the right choices with smart tax planning & filing services. Click here to get started—don’t miss out on potential savings!