Taxpayers often seek legitimate ways to optimise their income & reduce tax outflow. However, when certain methods are used solely to dodge tax liabilities, the Income Tax Act, 1961, has provisions to restrict such practices. One such anti-avoidance provision is Section 94(7) of the Income Tax Act, which deals with dividend stripping.

What Is Section 94(7) of the Income Tax Act?

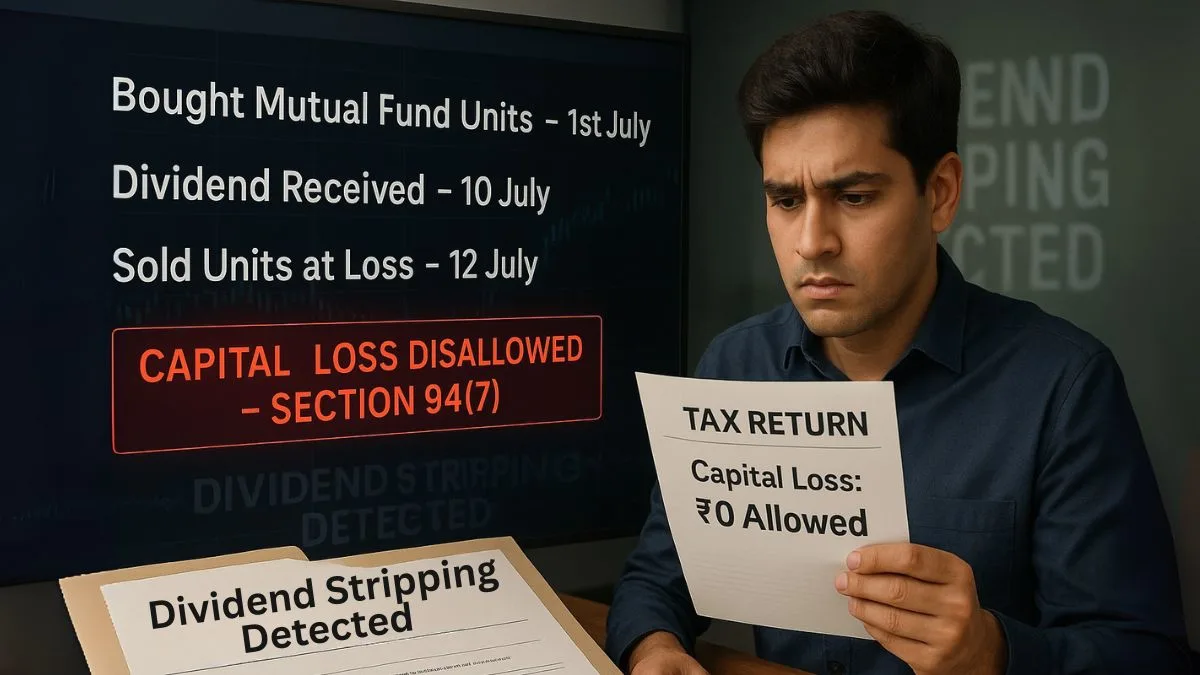

Section 94(7) of the Income Tax Act, 1961, aims to curb the practice where investors purchase securities just before the record date to receive tax-free dividends & then sell them at a loss. This loss is then claimed as a capital loss to offset other gains, creating a tax benefit. This tactic was a commonly used loophole before the introduction of this section.

So, what does the law say?

If the following conditions are met:

- A person buys securities or units within three months before the record date,

- Receives dividend or income, &

- Sells the securities within three months (in case of shares) or nine months (in case of units) after the record date,

Then the capital loss to the extent of the dividend received is disallowed.

In Simpler Words

Let’s say you buy mutual fund units or shares just before the record date to get a dividend. After receiving the dividend, you sell the units at a lower price. Naturally, this would lead to a capital loss. However, as per Section 94(7), this capital loss is disallowed up to the amount of the dividend received.

Section 94(7) of the Income Tax Act With Example

Suppose you bought mutual fund units worth ₹1,00,000 a week before the record date. You received a dividend of ₹5,000. After the record date, you sold the units for ₹95,000, thus incurring a capital loss of ₹5,000.

However, because this transaction meets all three conditions of section 94(7), the entire loss of ₹5,000 is ignored for tax purposes. You cannot claim this loss to reduce your taxable capital gains."

Why Was Section 94(7) Introduced?

This section was added to avoid tax manipulation through strategic trading. The provision ensures that dividends, which are exempt income, do not lead to the artificial creation of capital loss for reducing taxable income.

Without this law, investors could easily:

- Receive tax-free dividend income, &

- Offset taxable gains through artificial capital loss.

This violated the principle of fair taxation.

Difference Between Section 94(7) & 94(8) of Income Tax Act

While Section 94(7) focuses on securities & dividend stripping, Section 94(8) targets bonus stripping in mutual funds. In the case of 94(8), investors buy units before bonus declaration, receive bonus units, & sell the original units at a loss, while retaining bonus units. The law then disallows such capital loss if the bonus units are held.

Both sections aim to stop avoidance of tax by certain transactions in securities, but they apply to slightly different cases.

Key Points to Remember

- Applicability: Only if all three conditions (purchase before, dividend received, sale after) are met.

- Disallowance: Only to the extent of the dividend received.

- Type of Loss: Applies to both short-term and long-term capital loss.

- Applies to: Shares, mutual fund units, or any security.

- Legal Reference: As per Section 94(7) of the Income Tax Act, 1961."

Tax Planning vs. Tax Avoidance

It’s important to distinguish between genuine tax planning and abuse of loopholes. The introduction of section 94(7) makes it clear that the government wants to plug revenue leaks caused by manipulative short-term trades.

Final Thoughts

If you are an active investor or trader, being aware of Section 94(7) is crucial. Any attempt to exploit dividend stripping could not only lead to disallowed capital loss, but also increase your scrutiny risk during assessments. Always consult a tax professional before executing such strategies.

💡 Confused about how this applies to your investments? At Callmyca.com, we help investors and traders like you make tax-smart decisions. Don’t let a small mistake cost you a big tax deduction—speak to our CA experts today!