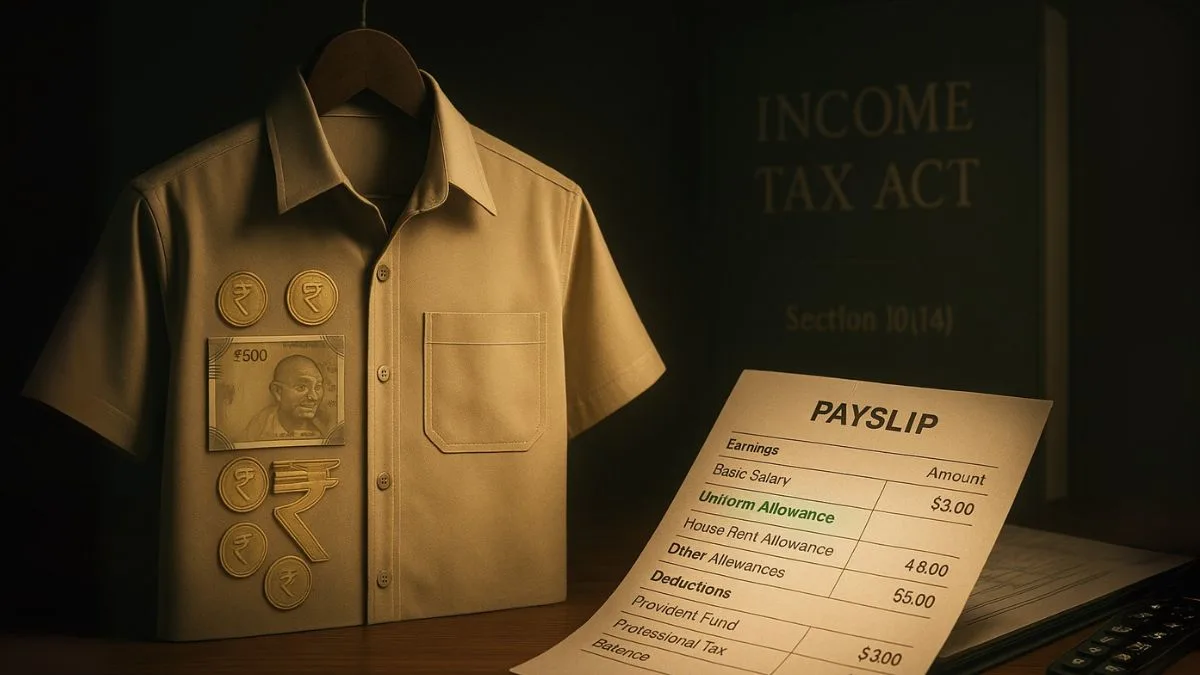

Many organizations, especially in aviation, defense, hospitality, and healthcare, require their employees to maintain a specific dress code. To help employees manage these additional costs, employers provide a special benefit known as the Uniform Allowance.

This allowance is not just a reimbursement—it recognizes the necessity of uniforms in professional roles. By compensating employees for the cost of purchasing & maintaining official attire, it ensures that staff members are not financially burdened by mandatory dress codes. Moreover, the tax rules provide relief, as the allowance is exempt from taxation to the extent of actual expenses incurred.

What is Uniform Allowance?

The Uniform Allowance is essentially a financial benefit provided by employers to cover the cost of purchasing & maintaining uniforms required for official duties. It is offered in addition to salary, specifically for those jobs where uniforms are part of the work culture.

For instance, a pilot, a police officer, a nurse, or even hospitality staff may need to wear prescribed clothing daily. To maintain professional standards, the employer provides a set allowance to help cover costs like stitching, cleaning, and replacement of uniforms.

Who is Eligible for Uniform Allowance?

This benefit is not limited to a single sector. All employees who are required to maintain a specific dress code in the course of their employment are eligible for uniform allowance.

Examples include:

- Army, Navy, and Air Force officers.

- Doctors, nurses, and healthcare staff.

- Hospitality industry employees like chefs & service staff."

- Public-sector employees in departments where uniforms are mandatory.

In every case, the aim is to ensure employees do not bear the entire financial responsibility of maintaining uniforms essential for work.

Tax Treatment of Uniform Allowance

One of the biggest advantages of uniform allowance is its tax treatment. According to the Income Tax Act, the uniform allowance is exempt to the extent of expenditure incurred for official purposes.

This means that if an employee spends the allowance fully on uniforms, the amount remains non-taxable. However, if the allowance is not fully utilized for official attire, the unspent part becomes taxable as part of salary income.

Thus, it is important for employees to maintain receipts & records of uniform-related expenses to claim full exemption.

Also Read: Tax-Exempt Allowances for Employees

Allowance Limits: Monthly and Annual Payments

The actual amount of uniform allowance depends on the organization’s policy. Commonly, the limits are structured as:

- Rs. 1800 per month – A standard rate followed by several public-sector organizations & government bodies.

- Annual dress allowance of Rs. 20,000 per annum, payable once in a year – More common in roles like defense services & aviation, where uniforms are expensive and need regular upkeep.

The mode of payment (monthly or annually) may differ, but the objective remains the same: to reduce the financial stress of employees.

Uniform Allowance vs. Dress Allowance

Though both terms are often used interchangeably, there is a slight difference:

- Uniform Allowance – Specifically provided to cover the cost of official uniforms, including maintenance.

- Dress Allowance – A broader term that may also cover civilian attire in certain services where a dress code is prescribed but not strictly a uniform.

In both cases, the allowance is treated similarly under tax laws, with exemptions tied to actual expenditure.

Example to Understand Better

Let’s consider Ms. Ritu, an airline staff member. She receives a uniform allowance of Rs. 1800 per month. Over the year, she spends ₹20,000 on purchasing, maintaining, and dry-cleaning her uniforms.

- Since her expenditure matches the allowance, the entire amount is exempt from tax.

- If she had spent only ₹15,000, the remaining ₹6,600 would be treated as taxable income."

This shows how tax exemption works in practice & why proper record-keeping is essential.

Importance of Uniform Allowance

Uniform allowance serves several purposes:

- Financial Support – Helps employees manage uniform expenses.

- Tax Relief – Provides exemptions to reduce taxable income.

- Professional Standards – Ensures uniformity & discipline in workplaces.

- Employee Welfare – Acts as a morale booster, especially in public service roles.

By covering both expenses and tax relief, the allowance adds significant value for employees.

Records and Proof Required

To claim exemption, employees must provide proof of expenditure. This includes:

- Bills for purchasing uniforms.

- Receipts for laundry or dry-cleaning services.

- Invoices for stitching & tailoring.

Without valid documentation, the tax department may disallow exemptions, treating the entire allowance as taxable.

Also Read: Tax-Free Allowances for Work-Related Expenses

Challenges and Limitations

Despite its benefits, the uniform allowance has some limitations:

- Restricted only to roles with mandatory dress codes.

- Tax exemption is available only for actual expenses incurred.

- Amounts like Rs. 1800 per month may not fully cover the costs in expensive industries like aviation."

However, even with these limitations, it remains a valuable component of employee benefits.

Final Thoughts

The Uniform Allowance is more than just a salary component—it is a thoughtful benefit that helps employees maintain official dress codes without financial stress. Whether it is Rs. 1800 per month or an annual dress allowance of Rs. 20,000 per annum, payable once in a year, it provides real support.

Most importantly, the uniform allowance is exempt to the extent of expenditure incurred for official purposes, making it not only a financial benefit but also a tax-saving tool.

✅ Want to claim uniform allowance exemptions smoothly & maximize your tax savings? Visit Callmyca.com and let our experts guide you through salary structuring, allowances, and compliance—so you never miss out on benefits you deserve.