When it comes to salary structures, many employees often overlook allowances and the tax benefits attached to them. Under Indian tax law, not all allowances are taxable. Some are partially exempt, while others are fully exempt. To ensure fairness, the Income Tax Act specifies allowances that are exempt under Section 10(14).

This provision exists to reduce the burden on employees who incur expenses for official or personal obligations tied to their job. From internet & uniform allowances to education and armed forces allowances, Section 10(14) provides clear guidelines on what can be excluded from taxable income.

What is Section 10(14)?

Section 10(14) of the Income Tax Act provides relief to salaried individuals by exempting certain allowances from tax. These allowances are usually offered to cover specific expenses incurred during employment.

Broadly, Section 10(14) exemptions are divided into two categories:

- Allowances for official duty – These reimburse employees for costs directly related to their job.

- Allowances for personal benefits – These are aimed at supporting employees’ families, education, or special circumstances.

By categorizing allowances this way, the law ensures that employees are not overburdened with taxes on amounts spent for legitimate purposes.

Specific Allowances Provided to Employees

One of the key aspects of this section is that it highlights specific allowances provided to employees, which are exempt from taxation. Unlike generic exemptions, these allowances are tailored for actual expenses.

For instance, allowances for transport, internet usage, or uniform maintenance are exempt as long as they are linked to work requirements. This makes taxation fairer, ensuring that employees are not taxed on reimbursements for genuine work-related expenses."

Allowances for Armed Forces Members

A special recognition under Section 10(14) is for defense personnel. Any special allowance granted to the members of the armed forces is exempt from taxation.

These allowances may include compensation for risk, high-altitude posting, field duties, or other unique conditions tied to military service. By exempting these from tax, the government acknowledges the sacrifices & extraordinary service of armed forces personnel.

This provision not only provides tax relief but also serves as a morale booster for those serving the nation.

Also Read: Tax-Free Allowances for Work-Related Expenses

Internet Allowance and Tax Exemption

In today’s digital era, working professionals rely heavily on internet services. Recognizing this, the Act specifies that the internet allowance provided by your employer is exempted from taxation if it is used for official purposes.

For example, if your employer gives you a monthly allowance to cover internet expenses required for work-from-home or office duties, that amount can be claimed as an exemption. However, you must maintain proof, such as bills, to show it was used for official purposes.

Exemption for Special Allowances and Benefits

Section 10(14) also ensures that an employee can claim exemption for any special allowance or benefit that is linked to official duties. This could include travel allowances, conveyance, academic research support, or project-based reimbursements.

These exemptions are not limitless. They apply only to the extent of actual expenses incurred. Any excess received beyond actual costs may become taxable. Still, the provision significantly reduces tax liability for employees whose work demands additional spending.

Uniform Allowance and Its Scope

Many jobs require employees to wear uniforms, be it in aviation, healthcare, or hospitality. Recognizing this, the law provides relief through uniform allowances.

The uniform allowance is exempt to the extent of expenditure incurred for official purposes. For example, if your employer pays you ₹15,000 annually for uniforms & you spend ₹12,000, only ₹12,000 is exempt while the remaining ₹3,000 will be taxable.

This ensures that exemptions are granted only for genuine expenses, keeping the system transparent.

Education Allowance for Children

Education expenses are a major concern for families. To provide relief, Section 10(14) includes a tax-exempt allowance for employees’ children’s education. Parents can claim exemption on such allowances, reducing their overall tax burden.

Currently, the exemption provides a tax exemption of up to Rs. 26,400 per year. This allows families to manage the rising costs of schooling while enjoying tax benefits. However, claims must be supported by proof of expenditure.

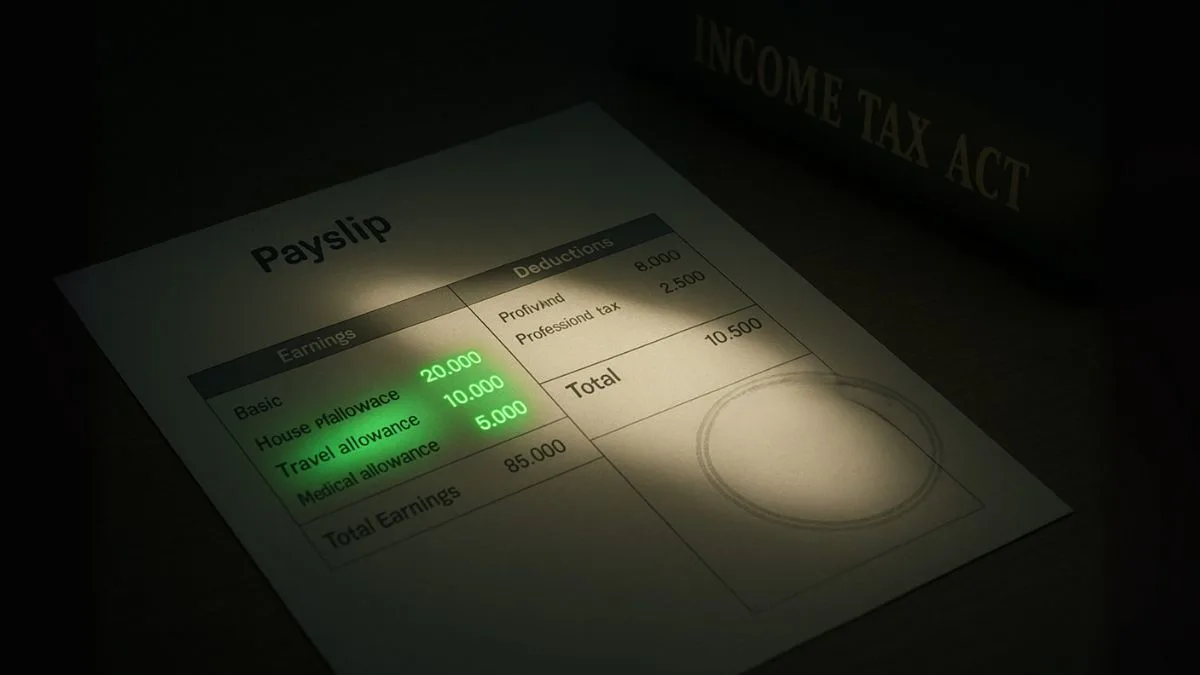

Practical Example

Let’s take an example. Mr. Rohan, a salaried employee, receives the following allowances:

- ₹12,000 annual internet allowance for work purposes.

- ₹15,000 annual uniform allowance, of which he spends ₹14,000.

- ₹26,400 annual education allowance for his two children.

Under Section 10(14), Rohan can claim exemptions for ₹12,000, ₹14,000, and ₹26,400 respectively. Together, he saves over ₹50,000 in taxable income—highlighting how these provisions significantly reduce tax liability."

Also Read: Tax-Free Allowances Explained for Employees

Why Section 10(14) Matters for Employees

Tax planning is not just about investments. Allowances play an equally important role. Section 10(14) ensures employees get tax relief for expenses they are required to bear in their jobs.

By providing exemptions for internet usage, uniforms, education, and even allowances for armed forces, this section makes salaries more meaningful & fair.

For employees, understanding & correctly claiming these exemptions is crucial for maximizing take-home pay while staying compliant with the law.

Final Thoughts

Section 10(14) of the Income Tax Act is a valuable tool for salaried employees. It specifies allowances provided to employees, which are exempt from taxation, including any special allowance granted to the members of the armed forces, internet allowance, uniform allowance, and tax-exempt allowance for employees’ children’s education. With provisions that even provide a tax exemption of up to Rs. 26,400 per year, it helps individuals save significantly.

By claiming these exemptions correctly, employees can reduce their tax liability while enjoying the benefits their employer provides.

✅ Want to maximize your tax savings under Section 10(14) and other provisions? Visit Callmyca.com and connect with our experts who simplify exemptions & ensure you never miss out on tax benefits.