The Goods and Services Tax (GST) has always been a dynamic system, evolving with the needs of India’s economy. The latest round of GST rate changes has sparked debate across households, industries, and policy circles. While the government argues that these reforms aim to simplify the system and provide relief, critics worry about sectoral imbalances and implementation challenges.

To cut through the noise, this blog breaks down the GST rate changes in 5 points—why the decision was made, who gains, who loses, and what it means for the Indian economy in the long run.

- Why Were GST Rate Changes Introduced?

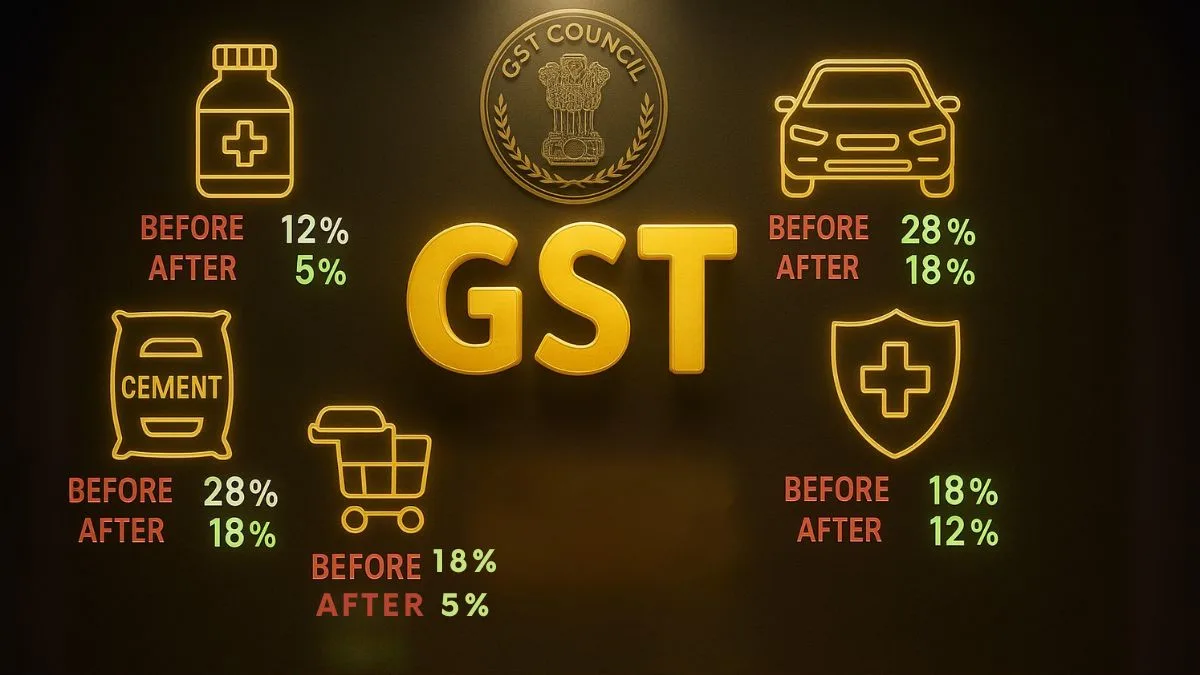

The government had two clear objectives: relief and simplification. Over time, GST had become cluttered with multiple slabs (5%, 12%, 18%, and 28%), creating confusion and disputes. Businesses often struggled with classification, while consumers remained unclear about why certain products were taxed higher.

By revising the slabs into a simpler structure—5% for essentials, 18% for most goods and services, and 40% for luxury or sin goods—the government hopes to streamline compliance & increase transparency. These reforms also align with the vision of reducing tax burden on essentials while generating revenue from high-end consumption.

- Who Benefits from the Changes?

The common man is one of the biggest winners. Essential goods like medicines, healthcare supplies, footwear, garments under ₹2,500, and household items now attract lower GST. Services such as education and health insurance premiums are either tax-free or fall under reduced rates. This directly reduces household expenditure and boosts purchasing power.

For small businesses and MSMEs, simplification of slabs and fewer disputes mean less time spent on compliance and litigation. Lower GST on raw materials like cement & steel also reduces input costs for industries such as housing and infrastructure."

By making goods and services cheaper, the reforms also encourage higher demand, which in turn benefits retailers, wholesalers, and manufacturers.

Also Read: New GST Rates List 2025: The Festive Season Tax Shake-Up Starting This Navratri

- Who Faces Higher Burden?

While the reforms offer relief in many areas, they also impose higher taxes on select categories. Luxury goods and sin items—such as premium SUVs, aerated drinks, tobacco, and alcohol alternatives—now face a 40% slab. This was done deliberately to ensure the government’s revenue stream remains stable.

Certain businesses that relied heavily on input tax credit (ITC) may also feel the pinch if credits are blocked under the new system. For instance, manufacturers in footwear or textiles could see costs rise if they cannot fully offset their input taxes, limiting their ability to reduce retail prices.

Thus, while the intent is consumer-friendly, some industries may face pressure in the short term.

- How Does It Impact the Economy?

The GST rate changes are designed to stimulate consumption by making essentials more affordable. A middle-class family now spends less on healthcare, education, & household items, freeing up money for discretionary spending. This can boost demand in retail, FMCG, and services."

At the same time, rationalizing slabs reduces classification disputes that often clogged up India’s tax administration. With simpler slabs, compliance improves, litigation decreases, and tax collection becomes more efficient.

By targeting luxury goods for higher taxation, the reforms also maintain revenue neutrality. While households save, the government ensures that big-ticket buyers continue to contribute significantly. In the long run, this balancing act could strengthen India’s fiscal position while sustaining growth.

- What Are the Long-Term Implications?

The GST reforms are not just about immediate price cuts or hikes—they represent a shift toward a mature tax system. Over time, simplification & compliance improvements will attract investment, reduce corruption, and create a more transparent ecosystem.

For businesses, the reforms mean clearer planning, reduced legal battles, and better cash flow management. For consumers, they mean more predictable pricing. And for the government, they mean a healthier balance between growth and revenue collection.

The long-term impact will depend on how smoothly the reforms are implemented and how effectively industries adapt. But the direction is clear—a simpler, fairer GST that works for both the common man & businesses.

Also Read: New GST Rates on All Cars: From Alto to Mahindra Thar and Tata Nexon

Final Thoughts

The latest GST rate changes reflect the government’s attempt to balance relief with revenue. By cutting rates on essentials and raising them on luxuries, the reforms provide direct benefits to the middle class while safeguarding fiscal needs. Businesses also stand to gain from fewer slabs and reduced compliance costs.

Explained in five key points, these changes highlight why they were done, who benefits, who pays more, how the economy adjusts, and what the long-term implications could be. While challenges remain, the overall message is one of relief, simplification, and growth for all."