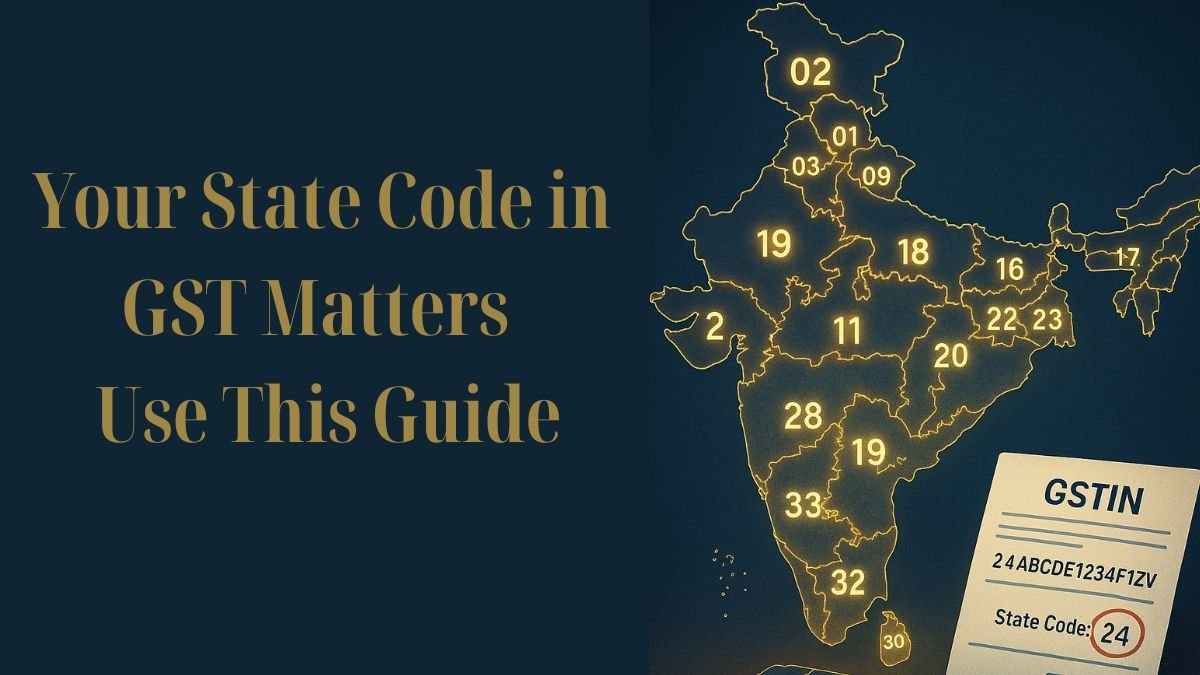

Every taxpayer registered under India's Goods & Services Tax (GST) receives a unique 15-digit alphanumeric GSTIN. But have you ever wondered what those first two digits mean?

That’s where the GST State Code comes into play.

Let’s understand everything about GST state codes, why they matter, & how to use them effectively in your tax filing & compliance work. “

What Is a GST State Code?

A GST state code is a two-digit number assigned to each Indian state & union territory. It helps identify the geographical location of the GST-registered business.

These codes are essential because they form the first two digits of a taxpayer's GSTIN (Goods & Services Tax Identification Number). For example, if a business is registered in Maharashtra, its GST state code will be 27.

So, if a GSTIN starts with 27XXXXXXXXXXXXX, you can immediately identify that it belongs to Maharashtra. “

Importance of the GST State Code

GST is a destination-based tax, & place of supply is crucial. That’s why identifying the origin & destination of goods or services using GST state codes becomes important for:

- Correct invoicing

- Filing GST returns

- E-way bill generation

- Place of supply rules

- Input tax credit tracking

It also ensures that the tax reaches the right state treasury.

Structure of GSTIN & Role of State Code

Here’s a quick breakdown of the 15-digit GSTIN structure:

AA – The First two digits represent the GST state code

BBBBB0000ZC1 – Followed by 10-digit PAN, 1 entity code, 1 checksum digit

For example:

- A GSTIN that begins with 29 is from Karnataka

- A GSTIN that starts with 07 is from Delhi

- GST state code 19 is for West Bengal

This code helps identify the state of registration for businesses during transactions.

Updated GST State Code List (2024)

Here’s a GST state code list with key entries:

|

State / UT |

GST State Code |

|

Jammu & Kashmir |

01 |

|

Himachal Pradesh |

02 |

|

Punjab |

03 |

|

Delhi |

07 |

|

Gujarat |

24 |

|

Maharashtra |

27 |

|

Karnataka |

29 |

|

Tamil Nadu |

33 |

|

West Bengal |

19 |

|

Uttar Pradesh |

09 |

|

Rajasthan |

08 |

|

Kerala |

32 |

|

Telangana |

36 |

|

Andhra Pradesh (New) |

37 |

|

Others (Lakshadweep, etc) |

30–35 (varies) |

🧾 For the complete GST state code list PDF, visit the official GST portal or download it from cbic.gov.in.

Frequently Searched GST State Codes

Here are some of the most searched state codes online:

- 06 GST state code – Haryana

- 09 GST state code – Uttar Pradesh

- 24 GST state code – Gujarat

- 29 GST state code – Karnataka

- 33 GST state code – Tamil Nadu

- 36 GST state code – Telangana

- 88 GST state code – Notified for International Organisations

Still confused about a specific code? Just check the first two digits of any GSTIN to know the registered state or union territory.

Where to Use the GST State Code?

GST state codes are used in:

- GST Return Filing (GSTR-1, GSTR-3B, etc.)

- Tax Invoices (for both intra-state and inter-state supplies)

- E-way Bills

- GST Registration

- Reconciliation of Input Tax Credit

Correctly assigning the state code ensures accurate IGST/CGST/SGST split & avoids notices from the tax department.

How to Find the GST State Code from GSTIN?

Let’s say a business has the GSTIN: 07ABCDE1234F1Z5

- 07 = Delhi

- ABCDE1234F = PAN

- The remaining digits are system-generated

So here, Delhi's GST state code is 07, & this number confirms that the business is registered in Delhi.

You can also use the GST portal or GSTIN verification tools to auto-identify the state.

Common Mistakes and Precautions

✅ Always match the GST state code with the state mentioned in the address

❌ Don’t confuse a state’s PIN code with its GST code—they are entirely different

✅ Use the GST state codes list when dealing with vendors in multiple states

❌ Avoid using incorrect codes, as it may lead to the wrong classification of intra vs inter-state supply

Final Thoughts

Whether you’re an accountant, entrepreneur, or tax consultant, understanding the GST state code system is critical for smooth GST compliance.

Let’s recap:

- A GST state code is a two-digit number assigned to each Indian state & union territory

- It forms the first two digits of a taxpayer's GST number

- For instance, GST state code 19 is for West Bengal, & Delhi's GST state code is 07

- Use these codes accurately in invoices, returns, and billing

Need a downloadable list?

👉 Grab the official GST state code list PDF from the government portal or use www.callmyca.com for quick reference tools & expert tax filing support.