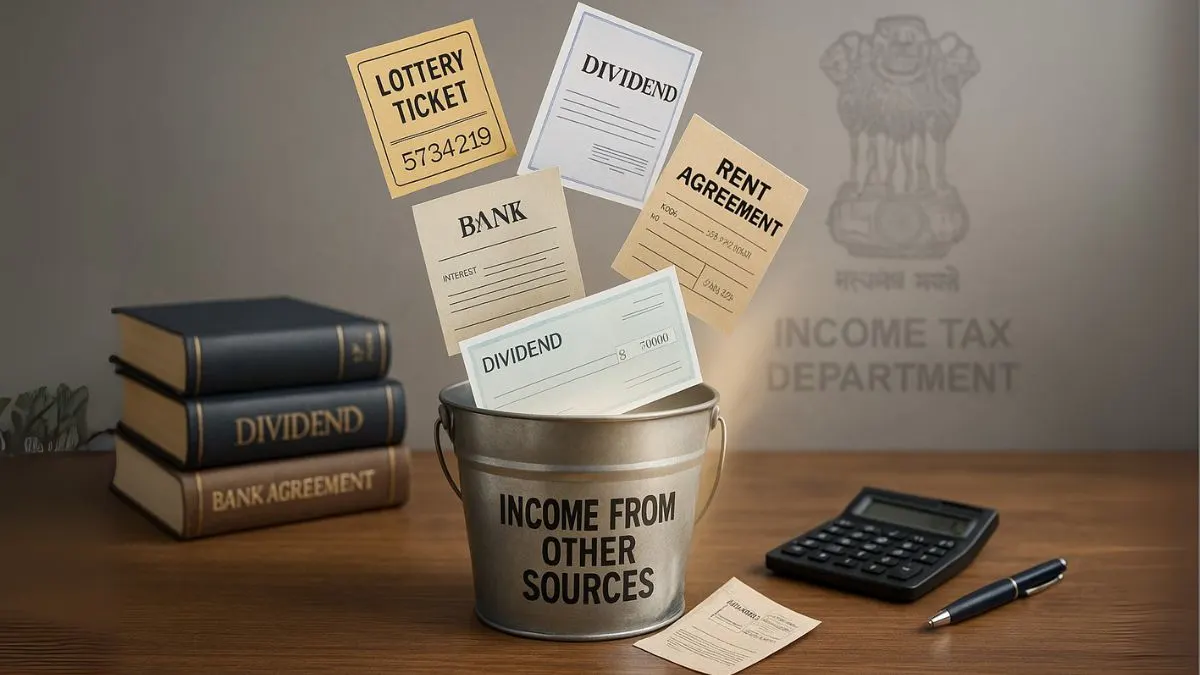

The Income Tax Act, 1961, classifies income under five major heads – Salary, House Property, Profits and Gains of Business/Profession, Capital Gains, and Income from Other Sources. Out of these, the last one often creates the most confusion.

Why? Because income from other sources is a residuary head of income. In simple words, if your earnings don’t fit under any of the first four heads, they are taxed here. It acts like a catch-all basket for diverse earnings.

For example, if you win a lottery, receive interest from bank deposits, or earn dividends beyond exempt limits, these incomes fall under this head. Even casual income like lottery or income from horse race winnings, taxed at 30%, is covered here.

In this blog, let’s understand the meaning, scope, examples, taxability, & common mistakes people make while filing ITR under “Income from Other Sources.”

What is Income from Other Sources?

As per Section 56 of the Income Tax Act, any income which is not chargeable to tax under any other heads of income will be taxed under this head.

So, all the income that does not fit into the other specified heads of income like salary or capital gains will be included here. This could include:

- Interest earned on savings accounts & fixed deposits.

- Dividend income.

- Winnings from lotteries, horse races, or crossword puzzles.

- Rental income from machinery or plant not covered under business income."

- Gifts received beyond exemption limits.

Simply put, it refers to any money you earn that doesn’t belong to the main categories.

Examples of Income from Other Sources

To make it clearer, let’s break down common incomes that fall under this head:

- Interest Income: Earnings from bank deposits, bonds, and debentures.

- Dividend Income: Dividends received from domestic companies (taxable beyond certain thresholds).

- Casual Incomes: Like lottery winnings, TV game shows, & income from horse race winnings taxed at 30%.

- Family Pension: Taxed after providing a standard deduction.

- Gifts: Any gift above ₹50,000 received without consideration.

- Employees’ Contribution: Employees' contribution to any welfare scheme received by the employer but not deposited is also taxed here.

This shows how diverse this category is – it picks up incomes that don’t neatly align with other heads.

Also Read: Flat 30% Tax on Lottery, Crossword Puzzles & Prize Winnings

Why is it Called a Residuary Head of Income?

The law uses the term “residuary head” because this section is like a fallback option. If income cannot be taxed under Salary, House Property, Business/Profession, or Capital Gains, it must be taxed here.

Thus, income from other sources is a residuary head of income that ensures no earning escapes taxation.

Taxability of Casual Incomes

One of the most important categories covered here is casual income.

- Lotteries, Crossword Puzzles, Game Shows, & Betting: Taxed at a flat 30% rate.

- Horse Race Winnings: Also taxed at 30% without any deductions.

Unlike other incomes where you can claim expenses or deductions, casual incomes are taxed at a flat rate with no relief.

So, if you win ₹1,00,000 in a lottery, the tax liability is ₹30,000 plus cess.

Taxation Rules for Income from Other Sources

Some important rules include:

- Grossing Up of Income: If tax is deducted at source, the income should be grossed up before reporting.

- Standard Deduction on Family Pension: A deduction of 33.33% or ₹15,000, whichever is less.

- Employees’ Contribution: If not deposited into welfare schemes by the employer, it becomes taxable.

- Dividend Income: Taxable beyond exempt limits.

- Gift Income: Entire amount above ₹50,000 is taxable.

Also Read: Taxation Rules for Non-Residents on Dividends, Interest, Royalties & Fees

Practical Examples for Better Understanding

Let’s look at scenarios:

- Case 1: Anil earns ₹15,000 as savings bank interest. This income doesn’t fall under salary or capital gains, so it will be taxed under Income from Other Sources.

- Case 2: Riya wins ₹5,00,000 in a TV reality show. This is casual income like lottery winnings taxed at 30%.

- Case 3: A company fails to deposit employees’ contribution to any welfare scheme. This becomes taxable in the employer’s hands under this head.

- Case 4: Meera receives a gift worth ₹2 lakh from a friend. Since it crosses the ₹50,000 exemption limit, the full amount is taxable here.

Common Mistakes in Reporting

- Not reporting bank FD interest: Many taxpayers forget to include FD interest in their returns.

- Misreporting gifts: Believing gifts are fully tax-free – they aren’t, beyond limits."

- Ignoring casual income: Winnings from lotteries or online games are fully taxable.

- Confusing heads of income: Some people wrongly classify income as business income instead of “Other Sources.”

These errors often lead to tax notices.

Importance of Declaring Income from Other Sources in ITR

The Income Tax Department cross-verifies incomes through Form 26AS and AIS. If you skip declaring, it may lead to penalties or notices.

Declaring all the income that does not fit into the other specified heads of income keeps you compliant & stress-free.

Also Read: Taxation of Royalties & Technical Service Fees

Conclusion

To summarize, Income from Other Sources is a residuary head of income that captures any income which is not chargeable to tax under any other heads of income. It covers casual income like lottery, income from horse race winnings taxed at 30%, employees' contribution to any welfare scheme, and any money you earn that doesn’t belong to the main categories.

👉 Confused about whether your income falls under this head? Don’t worry—our experts at Callmyca.com can help you file accurate returns and save you from unnecessary notices. Book your consultation today and stay compliant!